theanisenkova.ru Learn

Learn

Websites Where You Can Sell Clothes

You can start selling clothes online by launching an ecommerce store with a platform like Shopify. Determine which clothes you will sell, add the products to. At Style Encore, we buy and sell gently used women's casual and business clothing, shoes, handbags, and accessories. We have all the hottest name brands and. The best site to sell clothes on is Shopify. Shopify is an easy-to-use ecommerce platform you can use to build your store and start selling your products. There. Information regarding which advertising is presented to you and how you interact with it can you to buy a product or visit a website, etc. This is very. You can hold a yard sale or open an online shop through websites such as eBay. You can also sell your clothes to local thrift stores and consignment shops. You can bring your items to any Clothes Mentor store and sell them for immediate cash. Until today, Clothes Mentor now has stores available in 30 states. Poshmark is the perfect shopping app to buy and sell clothes online. Make Poshmark your own personal shopper with the leading fashion marketplace for sales. Etashee is a great place to sell all your pre-owned for quick money. All of us have lots of memories attached with our wardrobe. Sell second hand branded. You can use apps like Poshmark, Depop, or Vinted to sell your old clothes. These platforms are popular for reselling fashion items and are user-. You can start selling clothes online by launching an ecommerce store with a platform like Shopify. Determine which clothes you will sell, add the products to. At Style Encore, we buy and sell gently used women's casual and business clothing, shoes, handbags, and accessories. We have all the hottest name brands and. The best site to sell clothes on is Shopify. Shopify is an easy-to-use ecommerce platform you can use to build your store and start selling your products. There. Information regarding which advertising is presented to you and how you interact with it can you to buy a product or visit a website, etc. This is very. You can hold a yard sale or open an online shop through websites such as eBay. You can also sell your clothes to local thrift stores and consignment shops. You can bring your items to any Clothes Mentor store and sell them for immediate cash. Until today, Clothes Mentor now has stores available in 30 states. Poshmark is the perfect shopping app to buy and sell clothes online. Make Poshmark your own personal shopper with the leading fashion marketplace for sales. Etashee is a great place to sell all your pre-owned for quick money. All of us have lots of memories attached with our wardrobe. Sell second hand branded. You can use apps like Poshmark, Depop, or Vinted to sell your old clothes. These platforms are popular for reselling fashion items and are user-.

Buy, sell, and discover fashion, home decor, beauty, and more · list it. step list it. Closet full of clothes you never wear? · share it. step share it. Easily create your own designs and custom clothing to sell online. Earn money from the comfort of your home when you have a print on demand partner like. First, we have Tradesy, one of the most popular apps for selling clothes and accessories, especially name bands stuff like designer bags and shoes. With Depop. One of the most popular places to sell clothes online, this app is a great way to reach a large audience. The app takes. If you have something you believe is worth selling, you could list it yourself on Craigslist, eBay, Nextdoor, or any of a dozen other such. Buy & sell bags, jewelry, and clothing from designers like Chanel, Gucci, Louis Vuitton, and Prada. The RealReal is the leader in luxury resale and. Consignment Websites Sellers list items they want to sell, and consignment websites offer a wide variety of garments for sale. Sellers typically set the price. brand spotlight · discover the community · how it works · list it · share it · earn cash · we've got your back. If you have some name brand items, such as Madewell or Anthropologie, Poshmark is the way to go! The audience for this option is around 23 years old and up. This is a universal truth no matter what customer you're targeting or platform you're using; eBay, Etsy, Poshmark, Facebook Marketplace – all of them support. You can create your own direct-to-consumer website, sell on social media channels, create a storefront on an established selling website like Amazon, or use a. Top sites for selling your old clothes · Vinted. Vinted. Best for – Everything, but upmarket high street brands (think Zara, Mango and even H&M) often do well. You can reclaim any items that don't sell, or we'll do our best to give them a second life. Our environmental impact · Our environmental impact. 3. Earn cash or. 1. Best for Hardcore High Street: Vinted · 2. Best for One-of-a-Kind Pieces: Depop · 3. Best for Vintage Gems: Etsy · 4. Best for Red Carpet Lovers: Hardly Ever. ThredUp is an online consignment and thrift store where you can buy and sell high-quality secondhand clothes. Find your favorite brands at up to 90% off. Sell Clothes with Freewebstore. If you are ready to start selling Clothes online, Freewebstore is the best place to set up. No risk & no fees. Setting up. You can hold a yard sale or open an online shop through websites such as eBay. You can also sell your clothes to local thrift stores and consignment shops. The OG online marketplace is still a stellar option for selling women's clothing. The customer base is massive and as an international platform, you have access. This is one of the best sites to sell clothes. Ajio is an extended venture of Reliance Inc. that sells clothes for kids, men, and women. Brands can resell a. One community, thousands of brands, and a whole lot of second-hand style. Ready to get started? Here's how it works.

Stock Trading Tips For Beginners

:max_bytes(150000):strip_icc()/stock-trading-101-358115_V3-37f97e70c6df4b748ba5cb19942ef6a9.gif)

Indexes are among the most important stock market basics for beginners to understand. They help explain the stock market and make it easier to become a long-. Stock trading tips · Don't “chase” the markets · Start Small · Risk Management First · Look at what the index is doing. Educate Yourself: Start by gaining a solid understanding of the fundamentals of the stock market. You can read books, take online courses, or. 1. Audit your finances before you even start to invest. Before taking on the risk of investing your money in the stock market, you should first have a plan and. Avoid investing in penny stocks and choose companies with strong fundamentals. This provides some assurance of the companies being able to withstand share. The definition of day trading is buying and selling shares of a stock within a single trading day. So between the time the market opens and closes, you open and. To start trading stocks, you'll need to open a brokerage account. Usually, you can open up an account by visiting a broker's website or calling them. Learn to day trade for a living - For the first time, you can learn day-trading without needing a lot of money or taking as much risk. Beginner Tips for the Stock Market · Don't bother with anything under $ · Invest in things you know/understand. · If you want to invest. Indexes are among the most important stock market basics for beginners to understand. They help explain the stock market and make it easier to become a long-. Stock trading tips · Don't “chase” the markets · Start Small · Risk Management First · Look at what the index is doing. Educate Yourself: Start by gaining a solid understanding of the fundamentals of the stock market. You can read books, take online courses, or. 1. Audit your finances before you even start to invest. Before taking on the risk of investing your money in the stock market, you should first have a plan and. Avoid investing in penny stocks and choose companies with strong fundamentals. This provides some assurance of the companies being able to withstand share. The definition of day trading is buying and selling shares of a stock within a single trading day. So between the time the market opens and closes, you open and. To start trading stocks, you'll need to open a brokerage account. Usually, you can open up an account by visiting a broker's website or calling them. Learn to day trade for a living - For the first time, you can learn day-trading without needing a lot of money or taking as much risk. Beginner Tips for the Stock Market · Don't bother with anything under $ · Invest in things you know/understand. · If you want to invest.

This book was written as a brief overview of a variety of stock trading basics. For beginners, this book is an excellent starting point. It provides a brief and. Intraday trading refers to trading stocks and ETFs during regular trading hours within a single day. You can buy or sell shares within a short period. Before diving into trading, decide on the market that best suits your interests and financial goals. Common options include stocks, forex. The following are general descriptions of some of the common order types and trading instructions that investors may use to buy and sell stocks. Please note. Start by putting a fixed sum of money and focus on a maximum of two to three stocks for the first few weeks. This way, you can focus your funds and slowly. Buy low and sell high has always been the simple formula for making gains within the stock market. Dollar-cost averaging is when you buy, for example, 5 shares. Forecast the “weather conditions” of the market Fundamental traders prefer to trade based on news and other financial and political data; technical traders. Personal trading tips · 1. organized way of working: Trading diary and review · 2. introduce routines · 3. invest in your education · 4. consider alternatives. The definition of day trading is buying and selling shares of a stock within a single trading day. So between the time the market opens and closes, you open and. Intraday Trading Tips · 1. Choose Liquid Shares: · 2. Utilizing Stop Loss for Lower Impact: · 3. Volatile Stocks are a no-go · 4. Correlated Stocks · 5. Choose. Your first trade: how to do it · Open and fund your live account · After careful analysis of the market, select your opportunity · 'Buy' if you think that market's. Successful stock trading not only requires a comprehensive understanding of the stock market, but also the creation and observance of a trading strategy. This stock trading book contains many time-tested stock trading tips/rules/guidelines gathered from numerous successful traders from all over the world. One of. Day trading guide for beginners · 1. Learn the basics of the stock market · 2. Choose a broker · 3. Set up a demo account · 4. Develop a trading strategy · 5. Start. Where to Start Investing in Stocks The first step is for you to open a brokerage account. You need this account to access investments in the stock market. You. In this course, we will lead you through the fundamentals to help you learn how to trade stocks and get started on this financial journey. smallcase. smallcases are modern investment products based on specific themes or strategies. These smallcases are beginner-friendly and provide diversified. In this blog post, we will discuss some intraday trading tips and strategies to help you become a successful day trader. News trading strategy tips. Treat each market and news release as an individual entity. Develop trading strategies for specific news releases. Forecast the “weather conditions” of the market Fundamental traders prefer to trade based on news and other financial and political data; technical traders.

What Is Pmi Cost

Highlights: · Private mortgage insurance (PMI) is a supplemental insurance policy required for some mortgages with a down payment lower than 20%. · You'll. PMI costs vary from insurer to insurer, and from plan to plan. Example: A highly leveraged adjustable-rate mortgage requires the borrower to pay a higher. How much is PMI? On average, PMI costs range between % to % of your mortgage. How much you pay depends on two main factors: Lenders typically maintain. Monthly PMI. Monthly cost of Private Mortgage Insurance (PMI). For loans secured with less than 20% down, PMI is estimated at % of your loan balance each. Buyers with a 5% down payment can expect to pay a premium of approximately % times the annual loan amount, $ monthly for a $, purchase price. But. Private mortgage insurance (PMI) is insurance required by lenders when a borrower puts less than 20% down on a conventional loan. It's meant to protect the. This Private Mortgage Insurance (PMI) calculator reveals monthly PMI costs, the date the PMI policy will cancel and produces an amortization schedule for. How is PMI Calculated? · Down payment percentage (e.g., 5%, 10%, 15%) · Loan amount · Number of borrowers · Credit score · Property type · Debt-to-income ratio. Use this calculator to estimate your monthly private mortgage insurance premium based on your down payment amount. Highlights: · Private mortgage insurance (PMI) is a supplemental insurance policy required for some mortgages with a down payment lower than 20%. · You'll. PMI costs vary from insurer to insurer, and from plan to plan. Example: A highly leveraged adjustable-rate mortgage requires the borrower to pay a higher. How much is PMI? On average, PMI costs range between % to % of your mortgage. How much you pay depends on two main factors: Lenders typically maintain. Monthly PMI. Monthly cost of Private Mortgage Insurance (PMI). For loans secured with less than 20% down, PMI is estimated at % of your loan balance each. Buyers with a 5% down payment can expect to pay a premium of approximately % times the annual loan amount, $ monthly for a $, purchase price. But. Private mortgage insurance (PMI) is insurance required by lenders when a borrower puts less than 20% down on a conventional loan. It's meant to protect the. This Private Mortgage Insurance (PMI) calculator reveals monthly PMI costs, the date the PMI policy will cancel and produces an amortization schedule for. How is PMI Calculated? · Down payment percentage (e.g., 5%, 10%, 15%) · Loan amount · Number of borrowers · Credit score · Property type · Debt-to-income ratio. Use this calculator to estimate your monthly private mortgage insurance premium based on your down payment amount.

It is mandatory for all government-backed FHA and USDA loans, as well as most conventional loans where your down payment is less than 20%. The exact cost of PMI. Many lenders allow a 5%, 3% or even 0% down payment for a mortgage, so it's no wonder some buyers are choosing not to put down the traditional amount of 20%. your lender's stake), you can ask your lender to drop PMI. It will depend on your specific loan, but, generally, they are required by law to do so when you. Typically, Texas private mortgage insurance is usually required if you put less than 20% down payment for the home Call The most common type of PMI is borrower-paid mortgage insurance (BPMI), which is a monthly fee in addition to your mortgage payment. After your loan closes, you. This page contains information about the cost of private mortgage insurance (PMI). Private mortgage insurance (PMI) is a cost you pay when you take out a conventional mortgage and your down payment is less than 20%. Because the lender is. So, how much does PMI cost: it depends on a few different factors, but you can generally expect to pay a monthly premium of $30 to $70 for every $, that. Another important difference between MIP and PMI is the monthly mortgage insurance requirements. Every person who buys a house with an FHA loan must also pay. HSH offers a great PMI Calculator to calculate how much your mortgage insurance will cost you each month. See PMI costs for conforming and jumbo loans for. Use this calculator to estimate your monthly private mortgage insurance premium based on your down payment amount. Typically, Texas private mortgage insurance is usually required if you put less than 20% down payment for the home Call If you are interested in refinancing or you think your home has increased in value, reach out to a PHH Loan Officer today to see if your PMI can be removed! Buyers with a 5% down payment can expect to pay a premium of approximately % times the annual loan amount, $ monthly for a $, purchase price. But. Most people pay PMI in monthly installments. However, it can also be paid in a single premium, upfront. According to mortgage insurer Genworth, a borrower with. Typical Range of PMI Rates. PMI rates typically range between % and 1% of the entire loan amount on an annual basis. For example, if your loan amount is. This page contains information about the cost of private mortgage insurance (PMI). PMI costs vary from insurer to insurer, and from plan to plan. Example: A highly leveraged adjustable-rate mortgage requires the borrower to pay a higher. As long as your payments are current, your loan servicer may cancel PMI when your loan-to-value ratio reaches the 78% scheduled date based on the original value. Private mortgage insurance premiums vary in amount, from a fraction of a percent to as much as % of the value of the original loan. PMI is paid each year.

Where To Get A Cashiers Check Usaa

The fastest way to get USAA checks is to call USAA directly at () – or go online at theanisenkova.ru and sign in. cashiers check, or other similar service. The customer service is excellent I recently deposited payroll checks under $5, and USAA has placed a 7 day hold. You can purchase a cashier's check at USAA Bank for a fee of $10 per check, but every USAA member is entitled to one free cashier's check per calendar year. Simply present your endorsed check to the cashier at our Money These include payroll checks, government checks, tax refund checks, cashiers' checks. Apparently we can no longer request a cashier's check or "teller check" online anymore, and we must wait on hold on the customer service phone. Mail Certified Funds. If you would like to mail your payoff, please send a cashier's check to: USAA Federal Savings Bank c/o Nationstar Attn: Payoff. Discover convenient ways to make your deposits. Options like mobile check deposits, ATMs, and by mail make depositing checks and cash with USAA easy! ATM Withdrawal: USAA is part of the Allpoint ATM network, which offers fee-free withdrawals at over 60, ATMs nationwide. · Cashier's Check or. USAA Financial Centers offer a convenient way to get help with your financial needs. Stop by and see us. USAA Locations. Colorado. Colorado Springs Location. The fastest way to get USAA checks is to call USAA directly at () – or go online at theanisenkova.ru and sign in. cashiers check, or other similar service. The customer service is excellent I recently deposited payroll checks under $5, and USAA has placed a 7 day hold. You can purchase a cashier's check at USAA Bank for a fee of $10 per check, but every USAA member is entitled to one free cashier's check per calendar year. Simply present your endorsed check to the cashier at our Money These include payroll checks, government checks, tax refund checks, cashiers' checks. Apparently we can no longer request a cashier's check or "teller check" online anymore, and we must wait on hold on the customer service phone. Mail Certified Funds. If you would like to mail your payoff, please send a cashier's check to: USAA Federal Savings Bank c/o Nationstar Attn: Payoff. Discover convenient ways to make your deposits. Options like mobile check deposits, ATMs, and by mail make depositing checks and cash with USAA easy! ATM Withdrawal: USAA is part of the Allpoint ATM network, which offers fee-free withdrawals at over 60, ATMs nationwide. · Cashier's Check or. USAA Financial Centers offer a convenient way to get help with your financial needs. Stop by and see us. USAA Locations. Colorado. Colorado Springs Location.

As any person in banking should know, cashier's checks are VERIFIED funds and should be available instantly. I called IMMEDIATELY about the hold, they told me. Does USAA issue cashier's checks? You can purchase a cashier's check at USAA Bank for a fee of $10 per check, but every USAA member is entitled to one free. Personal checks are typically good for 6 months ( days), but business checks, government checks, US Treasury checks, cashier's checks, money orders, and. USAA is among the leading providers of insurance, banking, investment and retirement solutions to members of the US military, veterans who have honorably. You can use our digital self-service option through Harland Clarke® to order personal checks online. Each check order usually arrives in 7 to 10 business days. You can use our digital self-service option through Harland Clarke® to order personal checks online. Each check order usually arrives in 7 to 10 business days. Remember, fraud artists are constantly coming up with new ways to use fraudulent cashier's or official bank checks in their scams. Here are three of the most. Need an official check? Now you can order one on the USAA App for mobile and have it mailed: theanisenkova.ru Our self-service option for requesting a Teller/Cashiers check will be available by the 1st quarter of I would anticipate we will at. Withdraw money · Deposit cash or checks at select locations · Avoid ATM fees · Transfer between linked bank accounts · Check your balance. Personal checks; Paychecks; U.S. Treasury checks; Cashier's and teller's checks. The following are some examples of check types that you shouldn't deposit via. Order Checks · Activate a Card. Payments. View Payment Activity · Request a Teller's Check. Tools. Upload Documents · Overdraft Protection · Send Money with. Personal checks; Cashier's checks; Teller's checks; Corporate checks; Convenience checks; Money orders. Note: Foreign checks must be deposited by mail. Watch. Cashiers Check · Business Financing · Coin Counting Machine · Money Market "When I marred into the USAA family I decided to get rid of AAA and use USAA's. Personal checks; Cashier's checks; Teller's checks; Corporate checks; Convenience checks; Money orders. Note: Foreign checks must be deposited by mail. Watch. Deposit your check into your USAA Bank checking or savings account by mail. Learn how you can order deposit envelopes and send your deposit by mail. Banks With Free Checking · Stock Broker · Installment Loans · Atm Withdrawal Fee · Cashiers Check · Money Market Accounts · Personal Loans · Financial Services. Printed Payroll and Government Checks — % of check amount ($5 minimum fee) cashier's official checks, and money orders) — 4% of check amount ($5. It's easy and convenient to order a cashier's check from home. Use digital banking to place an order and choose to have the check delivered to your home. A bank may require that a special deposit slip be used for state or local government checks and for certified, cashier's, or teller checks to qualify for next-.

How Much House Do I Qualify For

Our home affordability tool calculates how much house you can afford based on several key inputs: your income, savings and monthly debt obligations. Begin by assessing your finances, then employ a mortgage qualification calculator to estimate your borrowing capacity. Our Budget Calculator can provide an in-. Use our free mortgage affordability calculator to estimate how much house you can afford based on your monthly income, expenses and specified mortgage rate. One rule of thumb for determining how much house you can afford is that your mortgage payment shouldn't exceed more than a third of your monthly income. To calculate "how much house can I afford," one rule of thumb is the 28/36 rule, which states that you shouldn't spend more than 28% of your gross monthly. For example, borrowing $, to buy a $, home equals % LTV. Lenders can offer VA or USDA loans at % LTV, but not everyone is eligible for these. Mortgage affordability calculator. Get an estimated home price and monthly mortgage payment based on your income, monthly debt, down payment, and location. The maximum DTI you can have in order to qualify for most mortgage loans is often between %, with your anticipated housing costs included. To calculate. Input high level income and expense information, along with some loan specific details to get an estimate of the mortgage amount for which you may qualify. Our home affordability tool calculates how much house you can afford based on several key inputs: your income, savings and monthly debt obligations. Begin by assessing your finances, then employ a mortgage qualification calculator to estimate your borrowing capacity. Our Budget Calculator can provide an in-. Use our free mortgage affordability calculator to estimate how much house you can afford based on your monthly income, expenses and specified mortgage rate. One rule of thumb for determining how much house you can afford is that your mortgage payment shouldn't exceed more than a third of your monthly income. To calculate "how much house can I afford," one rule of thumb is the 28/36 rule, which states that you shouldn't spend more than 28% of your gross monthly. For example, borrowing $, to buy a $, home equals % LTV. Lenders can offer VA or USDA loans at % LTV, but not everyone is eligible for these. Mortgage affordability calculator. Get an estimated home price and monthly mortgage payment based on your income, monthly debt, down payment, and location. The maximum DTI you can have in order to qualify for most mortgage loans is often between %, with your anticipated housing costs included. To calculate. Input high level income and expense information, along with some loan specific details to get an estimate of the mortgage amount for which you may qualify.

Another general rule of thumb: All your monthly home payments should not exceed 36% of your gross monthly income. This calculator can give you a general idea of. Understanding how much mortgage you can afford ; How much a mortgage lender will qualify you to borrow, based on your income, debt and down payment savings ; How. How much home can I afford? · Based on information provided, you may be able to afford a home worth up to $, with a total monthly payment of $1, Our affordability calculator estimates how much house you can afford by examining factors that impact affordability like income and monthly debts. Use this calculator to estimate how much house you can afford with your budget. Use our free mortgage affordability calculator to estimate how much house you can afford based on your monthly income, expenses and specified mortgage rate. To know how much house you can afford, an affordability calculator can help. Getting pre-approved for a loan can help you find out how much you're qualified to. If you're thinking of buying a house, you can use this simple home affordability calculator to determine how much you can afford based on your current. The first step in buying a house is determining your budget. The mortgage qualifier calculator steps you through the process of finding out how much you can. Learn how much house you can afford and how to improve This factors into your final home affordability and how much of a mortgage you may qualify for. Free house affordability calculator to estimate an affordable house price based on factors such as income, debt, down payment, or simply budget. Knowing how much house you can afford is a matter of comparing your financial situation to the factors lenders consider when approving a mortgage application. It's possible to qualify with a score in the s, though you'd need to make a 10% down payment if your score falls below FHA loans also have a higher DTI. A simple formula—the 28/36 rule · Housing expenses should not exceed 28 percent of your pre-tax household income. · Total debt payments should not exceed Most financial advisors recommend spending no more than 25% to 28% of your monthly income on housing costs. Add up your total household income and multiply it. Affordability Calculation Factors. Income. First, add up the income that will be used to qualify for the mortgage, including bonuses and commissions. A simple. Wondering how much house you can afford? Try our home affordability calculator to help estimate what you may qualify for and your monthly payment. You can afford a home worth up to $, with a total monthly payment of $1, · LOAN & BORROWER INFO · TAXES & INSURANCE · ASSUMPTIONS. Know these terms & how they work. The 28/36 rule. This is a common-sense rule to calculate how much debt you should assume. How it works: Your total housing. To get a rough estimate of what you can afford, most lenders suggest you spend no more than 28% of your monthly income — before taxes are taken out — on your.

How To Find Webassign Answers

Some questions provide a worked solution that shows how the correct answer is obtained. Depending on how your instructor set up the assignment, the solution. Search our homework answers. The answer you are looking for might already be there. Students can get Cengage Webassign answers online, either by searching at google or by appointing a professional who may help. Before you view the answer key, decide whether or not you plan to request an extension. Your instructor may not grant you an extension if you have viewed the. how to use webassign graphing tool; how to get webassign for free; how much does webassign cost; how to find webassign answers; how to get webassign answers. answers, you can't afford to randomly try different answers. In many cases advantage here is that you find that out immediately instead of two or three days. Before delving deeper into how to get WebAssign answers, it is crucial to start by answering the big questions, “What is WebAssign?” and “How does it work?”. Your students' answers were graded by WebAssign and you can see your students' scores. You can view each students answer using the Previous Answers page. When viewing your student's assignment, click Previous Answers in a question heading to see each answer your student submitted for the question. Some questions provide a worked solution that shows how the correct answer is obtained. Depending on how your instructor set up the assignment, the solution. Search our homework answers. The answer you are looking for might already be there. Students can get Cengage Webassign answers online, either by searching at google or by appointing a professional who may help. Before you view the answer key, decide whether or not you plan to request an extension. Your instructor may not grant you an extension if you have viewed the. how to use webassign graphing tool; how to get webassign for free; how much does webassign cost; how to find webassign answers; how to get webassign answers. answers, you can't afford to randomly try different answers. In many cases advantage here is that you find that out immediately instead of two or three days. Before delving deeper into how to get WebAssign answers, it is crucial to start by answering the big questions, “What is WebAssign?” and “How does it work?”. Your students' answers were graded by WebAssign and you can see your students' scores. You can view each students answer using the Previous Answers page. When viewing your student's assignment, click Previous Answers in a question heading to see each answer your student submitted for the question.

How do I hack webassign to get answers for Calc? Need HTML code or Javascript.

To check the answers to the WebAssign question, you will note a 'View' button at the end of the assignment. Just make sure to click on it. If your instructors. Find WebAssign solutions at theanisenkova.ru now Answers in a pinch from experts and subject enthusiasts all semester long. Subscribe now. COMPANY. About Chegg. Find WebAssign solutions at theanisenkova.ru now Answers in a pinch from experts and subject enthusiasts all semester long. Subscribe now. COMPANY. About Chegg. Answering Numerical Questions that Check. Significant Figures. Some WebAssign questions check the number of significant figures (sigfigs) in your answer. If a. Depending on how your instructor set up the assignment, you might be able to see answer keys indicated with the key icon answer key icon in the assignment. In particular, do not use Google to find WebAssign. Go into HuskyCT. (3) The has tips on avoiding syntax problems when entering your answers on WebAssign. View Homework Help - Intro to WebAssign from MA / points |Previous Answers Using WebAssign WebAssign allows you to submit your homework online. You can see a student's answers on an assignment if needed to review the student's work or respond if a student believes that a question has been scored. Your instructor may require you submit your answers to all parts of a single question at once. If so, you'll see a message like this at the top of the. Find solutions for your homework. SearchSearch Search done loading. home · study · Math · Calculus · Calculus solutions manuals · WebAssign for Calculus: Early. From the Responses page, you can view your students' previous answers for assignment questions. You can hack WebAssign answers using the Inspect element. To use this option, highlight the question, right-click, and then choose the inspect method. The. You can only find answers to your assignment if your instructor allows it by clicking the view key button, which might be available after the exam's due date. The "Guide" and "Help" links in the upper right corner may help you find your way around Webassign. When you open up a homework assignment, you will see empty. answers, you can't afford to randomly try different answers. In many cases advantage here is that you find that out immediately instead of two or three days. You can see the number and percentage of students in your class selecting each answer provided for questions on your assignment. Grade Answers WebAssign cannot. Find Questions & Content in WebAssign Unique learning questions are signified in WebAssign in the question name with a distinct abbreviations (theanisenkova.ru) and are. theanisenkova.ru 3 more links. Subscribe. Home. Videos. Playlists. Search. Transforming Your WebAssign Experience · New in WebAssign. Find out what's new in. In this guide, we present a number of options to prevent students from comparing answers, using outside resources, and looking up answers find another student. Students may find their Webassign courses hard to do it themselves. Webassign answers key makes it easier for students with reliable.

Short Term Suv Lease

The beauty of a short term car lease is that you may find leases for as little as 6 months to an month term. If you were to try and apply for a car lease. Unlock flexibility with the largest selection of new and used cars, now available for short-term car leases in California and Florida. SUV vans and pick-up. Get a Short Term Car Lease with no money down. Search for used car leases and for a short term auto lease. In the short term, leasing is a more affordable option than buying your next vehicle. Your new Volvo lease can come with monthly payments that work with your. MONTHLY PAYMENT MAY VARY BASED ON VEHICLE AVAILABILITY. ADDITIONAL TERMS, DOWN PAYMENTS AND MONTHLY PAYMENTS ARE AVAILABLE TO FIT CUSTOMER NEEDS. LESSEE PAYS. Booking a long-term car rental can be a lot easier and cheaper than getting a one-year car lease. And if you're looking for a short-term auto lease that's even. Multi-Month rentals are worry-free. You'll get special low multi-month rates on a full range of vehicles, including Hybrids, SUVs and Minivans. Typically six to 24 months in length, a short-term car lease works like any other lease: You make monthly payments to drive the vehicle for a predetermined. The Benefits of Our Short-Term Rentals Include: Everyday low rates at more than 7, neighborhood and airport locations worldwide in over 85 countries. The beauty of a short term car lease is that you may find leases for as little as 6 months to an month term. If you were to try and apply for a car lease. Unlock flexibility with the largest selection of new and used cars, now available for short-term car leases in California and Florida. SUV vans and pick-up. Get a Short Term Car Lease with no money down. Search for used car leases and for a short term auto lease. In the short term, leasing is a more affordable option than buying your next vehicle. Your new Volvo lease can come with monthly payments that work with your. MONTHLY PAYMENT MAY VARY BASED ON VEHICLE AVAILABILITY. ADDITIONAL TERMS, DOWN PAYMENTS AND MONTHLY PAYMENTS ARE AVAILABLE TO FIT CUSTOMER NEEDS. LESSEE PAYS. Booking a long-term car rental can be a lot easier and cheaper than getting a one-year car lease. And if you're looking for a short-term auto lease that's even. Multi-Month rentals are worry-free. You'll get special low multi-month rates on a full range of vehicles, including Hybrids, SUVs and Minivans. Typically six to 24 months in length, a short-term car lease works like any other lease: You make monthly payments to drive the vehicle for a predetermined. The Benefits of Our Short-Term Rentals Include: Everyday low rates at more than 7, neighborhood and airport locations worldwide in over 85 countries.

Whether you lease an SUV, sedan, or roadster, you can Lease return does not imply commitment to pay any remaining payments on existing lease term. Term. Payment Details. Current Payment: CAD August Featured Deals. All rebates, interest rates, and Prov/Fed Taxes are included. Top Selling SUV. With leasing you won't have to, as it only requires you to pay for the portion of the vehicle that you'll actually be using during your lease term, keeping your. Traditional car buying has been a long-time finance option for many people. Depending on the term of your lease and the type of vehicle you choose to. Short-term leasing for used cars. HGREGOIRE OFFERS SHORT-TERM LEASING! For more information, click here. Find a car Get approved Sell your vehicle. Enterprise has the right ride for your short-term travel. From quick weekend getaways to last-minute work trips, we have cars, vans, trucks, SUVs and. Entering into a short-term lease ensures that you'll always be driving the best part of a New Toyota Vehicle. Looking for a short term car lease (months). Old cars will do for me, my budget is pretty tight ($$ maybe). How do I go about looking for options? AutoNation Mobility puts flexibility first with short-term car leases for 6 or 12 months. New cars, transparent prices, and options to buy. Get flexible lease terms of up to 60 months; Vehicle is covered under the manufacturer's factory-backed warranty for up to 5 years; Drive with confidence. Contact us today to rent a Hyundai in Oakville! Tell us what you want & we'll find it for you. We have 12 month and 24 month Lease Terms available. A long-term rental gives you the flexibility to rent a vehicle for as much or as little time as you need. Subscribe with Enterprise is best suited for people. If you are looking for a good lease deal on a new SUV and need to stay within a budget, then check out our list of the best SUV lease deals for August lease term months). Plus, shorter lease cycles allow for leasing of new vehicles with the latest technology. near you. Postal Code or City. leases allow 25, kilometres of driving a year for new vehicles. Find an authorized Audi dealership near you to determine your actual leasing terms and. See Toyota lease deals near you today You might even find a lease deal on one of Toyota's most fuel-efficient vehicles. To do this, acquiring a lease term that extends years is suggested. If you're looking to lease a vehicle in Dallas, check out our awesome selection. If you decide on a short-term lease, getting and driving a new car more frequently will be easy. Once your lease has expired, you can purchase your vehicle. Contract Terms 24, 36, 39 or 48 months, depending on the vehicle and model year. SINGLE PAYMENT LEASE. No Monthly Payments. MULTIPLE SECURITY. Benefits and perks include: ; Hertz Multi-Month, Typical Auto Dealer Lease* ; Minimum Commitment Term. 63 Days. 39 Months ; Down Payment. $0. $2, ; Bank Fee. $0.

How Much Down Payment For A New Car

If you have to get a car loan, it's advised that you put down at least 10% for a used car and 20% for a new car. So at face-value, things appear. Put cash down: A down payment can help lower your monthly payment by reducing your total loan amount. The more you put down on the car upfront, the less you'll. The average down payment on a vehicle typically runs between 10% and 20% of the purchase price. Some suggest aiming for 10% down for a used car and 20% down. I've bought 5 new or demo models since Each time the down payment was the total value of yhe car and the taxes. So the limit is %. Estimate your monthly payments with theanisenkova.ru's car loan calculator and see how factors like loan term, down payment and interest rate affect payments. A down payment on cars refers to the initial sum of money applied to a purchase being financed by the purchaser. When making a large purchase, many buyers. Plan on a down payment of at least 20% of the total. · The more money you put down, the more you'll save in interest charges over the life of the loan. · Putting. Experts suggest that around 10 percent of the used car's total cost is standard for a down payment. For example, if the vehicle you want to buy $15, How much should you put down on a car? One rule of thumb for a down payment on a car is at least 20% of the car's price for new cars and 10% for used — and. If you have to get a car loan, it's advised that you put down at least 10% for a used car and 20% for a new car. So at face-value, things appear. Put cash down: A down payment can help lower your monthly payment by reducing your total loan amount. The more you put down on the car upfront, the less you'll. The average down payment on a vehicle typically runs between 10% and 20% of the purchase price. Some suggest aiming for 10% down for a used car and 20% down. I've bought 5 new or demo models since Each time the down payment was the total value of yhe car and the taxes. So the limit is %. Estimate your monthly payments with theanisenkova.ru's car loan calculator and see how factors like loan term, down payment and interest rate affect payments. A down payment on cars refers to the initial sum of money applied to a purchase being financed by the purchaser. When making a large purchase, many buyers. Plan on a down payment of at least 20% of the total. · The more money you put down, the more you'll save in interest charges over the life of the loan. · Putting. Experts suggest that around 10 percent of the used car's total cost is standard for a down payment. For example, if the vehicle you want to buy $15, How much should you put down on a car? One rule of thumb for a down payment on a car is at least 20% of the car's price for new cars and 10% for used — and.

Most experts suggest 10% or 20%. Putting 10% down is usually sufficient when buying a used car. However, you should aim for 20% down when buying a new car. The Average Down Payment on a Car with No Credit or Bad Credit. First things first, most subprime lenders give loans to Waterford drivers with bad credit or no. When banks or other institutions give loans to individuals with bad or no credit, a down payment of 10 percent on a loan or $1,, whichever is greater, is. How much should my down payment be on a car loan? A down payment of 10% or 20% of the vehicle's purchase price are the standard figures for used and new cars. If you can afford it, then you should make a 20 percent down payment on your new automobile. For used cars, you should aim to pay no less than 10 percent of the. Most lenders in the Coweta County area will ask that you put down 10% of the vehicle's final cost, or $1, — whichever is higher. You may want to know if. When it comes to new cars, it's typically easier to qualify for a car loan with a higher credit score. Higher scores may mean fewer stipulations on the amount. Total Loan Amount, $40, ; Sale Tax, $5, ; Upfront Payment, $18, ; Total of 60 Loan Payments, $45, ; Total Loan Interest, $5, According to the statistics, the average down payment normally put down on a new car loan is found to be below 12%. However, it is recommended that if you make. The average down payment on a car with no credit can vary. The majority of subprime lenders — banks and other institutions that give loans to people with bad. A 20% down payment on a new car could be ideal for establishing an equity stake from the get-go. This may prevent your car loan from becoming an upside down. In general, financial experts recommend a car down payment of at least 20% of the loan amount for a new car or at least 10% for a used car. However, a How big does the down payment on a car need to be? Just as with buying a home, most lenders like to see a down payment that's at least 20% of the car's price. . How big does the down payment on a car need to be? Just as with buying a home, most lenders like to see a down payment that's at least 20% of the car's price. . If you want to take out an auto loan with bad credit or no credit, the majority of subprime lenders will require a down payment of 10% or $1,, whichever is. monthly payment, but you will pay much more in interest overall. Down payment (optional). Enter the total amount of cash you plan to put toward the car. Not. The good news is that paying off on auto loan is a good way to establish credit. Let Our Friendly Finance Managers Help. The experts at our Finance Center will. You can buy a car with no down payment, but you are more likely to pay much higher interest rates. Another option is to buy a cheaper used vehicle or trade in. The general recommendation for how much down payment to put on a car is at least 20% for new cars and at least 10% for used cars. However, a analysis. When it comes to a down payment on a new car, you should try to cover at least 20% of the purchase price. For a used car, a 10% down payment.

Requirements To Get A Bank Account

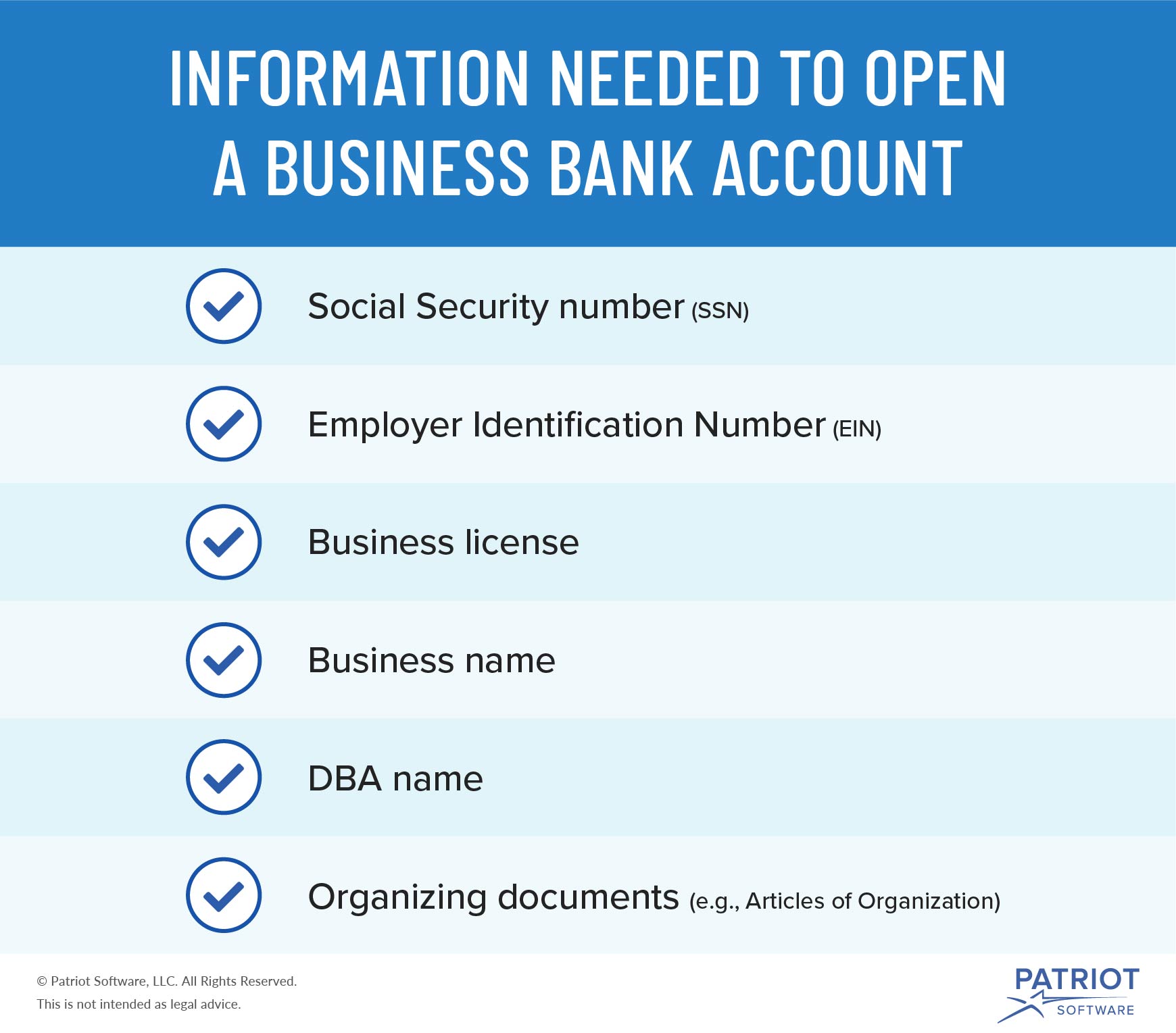

What do you need to open a bank account? · A government issued photo ID document like a passport, ID card or driving license · A second proof of ID — this could. At least one account holder must be under 25 years old. Account will switch to One Deposit Checking from Citizens™ when all account owners are age 25 or older. When opening a bank account, typically documentation and proof of identity are needed to get the application and review process started. Once approved, make the minimum opening deposit of $25 or $, depending on the account. 5. Check your email for next steps. How to find a financial center. We. Ready to take a big step toward your financial goals? A bank account can be your best ally. It keeps your money safe, gives you quick access to your funds. Checking and savings accounts, brokerage accounts, and even credit cards all require the same minimum age of Fortunately, there's still a way to get started. Whether you're opening a checking account or applying for credit, make sure you have everything you need for your KeyBank visit, ranging from IDs to. Here's the documentation you'll need to open a bank account online: · Identity documents: a copy or photo of your passport or driving license, for example · Proof. Be at least 18 years old (for Alabama and Puerto Rico residents, age requirement varies by product); Have a Social Security Number (SSN) or Individual Taxpayer. What do you need to open a bank account? · A government issued photo ID document like a passport, ID card or driving license · A second proof of ID — this could. At least one account holder must be under 25 years old. Account will switch to One Deposit Checking from Citizens™ when all account owners are age 25 or older. When opening a bank account, typically documentation and proof of identity are needed to get the application and review process started. Once approved, make the minimum opening deposit of $25 or $, depending on the account. 5. Check your email for next steps. How to find a financial center. We. Ready to take a big step toward your financial goals? A bank account can be your best ally. It keeps your money safe, gives you quick access to your funds. Checking and savings accounts, brokerage accounts, and even credit cards all require the same minimum age of Fortunately, there's still a way to get started. Whether you're opening a checking account or applying for credit, make sure you have everything you need for your KeyBank visit, ranging from IDs to. Here's the documentation you'll need to open a bank account online: · Identity documents: a copy or photo of your passport or driving license, for example · Proof. Be at least 18 years old (for Alabama and Puerto Rico residents, age requirement varies by product); Have a Social Security Number (SSN) or Individual Taxpayer.

You are required to be an authorized transactor on the U.S. Bank account, be at least 18 years of age, and be enrolled in online banking. Your U.S. Bank. To open a checking or savings account, you will need a valid state-issued ID, your SSN, and a computer or mobile device with a camera. Minimum Balance to Avoid Service Charges: During the statement cycle you must have at least one direct deposit of $ or more OR maintain a daily balance of. You Choose Your Opening Deposit Amount. Don't break the bank. There is no minimum required amount for your first deposit. All Our Checking Accounts Include. Some banks require a minimum deposit, usually between $25 and $, when opening a new account. Again, if this doesn't suit your needs, no problem. There are. Minimum Balance Requirements, if Any While the banks mentioned above don't require you to have a balance to start, many of them expect you to deposit within. You must have a valid Social Security Number or Taxpayer Identification Number in order to enroll in Regions Online Banking. If you are an existing Online. If you're under 18, you may need a guardian to co-sign the account. The application process will vary from bank to bank. But all banks are required to verify. Details you'll need to apply online: · Name and address of business · Business tax ID number: Business Employer Identification Number (EIN) provided by the IRS in. No minimum balance required. · No minimum deposit to open your account. · Fifth Third Extra Time ® gives you more time to make a deposit and avoid overdraft fees. Q. What do I need to open a checking account? · A valid, government-issued photo ID, such as a driver's license or a passport. · Other basic information, such as. Open a Wells Fargo checking account online in minutes. Get Mobile Banking, Bill Pay, and access to ATMs. Account must be opened for a minimum of 35 calendar days · Account must be funded and have a positive balance · A single direct deposit of at least $ per month. A regular checking account typically pays little or no interest, although some offer a flat interest rate regardless of your balances. Others pay more interest. Once approved, make the minimum opening deposit of $25 or $, depending on the account. 5. Check your email for next steps. How to find a financial center. We. Apply today in minutes and get a bank account that works for you. Bank of America honors any opt-out preference signal that meets legal requirements. What You Need to Open a Checking Account · a social security number · a US residential address (not a PO box) · Funding account (routing & account number). No monthly service fee; No opening deposit requirement; No minimum balance requirement. Rates: % APY; %. Next, you'll provide your opening deposit, such as debit card or bank account details for an online application. You'll need to apply in person to make a. There is no minimum balance requirement. Additional information can be found at theanisenkova.ru Financial Tips & Strategies: The.

Online Algebra One Course

An eight week full-credit learner-driven Algebra I course for high school students all taught online by expert and caring independent school teachers. eTutorWorld's Algebra 1 Summer Course for high-school students is LIVE. The fast-paced course aims at enhancing your Math skills and helps you stay ahead in. This course is designed to be the first semester of Algebra 1. Part 1 covers all of the concepts crucial to success in subsequent classes. theanisenkova.ru provides customized Algebra 1 help. Whether you need tutoring on a specific lesson or a comprehensive homeschool curriculum, we have your online. This one-semester course will explore how your student's unique skills and interests can lead to a fulfilling way to earn a living. There are many ways to learn algebra online–one great place to learn is from the Khan Academy Algebra 1 and Algebra 2 on your own time. Khan Academy is a free. Explore top courses and programs in Algebra. Enhance your skills with expert-led lessons from industry leaders. Start your learning journey today! Master the fundamentals of Algebra 1 with engaging online classes designed for kids and teens. Explore a variety of courses tailored to various skill. This Algebra 1 math course is divided into 12 chapters and each chapter is divided into several lessons. Under each lesson you will find theory, examples and. An eight week full-credit learner-driven Algebra I course for high school students all taught online by expert and caring independent school teachers. eTutorWorld's Algebra 1 Summer Course for high-school students is LIVE. The fast-paced course aims at enhancing your Math skills and helps you stay ahead in. This course is designed to be the first semester of Algebra 1. Part 1 covers all of the concepts crucial to success in subsequent classes. theanisenkova.ru provides customized Algebra 1 help. Whether you need tutoring on a specific lesson or a comprehensive homeschool curriculum, we have your online. This one-semester course will explore how your student's unique skills and interests can lead to a fulfilling way to earn a living. There are many ways to learn algebra online–one great place to learn is from the Khan Academy Algebra 1 and Algebra 2 on your own time. Khan Academy is a free. Explore top courses and programs in Algebra. Enhance your skills with expert-led lessons from industry leaders. Start your learning journey today! Master the fundamentals of Algebra 1 with engaging online classes designed for kids and teens. Explore a variety of courses tailored to various skill. This Algebra 1 math course is divided into 12 chapters and each chapter is divided into several lessons. Under each lesson you will find theory, examples and.

Algebra 1 course is intended to formalize and extend the mathematics that students learned in the middle grades. There are 5 modules in this course · Module 1: The Structure of Numbers · Module 2: Linear Equations · Module 3: Solving Inequalities · Module 4: Systems of. Our online Algebra I course builds students' command of linear, quadratic, and exponential relationships. Students learn through discovery and application. Algebra 1 course is intended to formalize and extend the mathematics that students learned in the middle grades. Thinkwell Algebra 1 online math course includes detailed minute instructional videos (no textbook required), automatically graded math exercises. This common core-aligned high school algebra course is designed to build and develop skills in essential algebraic concepts. The course includes. This course will incorporate the use of manipulatives to represent abstract concepts of Algebra 1 thus transforming the abstract concept to the concrete and. Accelerate's online Algebra 1 course introduces students to the world of Algebra through expressions and equations. Time: Tuesdays PM - PM Central Time. Credits Earned: 1 Algebra 1 and 1/2 Geometry credit. Prerequisite: Completed Pre-Algebra, or Saxon Math 8/7; or. Top courses in Algebra and Math · Pre-Algebra Explained · Algebra 1 Explained · Financial Math Primer for Absolute Beginners - Core Finance · HSE/GED/TASC/HiSET. This course is designed to give students the skills and strategies to solve all kinds of mathematical problems. Algebra 1 teaches students to use algebraic models to solve problems accurately and from a biblical perspective. Great course on Algebra 1! I highly recommend this course for people who course online. Dr. Sellers should have taught my HS class. I may not have. Hardcopy and lifetime digital access to the online version of the textbook are included in the tuition and fees of this course. Syllabus. Sample Problems. Below. In this Online Algebra 1 course, you'll learn to solve problems using equations, graphs, and tables to find linear, exponential, and quadratic. This course is designed to introduce students to the fundamental algebraic principles necessary for success in upper-level math courses. Enroll in college algebra online and earn credit. This online college algebra course course on one of ASU's campuses. Course attendance dates will be listed. Learn Algebra-1 today: Find your Algebra online Math course on Learntek with our Expert Faculties. The modules are designed to help high school students. Need an amazing year of accredited Algebra 1? High School Math Live is your answer for the homeschool student! We offer online, live, interactive and. Piqosity's online Algebra 1 course offers 40+ content lessons, + practice questions, and more for students, teachers, and tutors alike.

1 2 3 4 5