theanisenkova.ru Gainers & Losers

Gainers & Losers

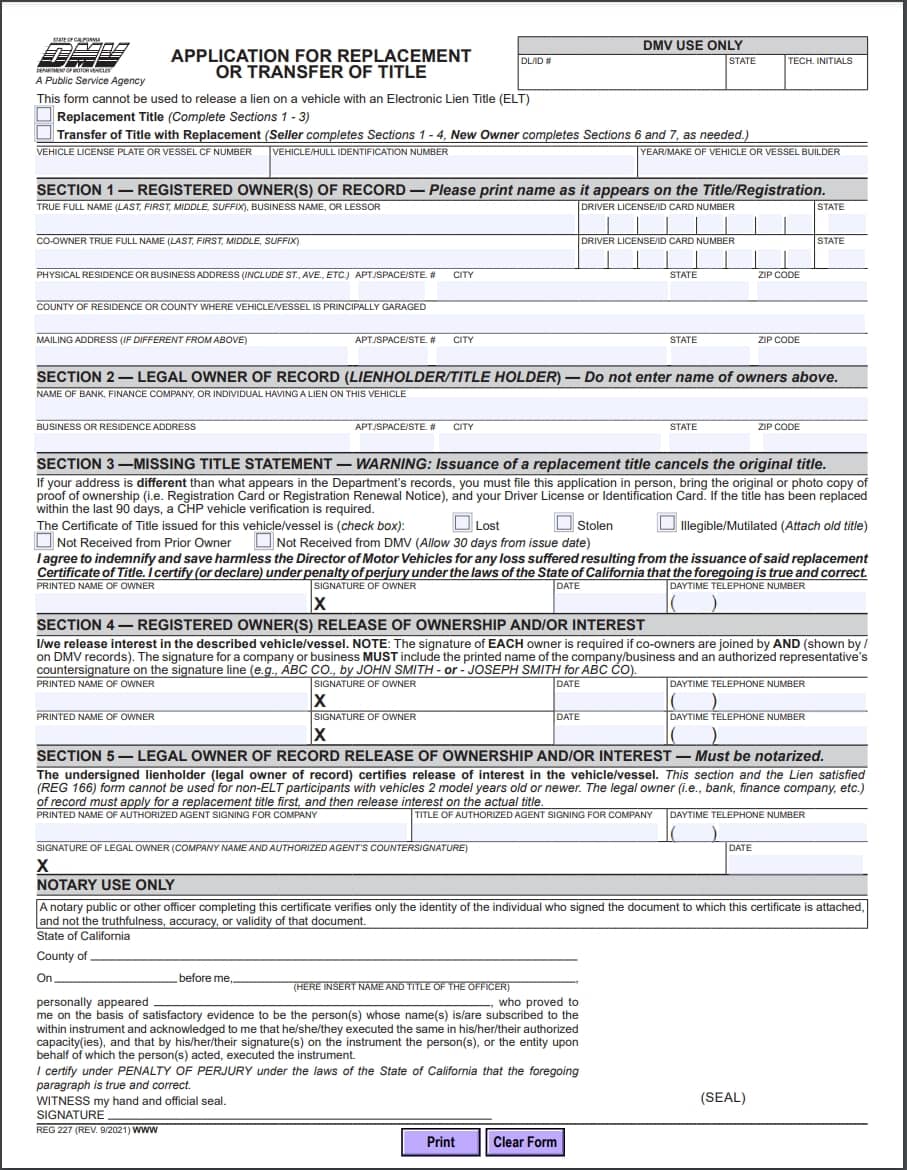

Lost Car Title California Dmv

Complete form REG , duplicate title, and send it in via mail. They will mail you a duplicate title. Keep in mind that only one copy of a. An Application for Replacement or Transfer of Title (REG ) form must be completed by the legal owner/lienholder (LO) of record for a vehicle two model years. The CA DMV form you'll need to complete is the REG - Application for duplicate title and transfer of ownership. You'll check the. It is also a good idea for the new vehicle owner to have a copy of the decedent's death certificate, as this may be requested by the DMV staff member handling. California DMV Vehicle Transfer for Vehicle Donations. CA title transfers or change of titles for vehicle donations copy for your records that includes a date. If you have lost or misplaced your original, California vehicle title and wish to avoid going to the DMV, let theanisenkova.ru save you a trip. To transfer a title, you will need: Either the California Certificate of Title or an Application for Replacement or Transfer of Title (REG ) (if the title is. If you lost your CA title and there is no lienholder listed on the vehicle record, you can request a replacement using a Duplicate Title Application Form - REG. Come into a DMV office and fill out a REG form for a duplicate registration card. As long as the car is registered here in CA, a record can. Complete form REG , duplicate title, and send it in via mail. They will mail you a duplicate title. Keep in mind that only one copy of a. An Application for Replacement or Transfer of Title (REG ) form must be completed by the legal owner/lienholder (LO) of record for a vehicle two model years. The CA DMV form you'll need to complete is the REG - Application for duplicate title and transfer of ownership. You'll check the. It is also a good idea for the new vehicle owner to have a copy of the decedent's death certificate, as this may be requested by the DMV staff member handling. California DMV Vehicle Transfer for Vehicle Donations. CA title transfers or change of titles for vehicle donations copy for your records that includes a date. If you have lost or misplaced your original, California vehicle title and wish to avoid going to the DMV, let theanisenkova.ru save you a trip. To transfer a title, you will need: Either the California Certificate of Title or an Application for Replacement or Transfer of Title (REG ) (if the title is. If you lost your CA title and there is no lienholder listed on the vehicle record, you can request a replacement using a Duplicate Title Application Form - REG. Come into a DMV office and fill out a REG form for a duplicate registration card. As long as the car is registered here in CA, a record can.

If you have any questions throughout the lost title application process, you can call the California DMV at or TTY for the hearing. How much does it cost to get a replacement title? The title fee is $ If you do send this out to the DMV make sure you have a check or money order written. //theanisenkova.ru California DMV registration services #title transfer #duplicatetitle #tagsrenewal #caplates DMV Near Me. If you lost the title or registration card, contact your state DMV or vehicle licensing department and request a replacement. The California DMV requires. An Application for Duplicate Title (REG ) is used to transfer ownership when the California title is lost, stolen, mutilated, or illegible. A mutilated or. filling-out-california-vehicle-title. California Department of Motor Vehicles (DMV) allows owners to update ownership members on the certificate of title. If. The bonded title allows you to claim ownership of your vehicle. The surety bond attached to the vehicle title may go by various names: lost title bond, DMV bond. You can request rush title processing for initial vehicle registration, transfer of ownership, or to obtain a replacement California Certificate of Title. Complete an Application for Duplicate Title (Form REG ). Pay the $27 duplicate title fee. Return the application to the CA DMV by mail or in person. Read on. This page will explain everything you need to know about applying for and receiving a duplicate title, and how to do it the fastest way possible. Certificate of Title. I certify (or declare) under penalty of perjury under the laws of the State of California that the foregoing is true and correct. Fill out an Application for Duplicate Title form (Form REG ) · Pay the duplicate title fee of $20 (can vary depending on the motor vehicle) · Mail in the. Just use your cellphone or tablet to order your title replacement in minutes. For close to a decade, we've been offering a more personalized experience to DMV. A properly endorsed Application for Replacement or Transfer of Title (REG ) form may be accepted for any transfer of a California-registered vehicle when the. The title was returned to the California DMV and you need to update your mailing address to obtain the duplicate. Permanent Registration in California for. There's a hassle-free solution to getting your lost car title replaced quickly, easily, and affordably with Quick Auto Tags! This page will explain everything you need to know about applying for and receiving a duplicate title, and how to do it the fastest way possible. Complete an Application for Duplicate Title (Form REG ). Pay the $27 duplicate title fee. Return the application to the CA DMV by mail or in person. Read on. Frequently Asked Questions · Smog certification · Use tax and/or various other fees. · Application for Replacement or Transfer of Title (REG ) form. · A Vehicle/. My registration or title is missing or stolen. Can I get a replacement at a AAA branch?

How Can I Get A Roth Ira

With a Roth IRA, you'll pay taxes on the money going into your account, and then all qualified withdrawals are tax-free. Roth IRA contributions. Your contributions to a Roth IRA are made with after-tax dollars, since you can't deduct them from your income taxes. In exchange for. A Roth IRA can be a powerful way to save for retirement as potential earnings grow tax-free. Get Started at Fidelity. An E*TRADE Roth IRA lets you invest your way. Our Roth IRA lets you withdraw contributions tax-free at any time. Open a Roth IRA with us today. Roth IRA: How it works & when consider it · An · A Roth IRA is a retirement account funded by money that you've already paid taxes on, so withdrawals of your. Learn all you need to know about Roth IRAs with State Farm®. Compare Roth and Traditional IRAs, learn about eligibility, limits, and more Roth IRA rules. Who can open a Roth IRA? Anyone can open a Roth IRA.1 However, only those with earned income within the IRS's annual limits are eligible to contribute. A Roth IRA is a retirement account where you can make after-tax, non-deductible contributions and then make withdrawals tax-free during retirement. A Roth IRA can be an advantage to your overall retirement strategy, as it offers tax-free growth and withdrawals. It can help you minimize taxes when you. With a Roth IRA, you'll pay taxes on the money going into your account, and then all qualified withdrawals are tax-free. Roth IRA contributions. Your contributions to a Roth IRA are made with after-tax dollars, since you can't deduct them from your income taxes. In exchange for. A Roth IRA can be a powerful way to save for retirement as potential earnings grow tax-free. Get Started at Fidelity. An E*TRADE Roth IRA lets you invest your way. Our Roth IRA lets you withdraw contributions tax-free at any time. Open a Roth IRA with us today. Roth IRA: How it works & when consider it · An · A Roth IRA is a retirement account funded by money that you've already paid taxes on, so withdrawals of your. Learn all you need to know about Roth IRAs with State Farm®. Compare Roth and Traditional IRAs, learn about eligibility, limits, and more Roth IRA rules. Who can open a Roth IRA? Anyone can open a Roth IRA.1 However, only those with earned income within the IRS's annual limits are eligible to contribute. A Roth IRA is a retirement account where you can make after-tax, non-deductible contributions and then make withdrawals tax-free during retirement. A Roth IRA can be an advantage to your overall retirement strategy, as it offers tax-free growth and withdrawals. It can help you minimize taxes when you.

Find out about Roth IRAs and which tax rules apply to these retirement plans.

Savings IRAs from Bank of America and Investment IRAs from Merrill Edge® are available in both Traditional and Roth. Find the IRA that's right for you. Open a Roth IRA with Merrill and give your contributions the opportunity to grow tax free through retirement. Learn how to get started investing today. Best Roth IRA Accounts Of August · Best Roth IRA Accounts for Self-Directed Investors · Fidelity Investments · Charles Schwab · TD Ameritrade · The Best. Best Roth IRA Accounts Of August · Best Roth IRA Accounts for Self-Directed Investors · Fidelity Investments · Charles Schwab · TD Ameritrade · The Best. How To Open a Roth IRA in 5 Easy Steps · 1. Make Sure You're Eligible · 2. Decide Where To Open Your Roth IRA Account · 3. Fill out the Paperwork · 4. Choose. If your earned income is below a certain threshold – $ (filing single) or $ (filing joint) for – a Roth IRA may be appropriate for you. Roth IRAs are available through credit unions, banks, brokerage firms and other financial institutions. You will complete an application that includes your name. Decide which IRA suits you best. Start simple, with your age and income. Then compare the IRA rules and tax benefits. Compare Roth vs. traditional IRAs >. Key takeaways. 1. A Roth IRA is a type of tax-advantaged retirement savings account. 2. You contribute after-tax dollars to a Roth, but the money grows tax-free. Invest in a Roth IRA at T. Rowe Price. Find out how you can take advantage of Roth IRAs: a flexible, tax-efficient retirement investing option. With a Roth IRA, you contribute after-tax dollars, your money grows tax-free, and you can generally make tax- and penalty-free withdrawals after age 59½. With a. Roth IRAs are similar to traditional IRAs, with the biggest distinction being how the two are taxed. Roth IRAs are funded with after-tax dollars. Unlike a. Distributions, or withdrawals, from traditional IRAs are treated as ordinary income and taxed accordingly when withdrawn after age 59½. For withdrawals before. Roth IRAs let you invest for retirement today and withdraw tax-free later. Open a Roth to experience Betterment's retirement advice and technology. Roth IRA Features · Great interest rates — consistently among the best in the country · No minimum balance requirement. · Ability to withdraw contributions any. How to Open a Roth IRA in Five Simple Steps · 1. Make sure you're eligible to open a Roth IRA. The first step in opening a Roth IRA is determining if you're. How does a Roth IRA work? · You choose to put some of your income into these plans now to save for retirement later. · The money is a voluntary amount you can. Thrivent Mutual Funds fees · Annual Retirement custodial fee is $15 per shareholder (Traditional, SEP and Roth IRAs combined). · Retirement account closeout fee. A Roth IRA allows for tax-deferred investment: You pay taxes on your contributions at the time you put money in and any growth is tax-free. The Mutual of America Roth IRA is a type of individual retirement variable annuity contract that generally allows you to receive distributions on a tax-free.

Standard Mortgage Fees

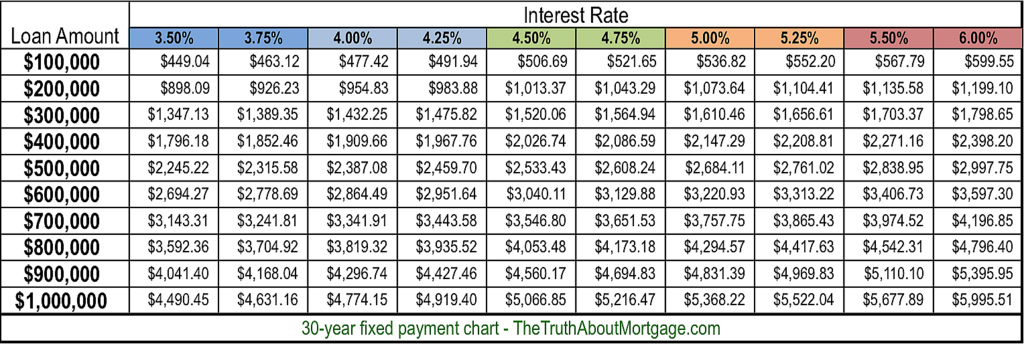

The cost to refinance a mortgage ranges from 2% to 6% of your loan amount, and you can expect to pay less to close on a refinance than on a comparable purchase. % is a typical FHA loan down payment and closing costs will include a private mortgage insurance payment in addition to other related fees. How to Pay the. You'll typically pay mortgage refinance closing costs ranging from 2% to 6% of your loan amount, depending on the loan size. National average closing costs for. Title fees and title insurance. Your lender and the title company will determine if these fees may or may not be rolled into your loan. Is it a good idea to. Lenders can still reserve loans or Standard Rate Lock. Low Income (LI) Rate Lock · CalHFA Conventional (No CalHFA DPA). High Balance Loan Limit Fee: %. Home-buying closing costs can include attorney fees, property appraisals, and mortgage fees. Sometimes these are fixed costs, and other times they're negotiable. Find loan options from the best mortgage lenders. The nationwide average closing costs for a single-family property in were $6, with transfer taxes. Pre-paid expenses are not a fee, but are costs associated with the home that are paid in advance when closing on a loan. These include Property Taxes. Typically the charges range from % of the value of the early repayment. For example, a £, mortgage with a 3% charge would cost you £3, This covers. The cost to refinance a mortgage ranges from 2% to 6% of your loan amount, and you can expect to pay less to close on a refinance than on a comparable purchase. % is a typical FHA loan down payment and closing costs will include a private mortgage insurance payment in addition to other related fees. How to Pay the. You'll typically pay mortgage refinance closing costs ranging from 2% to 6% of your loan amount, depending on the loan size. National average closing costs for. Title fees and title insurance. Your lender and the title company will determine if these fees may or may not be rolled into your loan. Is it a good idea to. Lenders can still reserve loans or Standard Rate Lock. Low Income (LI) Rate Lock · CalHFA Conventional (No CalHFA DPA). High Balance Loan Limit Fee: %. Home-buying closing costs can include attorney fees, property appraisals, and mortgage fees. Sometimes these are fixed costs, and other times they're negotiable. Find loan options from the best mortgage lenders. The nationwide average closing costs for a single-family property in were $6, with transfer taxes. Pre-paid expenses are not a fee, but are costs associated with the home that are paid in advance when closing on a loan. These include Property Taxes. Typically the charges range from % of the value of the early repayment. For example, a £, mortgage with a 3% charge would cost you £3, This covers.

Your closing costs, which will depend on your lender, type of mortgage, and home location, may cost thousands of dollars — they're typically 2 to 5% of your. A standard charge is a traditional or conventional charge. It's registered on titleOpens a popup. in a document that includes the details of. Check out the web's best free mortgage calculator to save money on your home loan today. Estimate your monthly payments with PMI, taxes. Table 1. Average Mortgage Balance · Average of first and last balance Through April 30, they made home mortgage interest payments of $1, The. Standard buyer closing costs can generally be divided into two categories: lender fees and homeowner costs. See the mortgage rate a typical consumer might see in the most recent Primary Mortgage Market Survey, updated weekly. The PMMS is focused on conventional. Your closing costs, which will depend on your lender, type of mortgage, and home location, may cost thousands of dollars — they're typically 2 to 5% of your. The HECM loan includes several fees and charges, which includes: 1) mortgage insurance premiums (initial and annual) 2) third party charges 3) origination fee 4. Closing costs, or "settlement costs," are the upfront costs you will be charged to get your loan and transfer ownership of the property. They are part of what. The average APR for the benchmark year fixed mortgage fell to %. Last week. %. year fixed-rate mortgage: Today. The average APR on a year fixed. standard fee lenders charge for the service of getting you a loan. Typically, this money is used to pay the broker or loan officer who got you the loan. Home-buying closing costs can include attorney fees, property appraisals, and mortgage fees. Sometimes these are fixed costs, and other times they're negotiable. Additional points the lender charges in lieu of other costs such as appraisal fees, inspection fees, title fees, attorney fees, and property taxes. In addition. Refinancing costs include your loan origination fee and the following: Government recording costs. Appraisal fees. Credit report fees. Lender origination fees. Offers a one-day mortgage that lets eligible borrowers apply, lock in a rate and get a loan commitment within 24 hours. Average interest rates are on the low. A home loan often involves many fees, such as loan origination fee or commitment fee, broker fee and closing costs. Some fees are paid when you apply for a loan. This is charged by lenders for setting up a mortgage deal. Because it can set you back in excess of £1,, the arrangement fee should be treated as a key part. Monthly mortgage payments usually comprise the bulk of the financial costs The annual real estate tax in the U.S. varies by location; on average. How much can the origination fee cost you? Origination fees vary. Generally, though, they average around % to % of the total loan amount — so $1, to.

2 3 4 5 6