theanisenkova.ru Overview

Overview

Copper Market Outlook

“Copper is expected to average US$8,/t in – down % from Little recovery in prices is forecast over the outlook period, averaging US$8,/t in. Copper futures offer price mitigation to a range of market participants. An important risk management tool and the preferred instrument used by the investment. In , traditional sectors accounted for 92% of refined copper demand, with energy transition sectors, such as wind and solar power and EVs, accounting for. The global copper mining market size was valued at $ billion in & is projected to grow from $ billion in to $ billion by Copper Market Size accounted for USD Billion in and is estimated to achieve a market size of USD Billion by growing at a CAGR of. Reuters estimates copper demand will double to more than 50 million tonnes by Others estimate that this figure will reach 77 million tonnes as early as. CRU provides latest updates on copper price news, forecasts, mining news and market analysis across global markets. Find our latest updates here from. Copper Outlook Published on - July Summary of Copper Outlook Report - July Global Copper Demand and Usage Growth in Preliminary data. Copper Market was valued at USD billion in and is projected to reach USD billion by , with a CAGR of % during the forecast period. “Copper is expected to average US$8,/t in – down % from Little recovery in prices is forecast over the outlook period, averaging US$8,/t in. Copper futures offer price mitigation to a range of market participants. An important risk management tool and the preferred instrument used by the investment. In , traditional sectors accounted for 92% of refined copper demand, with energy transition sectors, such as wind and solar power and EVs, accounting for. The global copper mining market size was valued at $ billion in & is projected to grow from $ billion in to $ billion by Copper Market Size accounted for USD Billion in and is estimated to achieve a market size of USD Billion by growing at a CAGR of. Reuters estimates copper demand will double to more than 50 million tonnes by Others estimate that this figure will reach 77 million tonnes as early as. CRU provides latest updates on copper price news, forecasts, mining news and market analysis across global markets. Find our latest updates here from. Copper Outlook Published on - July Summary of Copper Outlook Report - July Global Copper Demand and Usage Growth in Preliminary data. Copper Market was valued at USD billion in and is projected to reach USD billion by , with a CAGR of % during the forecast period.

Copper Futures - Dec 24 (HGZ4) ; Open: ; Contract Size: 25, Lbs. ; Type:Commodity ; Group:Metals ; Unit:1 Pound. Copper Industry Prospective: The global copper market size was worth around USD billion in and is predicted to grow to around USD billion by When the worldwide economy is experiencing continuous expansion, the price of copper tends to rise owing to increasing factory output for the commodity. During. Copper Market size is estimated to grow by USD billion from to at a CAGR of 6% with the electrical and electronics having largest market. Copper price forecast Meanwhile, World Bank's price forecasts predict that copper could average US$10, per tonne in before retreating to US$9, next. “The supply cuts reinforce our view that the copper market is entering a period of much clearer tightening,” wrote Goldman's analysts, who see copper prices. Our experts predict a very bullish year copper in Get their forecasts for this red hot metal as well as trends and stocks that you need to watch. Copper Market Insights. Copper Market size was valued at USD billion in and is poised to grow from USD billion in to USD billion by. The copper mining industry worldwide is expected to reach a projected revenue of US$ million by A compound annual growth rate of % is. Copper price forecast for September In the beginning price at dollars. High price , low The averaged for the month In , the price of copper remained strong with an average annual price of $/lb, modestly down from 's annual average of $/lb. The Argus Copper Monthly Outlook supports your business with strategic analysis, benchmarking exercises and the assessment of individual assets, producers and. The website's copper price forecast for estimated that the price could reach $ by the end of the year, while its copper price forecast for Building construction is the single largest market, followed by electronics and electronic products, transportation, industrial machinery, and consumer and. market news to help you make sense of the forces influencing the copper market Data on forecast copper deficit; The emerging challenges for copper. Copper price hovers near the first target – Forecast today – Copper price approaches the first positive target at $, to face the MA55 that. In the final our Copper Webinar Series, Vanessa Davidson, CRU's Director of Copper Research and Strategy will be talking about the copper market outlook. The global copper market size was USD billion in , calculated at USD billion in and is expected to reach around USD billion by. Beyond the impact of near-term economic weakness, Citi Research forecasts copper prices being pushed higher by the relatively low level of investment, but.

How To Pay Back A Credit Card

You can pay your credit card in any of several convenient ways. On our website: Log in to Online Banking and select the Bill Pay tab, then follow the. The best way to pay your credit card bill is by paying the statement balance on your credit bill by the due date each month. Doing so will allow you to avoid. Most credit card issuers let you pay your credit card bill by phone, through an online account or mobile app, or by mail. You may also be able to pay in person. This credit card payoff strategy focuses on psychological factors like motivation and incentive to keep people on track towards paying off their credit card. Instead, aim to send the highest payment you can afford and reduce spending in other areas to focus on paying off the debt. It may not feel like you're saving. Tips for paying off debt · Pay more than the theanisenkova.ru · Pay more than once a theanisenkova.ru · Pay off your most expensive loan theanisenkova.ru · Consider the. You'll usually pay expensive interest on everything if you pay back less than the full amount. You must pay the minimum monthly repayment to avoid fees. Simply visit your local Bank of America ATM, insert your credit card and select Make a Payment. Please note that business credit cards are not supported at this. Paying off credit card debt can feel daunting. But with some research, an effective plan and consistency, you can get one step closer to paying off debt. You can pay your credit card in any of several convenient ways. On our website: Log in to Online Banking and select the Bill Pay tab, then follow the. The best way to pay your credit card bill is by paying the statement balance on your credit bill by the due date each month. Doing so will allow you to avoid. Most credit card issuers let you pay your credit card bill by phone, through an online account or mobile app, or by mail. You may also be able to pay in person. This credit card payoff strategy focuses on psychological factors like motivation and incentive to keep people on track towards paying off their credit card. Instead, aim to send the highest payment you can afford and reduce spending in other areas to focus on paying off the debt. It may not feel like you're saving. Tips for paying off debt · Pay more than the theanisenkova.ru · Pay more than once a theanisenkova.ru · Pay off your most expensive loan theanisenkova.ru · Consider the. You'll usually pay expensive interest on everything if you pay back less than the full amount. You must pay the minimum monthly repayment to avoid fees. Simply visit your local Bank of America ATM, insert your credit card and select Make a Payment. Please note that business credit cards are not supported at this. Paying off credit card debt can feel daunting. But with some research, an effective plan and consistency, you can get one step closer to paying off debt.

We're here to help with some tips about how to pay off credit card debts. Limit credit card use. If you have only one card, try to limit your use. By mail: If you prefer the old-school way of paying your credit card bill, you can mail a check along with your credit card bill. If going this route, be sure. Download the Amex App, and once you have setup Pay Bill Online you can select “Make payment” on the Home & (and) Statements tab(s) within the Amex App. Simply. Follow these steps to work out what you need to do · Cut the cost of your credit card debt · Cut the cost of your credit card debt · Try to avoid minimum payments. And you may be able to pay it back in stages. Some creditors will accept a 'full and final settlement'. This is when you pay off debts less that the total owed. they can help you pay off your debts “for pennies on the dollar.” But many times, these promises don't measure up. Watch out for any debt-relief. How debt payoff helps your credit Paying down debt reduces your credit utilization ratio and improves your attractiveness as a borrower since it improves your. Experts tend to recommend one of two methods for paying off credit card debt: the debt snowball method or the debt avalanche method. Pay off your balance every month. Avoid paying interest on your credit card purchases by paying the full balance each billing cycle. Resist the temptation. Try to make at least the minimum payment. · Stop using your credit card. · Call your credit card issuer. · Explore credit counseling. · Transfer your balance to a 0. For those who qualify, using a balance transfer card is the most active approach to paying off your credit card debt because it involves moving your debt to a. It's best to pay as much as you can each month. Any amount will help to reduce the amount of compounded interest you'll end up paying. Experts tend to recommend one of two methods for paying off credit card debt: the debt snowball method or the debt avalanche method. Pay off your credit card · Pay on time. Check your credit card statement for the due date and make sure you pay on or before that date. · Pay as much as you can. The best way to pay credit card bills is online with automatic monthly payments deducted from a checking account. Pay off your balance every month. Avoid paying interest on your credit card purchases by paying the full balance each billing cycle. Resist the temptation. With a solid plan and some dedication, you can pay off your card debt and reach your financial goals faster. Here are some ways to get started. By "adding" money to your credit card, whether via ATM or at a bank branch, you're really just paying off part of your balance, which increases your available. You'll find a few different methods that may help you decide which credit card balance to pay first and some factors to consider when implementing one of these. Eliminating credit card debt depends on three things: spending habits, saving habits and determination. That last one will make the following steps more.

If You Make Payments To A Collection Agency

If the contract with your original creditor permits, a debt collector may raise your interest rate. They may also charge extra fees, making repayment through a. Don't miss your court date! · If you can't afford to pay a debt let the court know. · If you agree to a payment plan with the debt collector, ask for a copy of. No, as long as your account is not settled yet, they will continue to chase you. However, paying in monthly plan will give you ease from. If the agency is collecting on a bad check, it can add collection and legal fees as allowed by state law. Partial Payments. A collection agency can demand full. If you don't pay the court-ordered amount each week, the debt collector can ask for a court order to take your property or money from your pay or bank account. Yes, but the collector must first sue you to get a court order — called a garnishment — that says it can take money from your paycheck to pay your debts. A. These expert tips from a financial planner could keep your debt from winding up in collections — plus what to do in case it does. Many collection agencies have an online payment option. If you pay debt collection online, be sure that you get an email receipt. If you don't, immediately. If the statute of limitations has passed, the only way a collector can get you to pay is if you volunteer to send the money for personal reasons. 3. Calculate. If the contract with your original creditor permits, a debt collector may raise your interest rate. They may also charge extra fees, making repayment through a. Don't miss your court date! · If you can't afford to pay a debt let the court know. · If you agree to a payment plan with the debt collector, ask for a copy of. No, as long as your account is not settled yet, they will continue to chase you. However, paying in monthly plan will give you ease from. If the agency is collecting on a bad check, it can add collection and legal fees as allowed by state law. Partial Payments. A collection agency can demand full. If you don't pay the court-ordered amount each week, the debt collector can ask for a court order to take your property or money from your pay or bank account. Yes, but the collector must first sue you to get a court order — called a garnishment — that says it can take money from your paycheck to pay your debts. A. These expert tips from a financial planner could keep your debt from winding up in collections — plus what to do in case it does. Many collection agencies have an online payment option. If you pay debt collection online, be sure that you get an email receipt. If you don't, immediately. If the statute of limitations has passed, the only way a collector can get you to pay is if you volunteer to send the money for personal reasons. 3. Calculate.

Depending on your circumstances, the creditor might let you make a lump-sum payment or a monthly payment arrangement. However, whether you can work with the. There are several situations where this may be a good option for the debt collector if they can get some of the money back and not have to pay court costs. If you believe you do not owe the debt, you should tell the debt It is a good idea to get this written notice before you agree to pay the debt collector or. If a creditor is finding it difficult to collect a debt, they might pay debt collection agencies or debt collectors to contact you instead. If they do not tell. Call the company to set up a standing order if you can afford payments. If you do make payments to a collection agent, make sure you: See their ID first; Get. They will attempt to contact delinquent borrowers through phone calls and letters and try to persuade them to pay what they owe. They can also conduct searches. That means they don't have to recover the entire amount to make a profit. By proposing a settlement, you can pay off the debt quickly, usually for far less than. Creditors may choose to sell a debt — often for far less than it is worth — because they do not believe you will pay what you owe. Selling the debt can help. If you have debt problems, go talk to a debt counsellor who will negotiate a deal for you. As a last resort, the business will garnishee your. This request must be made in writing to the collection agency and it's valid for three months. (It can be renewed.) Report on Payments and Amounts Still Owed. You should never pay a collection agency, even if they demand payment immediately and directly. This repayment will remain as a transaction on your credit. If you receive a notice from a debt collector, it's important to respond as soon as possible—even if you do not owe the debt—because otherwise the collector. If you owe the debt but do not have money available to pay it, ask the debt collector if you can work out a payment plan. Be honest about what you can afford to. Despite best efforts, sometimes people fall behind on payments to creditors. When this happens, a creditor has the right to collect on a debt that's owed to. Make all payments to the IRS. The PCA will never ask you to pay them directly or through prepaid debit, iTunes or gift cards. The private collection agency can. Work directly with the collection agency to pay the debt. Sometimes the collection agency will let you make payments or will accept a lower amount. Call our. In most cases, it is best to pay the debt as quickly as possible if you are contacted and do, in fact, owe the debt. Failing to act quickly can damage your. A paid collection doesn't help or hurt your score (FICO 8 or earlier model). You need to attempt what's called pay for delete for any accounts. The collection agency cannot raise your interest rate or add new fees, but it may choose to continue generating interest or late fee charges if they were part. What to do if your debt has been passed to a debt collection agency (DCA) · DCAs are not bailiffs · They are not(or sheriff officers (Scotland) · They have no.

Should I Buy A Gold Bar

bullion dealers have to buy gold above the spot price. ideal for you. However, be mindful that this relatively small saving would result in a lack of. For bars that don't have serial numbers, they should be kept in a sealed container that has it's own unique serial number, which you should be issued. With any. Buying gold bars is a highly effective method of safeguarding your wealth. It's an investment that provides a sense of unparalleled security in an uncertain. Gold retains its purchasing power over long periods of time despite general increases in the prices of goods and services. In other words, an ounce of gold. The main benefit of buying gold bars over coins is that they require little to no maintenance. Investing in other assets, such as a house, you need to make sure. They can be easily bought and sold worldwide, ensuring that you can quickly convert your investment into cash whenever necessary. This liquidity makes gold bars. We believe that you should invest in both gold coins and gold bars. This is the best way to hedge your bets, spread your risks, and diversify your portfolio. However, buying ten g gold bars will cost you more than buying a single 1kg gold bar. This is because of something called the premium, which is the cost. Gold coins are better than bars to buy or sell. · The problem with bars is twofold: First, LOTS of gold bars are being faked in China. Even the. bullion dealers have to buy gold above the spot price. ideal for you. However, be mindful that this relatively small saving would result in a lack of. For bars that don't have serial numbers, they should be kept in a sealed container that has it's own unique serial number, which you should be issued. With any. Buying gold bars is a highly effective method of safeguarding your wealth. It's an investment that provides a sense of unparalleled security in an uncertain. Gold retains its purchasing power over long periods of time despite general increases in the prices of goods and services. In other words, an ounce of gold. The main benefit of buying gold bars over coins is that they require little to no maintenance. Investing in other assets, such as a house, you need to make sure. They can be easily bought and sold worldwide, ensuring that you can quickly convert your investment into cash whenever necessary. This liquidity makes gold bars. We believe that you should invest in both gold coins and gold bars. This is the best way to hedge your bets, spread your risks, and diversify your portfolio. However, buying ten g gold bars will cost you more than buying a single 1kg gold bar. This is because of something called the premium, which is the cost. Gold coins are better than bars to buy or sell. · The problem with bars is twofold: First, LOTS of gold bars are being faked in China. Even the.

Gold bars lack artistic flair and rarity, and their value is solely based on precious metal content. For collectors, gold numismatic and rare coins are the way. Investing in gold coins and small bars has never been easier. But whichever way you choose to buy, it's not something that should ideally be stored at home. Gold Bars: While gold bars lack the official status of currency, they are universally accepted and traded in the bullion market. Their standardized form and. This could well be smaller gold bars. There are available in a range of sizes from 1g upwards, including g, 5g, 10g, 20g and 50g, and buying several of these. Investing in gold may provide investors with a hedge against inflation and economic uncertainty. It can also diversify an investment portfolio, reducing overall. Furthermore, physical gold in your possession has no counterparty risk (unlike savings stored in the account of a bank that may fail, or shares in a company. Buying gram gold bars made of fine gold offers investors a hedge against inflation like larger bars, but at a price point that is more manageable. You can buy gold bars from many places, but there's only one place where you can buy gold bars from America's Gold Authority®—that's at U.S. Money Reserve! When. Gold coins are generally deemed to be a better investment than gold bars, as long as you buy the right ones. Buying gold coins offers more divisibility than. For large-scale investors then, gold bars offer the cheapest option normally. For investors who prefer smaller units however, gold coins may be a better choice. Buying gold in the form of bars or bullion can be a great way to invest in gold, serve as a hedge against inflation and allow you to maintain your purchasing. Investment-quality gold bars should be at least % () pure gold. · Aside from bars and coins, it is also possible to buy physical gold in the form of. Gold bullion and silver bullion both offer worthwhile, dependable and reassuring investments. Bullion is tangible, easily traded and unlike ETFs or shares. Precious metal bars are fabricated by refineries as a practical form in which to hold a known weight of physical gold, silver or platinum, in a known and. Focus on buying gold bars with a fineness of and above. This designates 24 karat gold, which is % pure gold. Realistically % is the most common. For centuries, buying physical gold has been recognized as one of the best ways to store wealth and preserve purchasing power. In addition to these well-. Bullion coins are gold and silver coins that are purchased strictly as an investment or a hedge against inflation. Gold bars are a better way of investing in gold. These large bars are usually available at the lowest prices as compared to their smaller counterparts. For large-scale investors then, gold bars offer the cheapest option normally. For investors who prefer smaller units however, gold coins may be a better choice.

Credit Score Needed For Lightstream

You need a credit score of or higher to get a personal loan from LightStream. You will also need to meet other requirements like being at least 18 years old. *AutoPay discount is only available prior to loan funding. Rates without AutoPay are % points higher. Excellent credit required for lowest rate. Rates range. The lender doesn't list specific credit requirements on its website, but according to a representative, borrowers need a minimum credit score of to qualify. LightStream is more suitable for clients with excellent credit (+) and excellent credit history. If you have a very good credit history and credit score, we. LightStream is an online lender offering people with good credit scores personal loans and auto loans at low rates. Best Lender in the Industry I had a quick need, and Lightstream turned my application around in 24 hours with a favorable offer, and interest rate. Gave me. LightStream doesn't specify its credit score requirement, but it does state that it only offers loans to those with good to excellent credit. It'll also. Minimum recommended credit score: · State availability: 50 states and Washington, D.C. · Membership requirements: None. Maximum APR for a LightStream loan is %. Loan terms range from 24 - months depending on the loan type. 1You can fund your loan today. You need a credit score of or higher to get a personal loan from LightStream. You will also need to meet other requirements like being at least 18 years old. *AutoPay discount is only available prior to loan funding. Rates without AutoPay are % points higher. Excellent credit required for lowest rate. Rates range. The lender doesn't list specific credit requirements on its website, but according to a representative, borrowers need a minimum credit score of to qualify. LightStream is more suitable for clients with excellent credit (+) and excellent credit history. If you have a very good credit history and credit score, we. LightStream is an online lender offering people with good credit scores personal loans and auto loans at low rates. Best Lender in the Industry I had a quick need, and Lightstream turned my application around in 24 hours with a favorable offer, and interest rate. Gave me. LightStream doesn't specify its credit score requirement, but it does state that it only offers loans to those with good to excellent credit. It'll also. Minimum recommended credit score: · State availability: 50 states and Washington, D.C. · Membership requirements: None. Maximum APR for a LightStream loan is %. Loan terms range from 24 - months depending on the loan type. 1You can fund your loan today.

LightStream offers fixed-rate personal loans ranging from $5, to $,, depending on the loan purpose, which include debt consolidation, weddings, medical. That's the power of a low-interest, fixed-rate LightStream loan from $5, to $, Unlike credit card payments, for example, your LightStream loan payment. Yes, LightStream could be a great option for your personal loan needs, but it may be difficult to qualify for a loan even if you have a credit score of LightStream offers APRs ranging from % - % when you sign up for autopay. Credit score, loan amount and term length all impact what APR you qualify for. LightStream doesn't specify its credit score requirement, but it does state that it only offers loans to those with good to excellent credit. It'll also. Hey, neighbor, need a loan? Whether you're purchasing a new vehicle, putting All loans are subject to credit approval by LightStream, a division of Truist. Per LightStream rejection letter, I have an average credit score (from Equifax and Experian) of over So, if you are responsible (low debt, always pay on. LightStream online lending offers unsecured personal loans for auto, home improvement and practically anything else, at low rates for those with good credit. A credit score of or above means you're extremely well-positioned to take advantage of some of the lowest interest rates. A credit score of or above means you're extremely well-positioned to take advantage of some of the lowest interest rates. LightStream has relatively strict credit requirements, with a minimum recommended credit score of This is higher than most lenders we've reviewed that. LightStream uses FICO scoring, which means a good score is at least If you're on the edge and aren't sure if you will qualify, you may want to look. LightStream offers personal loans with no fees and low fixed rates. There's no option to prequalify, and you'll need a strong credit history to be eligible. LightStream is the online consumer lending division of Truist, one of the nation's leading financial services companies. LightStream offers innovative lending. LightStream Personal Loan Eligibility Requirements · Good-to-excellent credit scores for applicants or co-applicants · Sufficient income and assets to support. The minimum credit score is Lightstream doesn't have a uniform debt to income ratio, but they look for borrowers with a stable income and strong asset. Typically, borrowers will need to have a credit score of at least in order to qualify. The APR that you get for your loan depends on numerous factors. Minimum credit score A good credit score is anything between and , according to FICO. Both SoFi and LightStream require borrowers to have a good credit. Borrowers need to have good to excellent credit and several years of credit history for approval. APR Range: % to %. Loan Amount. Minimum credit score of Multiple account types in one's credit history, including major credit cards, car loans, or.

How To Take Money Back On Cash App

Cancelled Cash App to Cash App payments are refunded instantly but may take 1–3 business days if the funding source was a debit card. If a payment shows as. If the recipient agrees, they can reach out to Cash App support for assistance in canceling the refund. Nonetheless, if you see a cancel option. Merchant Refunds. When a merchant refunds a transaction it can take up to 10 business days (14 calendar days) for Cash App to receive the refund. Once canceled, it can take up to 10 business days (14 calendar days) for Cash App to receive the refund. If you have any questions before the 10 days have. Cash App Pay lets customers seamlessly pay with their Cash App account, enabling a fast and familiar checkout experience using a mobile payment application. To request a refund on Cash App, users can navigate to their transaction history, locate the payment they wish to reverse, and select the ". Go to the Activity tab on your Cash App home screen; Select the payment; Select Completed; Select Need Help? Select Call Merchant. Once canceled, it can take up. Cash App Pay lets customers seamlessly pay with their Cash App account, enabling a fast and familiar checkout experience using a mobile payment application. Tap the Money tab on your Cash App home screen · Press Withdraw · Choose an amount · Select a transfer speed · Confirm with your PIN or Touch ID. Cancelled Cash App to Cash App payments are refunded instantly but may take 1–3 business days if the funding source was a debit card. If a payment shows as. If the recipient agrees, they can reach out to Cash App support for assistance in canceling the refund. Nonetheless, if you see a cancel option. Merchant Refunds. When a merchant refunds a transaction it can take up to 10 business days (14 calendar days) for Cash App to receive the refund. Once canceled, it can take up to 10 business days (14 calendar days) for Cash App to receive the refund. If you have any questions before the 10 days have. Cash App Pay lets customers seamlessly pay with their Cash App account, enabling a fast and familiar checkout experience using a mobile payment application. To request a refund on Cash App, users can navigate to their transaction history, locate the payment they wish to reverse, and select the ". Go to the Activity tab on your Cash App home screen; Select the payment; Select Completed; Select Need Help? Select Call Merchant. Once canceled, it can take up. Cash App Pay lets customers seamlessly pay with their Cash App account, enabling a fast and familiar checkout experience using a mobile payment application. Tap the Money tab on your Cash App home screen · Press Withdraw · Choose an amount · Select a transfer speed · Confirm with your PIN or Touch ID.

To do this: Open the Cash App app. Navigate to the specific payment. Tap on the payment and select "Request Refund." The recipient will receive a notification. If the investigation takes longer than 10 days, you should receive a provisional refund of the money taken, including any associated fees or interest, while the. If your business allows returns, you can refund Cash App Pay transactions as you normally would for card payments. Cash App Pay supports partial or full refunds. No, Cash App generally does not guarantee refunds if scammed []. However, you can report the fraudulent transaction, contact Cash App support. If you have been the victim of an unauthorized payment on Cash App, the first step is to contact the company's customer service team. If the investigation takes longer than 10 days, you should receive a provisional refund of the money taken, including any associated fees or interest, while the. That's the thing about these 3rd party CashApp/Venmo style companies. They will do whatever they can to deny a dispute. Meanwhile, a legit bank. Cash App does have a refund [({+})] policy in place for users who have been scammed. If you believe you have been a victim of unauthorized. Then, hit the “Clock” icon and choose the specific payments that need to be refunded. ○ Now, tap on the “Refund” button and proceed to the further instructions. Refunded payments are generally returned instantly to your Cash App balance if the funds were sent from your bank or Cash App balance. If you refund a payment, the money will be returned to the sender's Cash App balance instantly if the funds were sent from the sender's Cash App balance or. Look for the option that says "Refund" or "Request Refund" and follow the prompts to initiate the refund process. If the refund option is not available or if. Cash App has a process for disputing transactions, and if a transaction meets the criteria for a reversal, they may be able to reverse it. It's. If you sent money to the wrong person or want to request a refund, open your Cash App home screen and select the “Activity” tab. Then, find the payment and. How do I file a dispute? · Go to the Activity tab on your Cash App home screen · Select the transaction in question and select the three dots () in the top right. 1. Sign in to your Cash App account and tap the Activity tab. · 2. Tap on payment and then tap on the three-dot icon. · 3. Click on the refund option, and enter. If you do respond within 13 days and win the dispute, the funds are returned to you. The Cash App Pay chargeback flow is as follows: Notification of Chargeback. 1. Sign in to your Cash App account and tap the Activity tab. · 2. Tap on payment and then tap on the three-dot icon. · 3. Click on the refund option, and enter. Cash App is the easy way to send, spend, save, and invest* your money. Download Cash App and create an account in minutes. SEND AND RECEIVE MONEY INSTANTLY.

How Does The Fed Interest Rate Affect Mortgage Rates

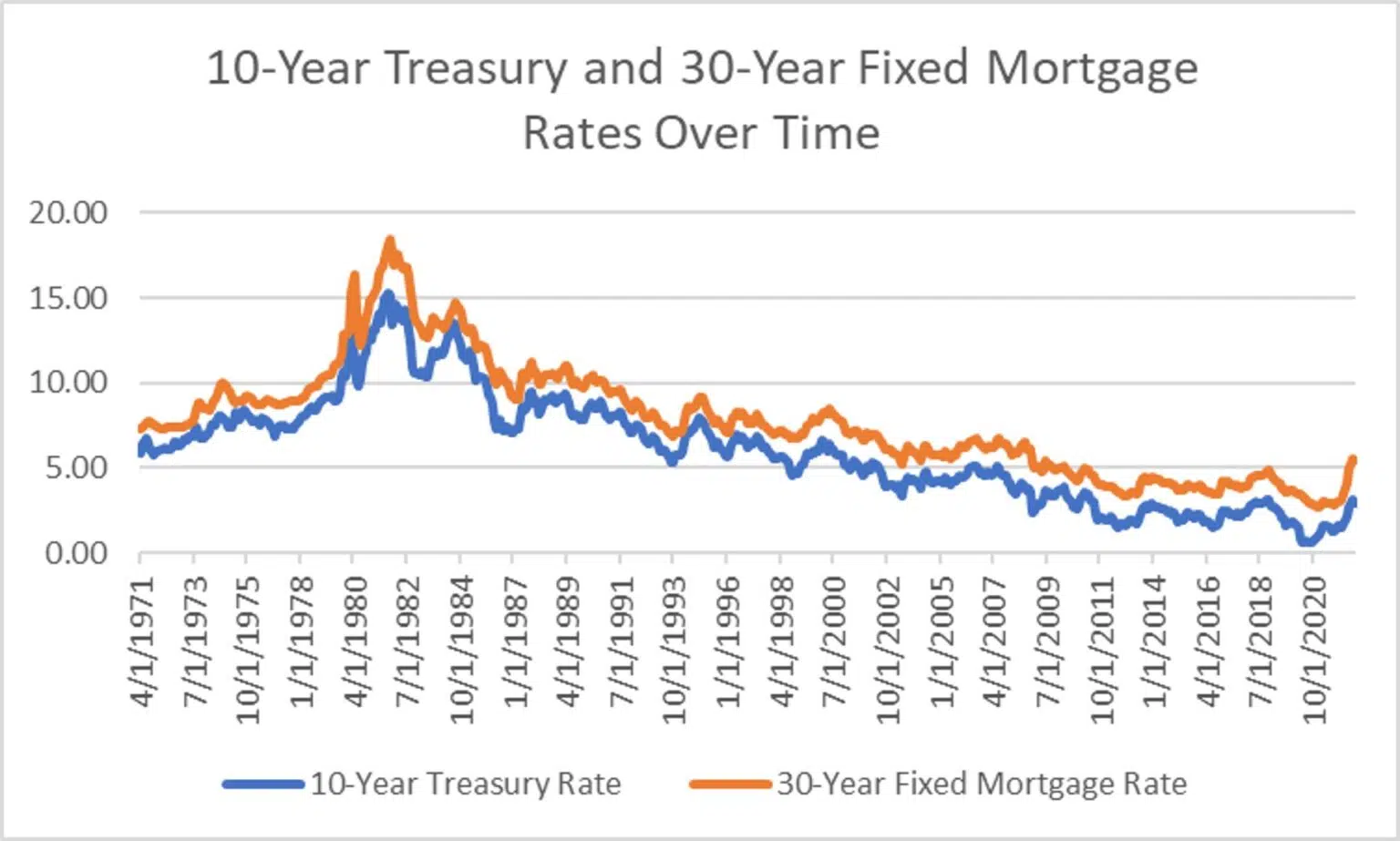

Short- and mid-term ARMs, such as the 5/1 ARM shown above, are also affected by trends in short-term interest rates. As a lenders' cost of obtaining funds to. Low-interest-rate environments help prospective buyers afford mortgage loans and refinances. A more competitive homebuying market also pushes prices higher. The Federal Reserve does not set mortgage rates, these rates are set by individual lenders. However, the Fed does set the federal funds rate, which affects. There's a common misconception that mortgage rates rise and fall with the Federal Reserve funds rate. Actually, the most common mortgage—the year, fixed-rate. These cuts lowered the funds rate to a range of 0% to %. The federal funds rate is a benchmark for other short-term rates, and also affects longer-term. It's true that higher rates directly affect credit card balances and adjustable-rate loans. But, while higher rates increase borrowing costs, a rate hike also. However, depending on the kind of mortgage you have, a rise in the fed funds rate could result in major changes in your monthly mortgage payment. What is the. There is no connection between it and mortgage rates. Mortgages in general are priced based on Mortgage Backed Securities (MBS). These are. Changes in this rate can affect other interest rates, including mortgage rates. By adjusting the federal funds rate, the Fed can stimulate economic growth. Short- and mid-term ARMs, such as the 5/1 ARM shown above, are also affected by trends in short-term interest rates. As a lenders' cost of obtaining funds to. Low-interest-rate environments help prospective buyers afford mortgage loans and refinances. A more competitive homebuying market also pushes prices higher. The Federal Reserve does not set mortgage rates, these rates are set by individual lenders. However, the Fed does set the federal funds rate, which affects. There's a common misconception that mortgage rates rise and fall with the Federal Reserve funds rate. Actually, the most common mortgage—the year, fixed-rate. These cuts lowered the funds rate to a range of 0% to %. The federal funds rate is a benchmark for other short-term rates, and also affects longer-term. It's true that higher rates directly affect credit card balances and adjustable-rate loans. But, while higher rates increase borrowing costs, a rate hike also. However, depending on the kind of mortgage you have, a rise in the fed funds rate could result in major changes in your monthly mortgage payment. What is the. There is no connection between it and mortgage rates. Mortgages in general are priced based on Mortgage Backed Securities (MBS). These are. Changes in this rate can affect other interest rates, including mortgage rates. By adjusting the federal funds rate, the Fed can stimulate economic growth.

Changes in interest rates can also affect other financial products, such as bonds. The effects of interest on bonds are complex, but in general, rising interest. However, the spread between mortgage rates and Treasury bond rates fluctuates for various reasons, including changes in credit conditions and interest rate. Instead, it influences them, with the bond market determining the subsequent course of action. The Federal Reserve oversees the Fed Funds rate, which represents. There is no connection between it and mortgage rates. Mortgages in general are priced based on Mortgage Backed Securities (MBS). These are. While the Fed doesn't set mortgage interest rates, its activity can indirectly affect mortgage rates in the following ways: Federal funds rate. This is the. Or mortgage rates may decrease when inflation is stagnant, and the Fed lowers its rate to stimulate economic activity. Mortgage interest rates and the stock. When the Fed cuts interest rates they are lowering the fed funds target rate. This is the rate banks charge each other when lending money overnight to meet the. No. Banks borrow from the fed as a last resort. The fed sets the federal funds rate (overnight borrowing between banks to meet short-term. How Bank Rate affects you partly depends on if you are borrowing or saving money. If rates fall and you have a loan or mortgage, your interest payments may get. Changes in interest rates can also affect other financial products, such as bonds. The effects of interest on bonds are complex, but in general, rising interest. Specifically, the federal funds rate is what commercial banks use to lend and borrow from each other. The rate impacts the long-term outlook of the bond market. If the Fed raises rates, mortgage interest rates are likely to rise. This is only a rule of thumb, though. Consider how mortgage rates go up and down daily, in. The federal funds rate doesn't just affect banks. It has ripple effects on the price of consumer products such as credit cards, student loans and mortgages. The prime rate is also referred to as the prime interest rate, prime lending rate or simply prime. interest rates they charge each other on the federal funds. The Fed and Mortgage Rates The interest rate is the part of a mortgage that gets the most attention. A mortgage rate is how lenders are able to assume the. How does the Prime Rate affect mortgage rates? Since the rate is used by most banks as the baseline interest rate, any increases or decreases will cause your. Generally, the prime rate is about 3 percent higher than the federal funds rate. That means that when the Fed raises interest rates, the prime rate also goes up. Why does the Fed raise interest rates? When the Federal Reserve interest rate is high, banks are discouraged from borrowing from each other, and the supply of. What Affects Mortgage Rates? A complex set of factors impact mortgage interest rates, including broader economic conditions, the monetary actions of the Federal. The yields that banks pay are heavily influenced by the Federal Reserve's interest-rate decisions. So when the Fed raised rates sharply in 20to.

Average Insurance Rate By State

This guide lists annual rates for four typical homeowners policies. The STATE FARM FIRE AND CASUALTY CO. F1, F2, F3, F4, M1, M2. Average cost of homeowners insurance by state ; New Jersey, $1, ; New Mexico, $ ; New York, $ ; North Carolina, $1, Maine has the lowest auto insurance rates in the nation, on average. Our data shows that the average annual car insurance rate for Maine drivers is $, which. Hence, the rates shown above for Farmers Ins Co are actually the new rates in Mid-Century's Farmers Flex Auto Program. STATE FARM MUTUAL AUTOMOBILE INS. CO. A. The table below lists the average car insurance rates in each state for both minimum and full coverage car insurance, which includes comprehensive and. An annual survey of establishments that collects information about employer-sponsored health insurance offerings in the United States. Average car insurance rates by state ; Arizona, $ ; California, $ ; Colorado, $ ; Connecticut, $ Your state's averages can provide a better idea of what you might pay for home insurance. Let's take a look. What's the average cost for home insurance in my. Find out how age, claims history, vehicle type, and other factors impact your car insurance rate. Plus, learn the average cost of car insurance in your state. This guide lists annual rates for four typical homeowners policies. The STATE FARM FIRE AND CASUALTY CO. F1, F2, F3, F4, M1, M2. Average cost of homeowners insurance by state ; New Jersey, $1, ; New Mexico, $ ; New York, $ ; North Carolina, $1, Maine has the lowest auto insurance rates in the nation, on average. Our data shows that the average annual car insurance rate for Maine drivers is $, which. Hence, the rates shown above for Farmers Ins Co are actually the new rates in Mid-Century's Farmers Flex Auto Program. STATE FARM MUTUAL AUTOMOBILE INS. CO. A. The table below lists the average car insurance rates in each state for both minimum and full coverage car insurance, which includes comprehensive and. An annual survey of establishments that collects information about employer-sponsored health insurance offerings in the United States. Average car insurance rates by state ; Arizona, $ ; California, $ ; Colorado, $ ; Connecticut, $ Your state's averages can provide a better idea of what you might pay for home insurance. Let's take a look. What's the average cost for home insurance in my. Find out how age, claims history, vehicle type, and other factors impact your car insurance rate. Plus, learn the average cost of car insurance in your state.

Washington State Office of the Insurance Commissioner home page. Search. For Why does auto insurance cost so much? Insurance premiums go up when. How much does car insurance cost in my state? Insurance costs vary from state to state. If you're a resident of Florida, you'll be paying the highest average. Competition is designed to encourage insurance companies to offer their lowest possible premium to each driver. Although the majority of Massachusetts. * This average rate is for a minimum coverage policy—meaning it only meets the minimum requirements for an auto insurance policy in that state. On the other. Average car insurance rates by state ; Arizona, $ ; California, $ ; Colorado, $ ; Connecticut, $ Average cost of homeowners insurance by state for $, in dwelling coverage. Georgia. Average annual premium. $1, Average monthly premium. $ Having an expensive car may affect your premium, since it may cost more to repair. Your Driving History. Having tickets in your recent history may also affect. Average Cost of State-Minimum Liability Coverage by State · 1. Michigan. $2, % · 2. New York. $2, % · 3. Louisiana. $1, % · 4. Maryland. Information about the cost of homeowners insurance State law requires insurance companies to offer lower than standard limits. The average full-coverage insurance cost for medium sedans was $1,, compared with $1, for a medium SUV. The average insurance cost for all vehicles. Michigan is the most expensive state for car insurance, with an average monthly rate of $ New Hampshire drivers pay the least, at $ Nationally, homeowners pay an average premium of $ per year. A house year is equal to days of insured coverage for a single dwelling. The NAIC does not rank state average premiums and does not endorse any conclusions. Sign up for DOI Emails · Request a Cost-Benefit Analysis. placeholder. © State of Colorado; Transparency Online · General Notices · Colorado Official State. In states like California, Hawaii, Massachusetts, Pennsylvania, North Carolina, and Montana, there is no difference in car insurance premiums for men and women. Average Car Insurance Cost by State ; Colorado, $ per year, $2, per year ; Connecticut, $1, per year, $2, per year ; Delaware, $ per year, $2, CY Retiree Rates · Retiree Rates - Health, Dental, and Vision Insurance (Defined Benefit) · Retiree Rates - Health, Dental, and Vision Insurance (Defined. Cost of Commercial Truck Insurance in 50 States ; 39, Maryland, $11, ; 40, Kentucky, $11, ; 41, West Virginia, $11, ; 42, California, $11, Note that the price for any state is the average cost of homeowners insurance for all states combined in each category. For example, the average monthly price. Our car insurance calculator factors in life changes such as marital status and homeownership to provide customized cost estimates and coverage suggestions.

Best Stock Apps For Pc

Key features · Native apps for macOS, Windows 10, 11 · Multi-monitor support. · Native desktop experience. · Simulated holdings and alerts · Powerful customization. Although it would be great to turn on the computer and leave for the day, automated trading systems do require monitoring. This is because of the potential for. Our exhaustive research has found that E*TRADE is our overall pick for best investment and trading app because of how it optimizes its mobile platforms to. Invest and build wealth with Stash, the investing app helping over 6M Americans invest and save for the future. Start investing in stocks, ETFs and more. From left to right: Ubuntu (Linux Distro), macOS, Windows operating systems. When it comes to day trading, you should stick to the operating system of your. Experience thinkorswim® desktop—a customizable trading software with elite tools that help you analyze, strategize, and trade like never before. Download Stock Trading - Best Software & Apps · TradingView · MetaTrader 4 · MetaTrader 5 — Forex, Stocks · OctaFX Trading App · Virtual Stock Trading App Protect & grow your stock portfolio in only 10 minutes a day VectorVest analyzes 16,+ stocks daily and gives a simple buy, sell, or hold rating on each. Seamless trading with the Olymp Trade desktop app The digitalization of the trading industry has revolutionized trading apps for the PC market. To meet the. Key features · Native apps for macOS, Windows 10, 11 · Multi-monitor support. · Native desktop experience. · Simulated holdings and alerts · Powerful customization. Although it would be great to turn on the computer and leave for the day, automated trading systems do require monitoring. This is because of the potential for. Our exhaustive research has found that E*TRADE is our overall pick for best investment and trading app because of how it optimizes its mobile platforms to. Invest and build wealth with Stash, the investing app helping over 6M Americans invest and save for the future. Start investing in stocks, ETFs and more. From left to right: Ubuntu (Linux Distro), macOS, Windows operating systems. When it comes to day trading, you should stick to the operating system of your. Experience thinkorswim® desktop—a customizable trading software with elite tools that help you analyze, strategize, and trade like never before. Download Stock Trading - Best Software & Apps · TradingView · MetaTrader 4 · MetaTrader 5 — Forex, Stocks · OctaFX Trading App · Virtual Stock Trading App Protect & grow your stock portfolio in only 10 minutes a day VectorVest analyzes 16,+ stocks daily and gives a simple buy, sell, or hold rating on each. Seamless trading with the Olymp Trade desktop app The digitalization of the trading industry has revolutionized trading apps for the PC market. To meet the.

Looking for an Indian Stock Market app with advanced features? Upstox is the one for you! Join Cr+ users growing their wealth right on Upstox! E*TRADE: Invest. Trade. Save. 4+. Stocks, options, mutual funds. E*TRADE Securities. Designed for iPad. Best Free Stock Charts · Best Day Trading Tools · Best Day Trading Platforms · Best Apps for Day Trading Your computer's ability to process all this. Highly recommended computer for most traders. Best Bang-For-Buck. Fast and reliable. Best PC for most traders of stocks, futures, forex, options, and more. Download Stock Market For Windows - Best Software & Apps · ChartNexus · TD Ameritrade · Uplink: Hacker Elite · QChartist · MyStockPlanner: Stock Market India. Stock tracker to help you track stocks, crypto, forex, and more. Track stocks with stock alerts through phone calls, text messages, emails. Trading does not require an expensive PC or Laptop with lots of processing power. For most users, a computer with 16GB of ram, an 8-core Intel i5 or Ryzen. Download Trading For Windows - Best Software & Apps · TradingView · GoreBox · MetaTrader 5 — Forex, Stocks · Trader Life Simulator · The Sandbox Game · Pokemon. On any device. Experience the ultimate in trading convenience with our mobile and desktop apps, offering synced layouts, watchlists, settings, and more. Robinhood has commission-free investing, and tools to help shape your financial future. Sign up and get your first stock free. Limitations and fees may. There are many platforms available for windows PC, and the best one for you will depend on your specific needs and preferences some. StockChart is a simple app which provides one click link to your favorite stock charts on theanisenkova.ru with detailed settings such as overlay, indicator. Investing. Investing. Find an Advisor · Stocks · Retirement Planning · Cryptocurrency · Best Online Stock Brokers · Best Investment Apps · View All · Mortgages. Paytm Money is India's best overall trading application, offering Rs. free brokerage this month. Aside from that, the app has an easy-to-use interface. Access the ultimate app for share market. Supercharge your financial journey with US stocks & ETFs. Unlock online trading success & high returns with. Investing. Investing. Find an Advisor · Stocks · Retirement Planning · Cryptocurrency · Best Online Stock Brokers · Best Investment Apps · View All · Mortgages. Mac users are already used to a smaller software selection. But one good program like StocksToTrade is all you need for high-level trading. Want to Know What We. Kernel: Best App or Platform for Specialised Index Funds; Simplicity Investment Funds: Best App or Platform for Low-Cost Index Funds. Disclaimer: Interactive. The best apps and websites to track your stocks · Overview of the best stock market tracking apps and websites · Yahoo Finance: Best for beginners · Morningstar. theanisenkova.ru is one of the best trading Apps in India, offering Zero Brokerage across products for life. With 25 years of rich global lineage, across 19+ countries.

Average Electric Bill For A 3 Bedroom House

Texas Residential Electricity Prices ; Two Bedroom Apartment, 1, sq. ft. kWh, ¢, $ ; Average Home, 2, sq. ft. 1, kWh, ¢, $ 3 hrs/day. $ $ Outdoors. Hot Tub. 12 hrs/week. $ $ Pool *The average monthly hours of use and corresponding appliance wattage used. The average electricity bill for a 4-bedroom house in Melbourne is $ per week (or around $ per month). That includes the cost of the. The average monthly bills are $ for electricity, $ for water and sewer, and $ for food. The total monthly expenses are $ Because there are 4. Wondering if anyone could give an idea of average electricity bill cost for their 3 bedroom. Is it a choice between Eversource and National Grid in East Boston? A 3 bedroom house falls under a medium residential category. It typically uses kWh per year (Ofgem statistics). Apart from that, additional electricity. In the US, residents should plan to spend at least $ per month on essential utilities like electricity, natural gas, water, and sewer. Depending on where. Average Electric Bill for Homes ; Arkansas, $81, $83 ; California, $, $ ; Colorado, $99, $ ; Connecticut, $, $ Monthly electric bills are a product of how much electricity you use per month and your electric rate. In Virginia, the average monthly electric bill for. Texas Residential Electricity Prices ; Two Bedroom Apartment, 1, sq. ft. kWh, ¢, $ ; Average Home, 2, sq. ft. 1, kWh, ¢, $ 3 hrs/day. $ $ Outdoors. Hot Tub. 12 hrs/week. $ $ Pool *The average monthly hours of use and corresponding appliance wattage used. The average electricity bill for a 4-bedroom house in Melbourne is $ per week (or around $ per month). That includes the cost of the. The average monthly bills are $ for electricity, $ for water and sewer, and $ for food. The total monthly expenses are $ Because there are 4. Wondering if anyone could give an idea of average electricity bill cost for their 3 bedroom. Is it a choice between Eversource and National Grid in East Boston? A 3 bedroom house falls under a medium residential category. It typically uses kWh per year (Ofgem statistics). Apart from that, additional electricity. In the US, residents should plan to spend at least $ per month on essential utilities like electricity, natural gas, water, and sewer. Depending on where. Average Electric Bill for Homes ; Arkansas, $81, $83 ; California, $, $ ; Colorado, $99, $ ; Connecticut, $, $ Monthly electric bills are a product of how much electricity you use per month and your electric rate. In Virginia, the average monthly electric bill for.

Interested in what comprises a typical residential electricity bill? The graphs below compare average monthly electricity bills over the last 10 years for. Your average gas and electric bill by house size and usage. Energy prices go Medium (3-bedroom house / people), Gas: 11, kWh Elec: 2, kWh. How much kWh does a house use? The average residential electricity consumption in the United States is about 10, kWh per year, which translates to. For example, for " North Main Street," try " Main." Enter just the house number and first letter of the street name. Make sure you have selected the right. The average monthly electricity cost of a 3-bedroom apartment is $ The average water bill for a 3 bedroom apartment is $; The average water. How much are average utilities for a house? · Electricity: $ · Natural gas: $ · Water: $ · Trash/Recycling: $ · Internet: $ · Cable: $ average, while 2-bedroom apartments and 3-bedroom apartments. Find your independence placeFor example, the average electric bill for one-bedroom. So, if you live alone or with one other person, you'll likely use between and 1, kWh. If you have a family of 3 to 4 people, 1, kWh is a good. Average**. Delivery. $. $. $. $. Delivery. $. $. $. $. Commodity. High, low and average bill amounts; 3. Estimated monthly bill if enrolled in Alliant Energy's Budget Billing program house and energy conservation habits. The graphs below compare average monthly electricity bills over the last 10 years for residential customers who purchased their electricity supply from RG&E. Large House Electricity Bill. The average kWh usage for a 3,sq-ft home is 2, kWh per month. The average monthly power bill for a large house translates. This is a CPS Energy bill estimator for residential customers. To estimate the monthly bill for your home, simply input your estimated electric and gas. Although utility customers in New York State are free to choose their energy supplier, these bill calculations reflect the provision of energy by the respective. They are based on the typical cost of utilities and services paid by energy bill or the landlord charges the tenant extra for the utility bill. To. In the US, residents should plan to spend at least $ per month on essential utilities like electricity, natural gas, water, and sewer. Depending on where. How much is an average energy bill? + energy-saving tips. Back to all Medium (3-bedroom house/ people), 2, kWh, 11, kWh. High (5-bedroom. The average monthly electricity cost of a 3-bedroom apartment is $ The average water bill for a 3 bedroom apartment is $; The average water. The average monthly electric bill in Texas is about $ We know that how you live and the size of your home will determine how much you're paying for. The average electricity in a Texas apartment will cost $89/month while a house will cost $/month. The electricity cost per month can also fluctuate depending.

1 2 3 4 5 6