theanisenkova.ru Prices

Prices

Organic Farming Stocks

Organic Farming Creates Value for Investors, Communities, and the Environment · 4x more · Revenue · 3x more · Jobs · + tons · of Carbon · Meet the Farmland Team. Our Top 3 ASX Agriculture Stocks · Elders (ASX: ELD) · GrainCorp (ASX: GNC) · Select Harvests (ASX: SHV). Table of contents · What Are Organic Food Stocks? · The Best Organic Food Stocks to Buy Now · The Simply Good Foods Company (NASDAQ:SMPL) · Sprouts Farmers Market. Our Eggs, Butter, and Ghee from American family farms are delicious, ethical food you don't have to question. Investing in Agriculture Stocks · Top 8 agriculture stocks to invest in · 1. Archer-Daniels-Midland · 2. Bayer · 3. Bunge · 4. Scotts Miracle-Gro · 5. Corteva. Home India - Agriculture Agricultural Stocks. This section has covered the Organic Farming through Various Schemes/Programmes - India: Integrated. Sustainable and organic research investments drive innovation Over the last several decades, publicly funded agricultural research has led to the advancement. Bunge Global SA's diverse product offerings and solid financial performance make it a top agriculture stock to watch in Emerging Opportunities in the. Welcome · Green Investment with High Returns. While it is high returns that we are after, the fact that organic farming uses safe, eco-friendly methods that. Organic Farming Creates Value for Investors, Communities, and the Environment · 4x more · Revenue · 3x more · Jobs · + tons · of Carbon · Meet the Farmland Team. Our Top 3 ASX Agriculture Stocks · Elders (ASX: ELD) · GrainCorp (ASX: GNC) · Select Harvests (ASX: SHV). Table of contents · What Are Organic Food Stocks? · The Best Organic Food Stocks to Buy Now · The Simply Good Foods Company (NASDAQ:SMPL) · Sprouts Farmers Market. Our Eggs, Butter, and Ghee from American family farms are delicious, ethical food you don't have to question. Investing in Agriculture Stocks · Top 8 agriculture stocks to invest in · 1. Archer-Daniels-Midland · 2. Bayer · 3. Bunge · 4. Scotts Miracle-Gro · 5. Corteva. Home India - Agriculture Agricultural Stocks. This section has covered the Organic Farming through Various Schemes/Programmes - India: Integrated. Sustainable and organic research investments drive innovation Over the last several decades, publicly funded agricultural research has led to the advancement. Bunge Global SA's diverse product offerings and solid financial performance make it a top agriculture stock to watch in Emerging Opportunities in the. Welcome · Green Investment with High Returns. While it is high returns that we are after, the fact that organic farming uses safe, eco-friendly methods that.

Organic farmers manage their land without synthetic pesticides, mineral fertilisers, growth promoters or genetically modified organisms. This is to minimise the. As a certified organic farm, you are required to use organically grown seeds and planting stock if the variety — or its equivalent — is available. The latest agriculture news and market analysis for investors, including expert forecasts, trends, CEO interviews, company profiles and top stocks to watch. Organic Food Stocks List ; LANDM, A, Gladstone Land Corporation - % Series D Cumulative Term Preferred Stock, ; STKL, B, SunOpta, Inc. The USDA organic regulations at 7 CFR § require that organic producers use organic seeds, annual seedlings, and planting stock. The regulations allow. Agriculture Stocks ; CTVA CORTEVA · ; ADM ARCHER DANIELS MIDLAND · ; NTR NUTRIEN · ; CF CF INDUSTRIES · ; BG BUNGE · Background Changes in soil organic carbon (SOC) stocks significantly influence the atmospheric C concentration. Agricultural management practices that increase. Agriculture Industries: ; NTR, Nutrien Ltd, % ; NUGS, Cannabis Strategic Ventures, N/A ; NZKSF, New Zealand King Salmon Investments Ltd, N/A ; OGAA, Organic. PDF | For decades, conservation tillage has been promoted as a measure to increase carbon stocks in arable soils. Since organic farming improves soil. Shallow non-inversion tillage in organic farming maintains crop yields and increases soil C stocks: a meta-analysis. theanisenkova.ru Small-scale pasture based farm in Southeast Wisconsin. Stock Family Farm provides healthy, Organic fed, pasture raised chicken, lamb, eggs. The soil organic matter submodel includes two fresh residue pools (litter) and three SOC pools. Litter is subdivided in two pools (metabolic and structural) and. It has been suggested that conversion to organic farming contributes to soil carbon sequestration, but until now a comprehensive quantitative assessment has. stock," says Bradford. A Read our article, Nature's Path: Model for Organic Farming, about another company that's buying land for organic production. the seed was not treated with prohibited materials. Annual seedlings. Transplants, starts, or seedlings used to produce an annual organic crop must have been. List of Best Agriculture Stocks ; img Fertilizers & Chemicals Travancore Ltd. ₹ MID CAP ; img Bombay Burmah Trading Corporation Ltd. ₹2, SMALL CAP. A list of Organic Food ETFs. Organic food is food produced by methods that comply with the standards of organic farming View All Organic Food Stocks. While organics still account for under five percent of grocery sales, a growing market is clearly attractive both to the food industry and to farmers, who. At Pipers Farm we passionately believe in enjoying food that is totally natural, wholesome and good for you. Our range of pure stocks and Organic bone. organic farmer land to lease or mortgage. The So, during inflation, farming investments do well because crop income and the value of farmland increase.

Best Insurance For Fertility Treatments

Insurance plans in which we are currently “participating providers” ; Blue Choice (also Blue Options), PPO PPO (BCS) ; Blue Cross. PPO ; Cigna. PPO POS ; Humana. Benefits and Coverage · Carefully review your health insurance policy. · Ask your insurance company which infertility treatments they do and do not cover. · Take. Aetna** HMO, PPO and POS (RBA is a Center of Excellence) · Blue Cross Blue Shield** · First Health* · Kaiser (if your plan has with infertility treatment coverage). People who are affected by infertility have options to try, but in vitro fertilization (IVF) and diagnostics, medication, surgery, and other treatments can. The Best Fertility Insurance of · Best Value: Blue Cross Blue Shield · Best for Customer Satisfaction: Kaiser Permanente · Best for Wide Acceptance. Navigating the world of fertility treatment and IVF can feel overwhelming, but understanding your insurance coverage shouldn't be. Basic infertility treatments must be covered under individual, small group, and large group comprehensive health insurance policies when you meet the definition. IVF and Infertility Insurance · United Health Care PPO · United Health Care POS · United Resources Network · CIGNA · PHCS · Private Indemnity · And many others. Boston IVF accepts all major insurance plans. We are a "Preferred Provider" of fertility services with the following health insurance plans: Aetna; Blue Cross. Insurance plans in which we are currently “participating providers” ; Blue Choice (also Blue Options), PPO PPO (BCS) ; Blue Cross. PPO ; Cigna. PPO POS ; Humana. Benefits and Coverage · Carefully review your health insurance policy. · Ask your insurance company which infertility treatments they do and do not cover. · Take. Aetna** HMO, PPO and POS (RBA is a Center of Excellence) · Blue Cross Blue Shield** · First Health* · Kaiser (if your plan has with infertility treatment coverage). People who are affected by infertility have options to try, but in vitro fertilization (IVF) and diagnostics, medication, surgery, and other treatments can. The Best Fertility Insurance of · Best Value: Blue Cross Blue Shield · Best for Customer Satisfaction: Kaiser Permanente · Best for Wide Acceptance. Navigating the world of fertility treatment and IVF can feel overwhelming, but understanding your insurance coverage shouldn't be. Basic infertility treatments must be covered under individual, small group, and large group comprehensive health insurance policies when you meet the definition. IVF and Infertility Insurance · United Health Care PPO · United Health Care POS · United Resources Network · CIGNA · PHCS · Private Indemnity · And many others. Boston IVF accepts all major insurance plans. We are a "Preferred Provider" of fertility services with the following health insurance plans: Aetna; Blue Cross.

Navigating insurance for fertility care can be difficult. Even in states that have IVF coverage laws, there may be criteria and certain exemptions that limit. Major insurance providers such as Aetna, Blue Cross Blue Shield, Cigna, United Healthcare and Tricare offer a wide spectrum of fertility benefits, including IVF. Massachusetts Has Mandatory Coverage for IVF. State law in Massachusetts requires that insurance cover infertility diagnosis and treatment, however that. Fertility Coverage · · Aetna HMO/PPO · Anthem · Cigna HMO/PPO · Emblem Health Plan (formerly GHI) · Empire Blue Cross Blue Shield HMO/PPO · First Health · Horizon. Care Health Insurance covers the IVF treatment expenses under the Care Classic health insurance plan. Q. Is there any medical insurance that covers IVF? Yes. Fertility insurance benefits help potential parents who are struggling to conceive or carry a pregnancy to term. Coverage through the Minnesota Advantage Health. Some insurance plans will require a referral from your primary care provider (for example an OB/GYN) before receiving treatment for infertility services. It is. Learn More About Fertility Treatment Financing Options. () Nashville Top Doctors. Nashville Fertility. New Patient Appointments: () Your health plan may provide some type of infertility insurance coverage. Does insurance cover IVF? Read about questions to ask and plans accepted at Aspire. If your employer is self-insured, they can choose to cover IVF and fertility preservation. If you are not sure if your plan covers IVF, contact our team and we. Participating Providers: Fertility Insurance Coverage · Aetna. Insurance Provider recognizes RMA of New York as a Center of Excellence. · Cigna · Maven · New York. Rhode Island, Massachusetts, and Connecticut are three of only 15 states in the country that have fertility insurance mandates, which means that the state's. treatment. It's no surprise that infertility treatment can be expensive, and fertility insurance coverage is spotty at best. Our financial counselor will. If you've found the best insurance for infertility treatments, you can change your coverage during open enrollment. Affording care: the cost of fertility. Future Generali is one of the top companies offering health insurance plans that also cover the cost of IVF and other infertility treatments. - Which insurance. PPO · Aetna · Anthem Blue Cross · Blue Shield (Covered California) · Carrot Fertility · Cigna · First Health Network · Great West · TriCare. PREG works diligently to contract with most major insurance carriers and will make every effort to get your treatments and medications covered within your. Each insurance carrier may have programs with infertility benefits, but these benefits can be modified depending on the group contract or an individuals. 1. Does my health insurance plan cover fertility treatments? Maternity and newborn care are considered essential benefits under most health plans, but. As of January 1, New York became one of thirteen states in the United States to expand In Vitro Fertilization (IVF) and Fertility Preservation.

How To Fix Charge Off On Credit Report

A charged-off account will be reported to the major credit rating bureaus and remain on your credit history for seven years, making it difficult for you to get. When you pay the full charge-off balance, the account's status on your credit report will be updated to show that it has been paid. It doesn't remove the charge. You can write a goodwill letter to the creditor asking them to remove the charge-off from your credit report. Explain your situation and why they should. Have the credit reporting agencies remove it from your account after you formally dispute it. If a collector keeps a debt on your credit report for an extended. You can negotiate with debt collection agencies to remove negative information from your credit report charge-off. What Is a Tradeline? Credit. A charge-off will cause more damage to a good credit score than it will to a bad credit score. Still, you should expect a hefty drop in your credit rating if. It is possible to remove a charge-off from your credit history, but it's not always easy. First, you should determine whether the charge-off on your report is. Before we start, let's be clear about one thing. There is no guaranteed way to remove a legitimate, verifiable charge-off from your credit report. The credit. The CRA will forward your dispute to the creditor for investigation. The creditor must conduct a thorough review and report back to the CRA. Once the. A charged-off account will be reported to the major credit rating bureaus and remain on your credit history for seven years, making it difficult for you to get. When you pay the full charge-off balance, the account's status on your credit report will be updated to show that it has been paid. It doesn't remove the charge. You can write a goodwill letter to the creditor asking them to remove the charge-off from your credit report. Explain your situation and why they should. Have the credit reporting agencies remove it from your account after you formally dispute it. If a collector keeps a debt on your credit report for an extended. You can negotiate with debt collection agencies to remove negative information from your credit report charge-off. What Is a Tradeline? Credit. A charge-off will cause more damage to a good credit score than it will to a bad credit score. Still, you should expect a hefty drop in your credit rating if. It is possible to remove a charge-off from your credit history, but it's not always easy. First, you should determine whether the charge-off on your report is. Before we start, let's be clear about one thing. There is no guaranteed way to remove a legitimate, verifiable charge-off from your credit report. The credit. The CRA will forward your dispute to the creditor for investigation. The creditor must conduct a thorough review and report back to the CRA. Once the.

The original lender or the collection agency may be willing to negotiate a payment plan or settlement. A payment plan or settlement may also impact your credit. In the event, the account is not reporting as a charge-off and simply just showing late payments then you can take this issue up directly with the creditor. If. In some cases, paying the charged-off account will show a positive impact to your credit score by eliminating excessive utilization. Seek the advice of a. A charge off will remain on your credit report for 7 years. Unpaid charge offs can then be removed under the Fair Credit Reporting Act by. Dispute that with the credit agencies. Then, review the reports again. Dispute with Discover. After that, you might try filing arbitration. You can reach a debt settlement before charge-off. A quick settlement benefits both sides, and may cause less damage to your credit score. To correct mistakes in your report, contact the credit bureau and the business that reported the inaccurate information. Tell them you want to dispute that. Reviewing and validating. Inaccurate reporting can cause additional damage to your credit report. Ensure that the details of your charge off are correct by. In practice, however, it is not common for creditors to do so. You asked about your credit score. See the theanisenkova.ru article Short Sale, Foreclosure & Your. While paying a charged-off debt won't directly boost your credit score, exploring avenues to remove the charge-off from your credit report can be worthwhile. A loan account can become charged off when the lender determines that there is a high risk that the borrower will not be able to repay the. The only way to remove a charge-off from your credit report without paying is to wait until it expires from your credit reports. After seven years, a charge-off. How to Dispute a Charge-Off. The Fair Credit Reporting Act gives you numerous rights when it comes to the information on your credit reports. For example, you. Unpaid credit card bills that go days without payment get charged off. If you can get a payment plan set up with the banks before that happens, or even. Steps to remove an error from your credit report · Step 1: Prepare documentation · Step 2: Report the inaccuracy to the bureau · Step 3: File a complaint with the. Use the sample letter below to request a removal of a charge-off on your credit report. If you've stopped paying your creditors for unpaid debts, they will. How does a charge-off affect credit? Once a creditor writes off the debt as a loss, they will report the charge-off to the credit reporting bureaus. It will. You can either contact the creditor to update their records or go directly to the credit bureaus and open an investigation to inform them of the mistake. To give you an idea of how serious a charge-off is, your credit score can drop 50 - points because of a charge-off. What's worse, even if you settle the. A charge off is cause for concern. It not only does major damage to your credit score, but likely means dealing with aggressive debt collection efforts.

Value Of The Pound To The Dollar

Popular British Pound (GBP) Pairings ; usd. US Dollar. 1 GBP equals to. USD. + (%) ; eur. Euro. 1 GBP equals to. EUR. + (%). The Bottom Line. Although the British pound is worth more than the U.S. dollar on a nominal basis, the dollar is still a stronger currency due to its status as. Download Our Currency Converter App ; 1 GBP, USD ; 5 GBP, USD ; 10 GBP, USD ; 20 GBP, USD. Just enter the GBP amount to be converted to USD. Commitment to security. Our encryption and fraud prevention efforts help protect your Western Union. Zimbabwean Dollar. GBP. USD; GBP; EUR; CAD; JPY. Know It's easy -- just select your country's currency and enter the dollar amount you would like to convert. The British Pound is currently stronger than the US Dollar, as 1 GBP is equal to USD. Conversely, 1 USD is worth GBP. Is the British Pound up or. 1 GBP = USD Aug 26, UTC Check the currency rates against all the world currencies here. The currency converter below is easy to use and. To convert Pounds (£) to Dollars ($, USD), we multiply the given value of Pounds by because of 1 British Pound Sterling = US Dollars. British Pounds to US Dollars conversion rates ; 1 USD, GBP ; 5 USD, GBP ; 10 USD, GBP ; 25 USD, GBP. Popular British Pound (GBP) Pairings ; usd. US Dollar. 1 GBP equals to. USD. + (%) ; eur. Euro. 1 GBP equals to. EUR. + (%). The Bottom Line. Although the British pound is worth more than the U.S. dollar on a nominal basis, the dollar is still a stronger currency due to its status as. Download Our Currency Converter App ; 1 GBP, USD ; 5 GBP, USD ; 10 GBP, USD ; 20 GBP, USD. Just enter the GBP amount to be converted to USD. Commitment to security. Our encryption and fraud prevention efforts help protect your Western Union. Zimbabwean Dollar. GBP. USD; GBP; EUR; CAD; JPY. Know It's easy -- just select your country's currency and enter the dollar amount you would like to convert. The British Pound is currently stronger than the US Dollar, as 1 GBP is equal to USD. Conversely, 1 USD is worth GBP. Is the British Pound up or. 1 GBP = USD Aug 26, UTC Check the currency rates against all the world currencies here. The currency converter below is easy to use and. To convert Pounds (£) to Dollars ($, USD), we multiply the given value of Pounds by because of 1 British Pound Sterling = US Dollars. British Pounds to US Dollars conversion rates ; 1 USD, GBP ; 5 USD, GBP ; 10 USD, GBP ; 25 USD, GBP.

This Free Currency Exchange Rates Calculator helps you convert British Pound to US Dollar from any amount. British Pound to US Dollar Exchange Rate is at a current level of , up from the previous market day and up from one year ago. The Bottom Line. Although the British pound is worth more than the U.S. dollar on a nominal basis, the dollar is still a stronger currency due to its status as. Get the latest Pound sterling to United States Dollar (GBP / USD) real Value of the base currency compared to the quote currency. Previous. Current exchange rate BRITISH POUND (GBP) to US DOLLAR (USD) including currency converter, buying & selling rate and historical conversion chart. Table of 1 British Pound to US Dollar Exchange Rate ; Minimum: USD, Maximum: USD, Average: USD. Delivery options, available branches and fees may vary by value and currency. Branch rates will differ from online rates. T&Cs apply. The value of the GBPUSD pair is quoted as 1 GBP per x USD. For example, if the pair is trading at , it means it takes USD to buy 1 GBP. What is. Our Pound to Dollar conversion tool gives you a way to compare the latest and historic interbank exchange rates for GBP to USD · Currency Menu. Historically, the British pound (GBP) has been stronger than most currencies, including the U.S. dollar. In , the value of the GBP hit a record doubling. Live GBP/USD Exchange Rate Data, Calculator, Chart, Statistics, Volumes and History ; = ; 1 GBP buys USD: Transfer Money Now. Compare Today's. Latest Currency Exchange Rates: 1 British Pound = US Dollar · Currency Converter · Exchange Rate History For Converting Pounds (GBP) to Dollars (USD). Pound Dollar Exchange Rate (GBP USD) - Historical Chart ; , , , , Change value during the period between open outcry settle and the commencement of the next day's trading is calculated as the difference between the last. Pounds to Dollars Currency Converter ; FOREX DATA ; GBP/USD, +0 ; , △, +0%. Pound highest against dollar in a year as investors bet on UK rates staying higher for longer. 17 Jul Business. GBP to USD interbank exchange rates: 1 GBP = USD, 1 USD = GBP. GBP/USD Quotes ; Real-time Currencies. 26/ , ; CME. 26/ , ; CME. 23/ , ; Moscow. 14/ , Enter old value in pounds: £. Convert Clear. Value at beginning of target year in dollars: $. The preceding table uses Java script. Please cite as follows. Enter the amount to be converted in the box to the left of Pound Sterling. WOW, I thought the American dollar was worth more abroad. Boy was I wrong! I.

How Much Will I Need For Retirement

Many experts maintain that retirement income should be about 80% of a couple's final pre-retirement annual earnings. Fidelity Investments recommends that you. Our Retirement Calculator estimates the future value of your retirement savings and determines how much more you need to save each month. Are you saving enough for retirement? SmartAsset's award-winning calculator can help you determine exactly how much you need to save to retire. At what age do you plan to retire? What's your current annual salary? What percentage of your current income do you think you will need in retirement? How much. We'll use this to figure out how much income you'll need to generate from your retirement savings. (We'll take care of inflation so tell us based on today's. How much money will you need to live once you have retired (after taxes)? This is the amount you'll need to cover all living expenses for an entire year. One rule of thumb is that you'll need 70% of your annual pre-retirement income to live comfortably. That might be enough if you've paid off your mortgage and. About how much money do you currently have in investments? This should be the total of all your investment accounts including (k)s, IRAs, mutual funds, etc. Typically 10 to 12 times your annual income at retirement age. While there is no one-size-fits-all plan, there are some common guidelines and benchmarks. Many experts maintain that retirement income should be about 80% of a couple's final pre-retirement annual earnings. Fidelity Investments recommends that you. Our Retirement Calculator estimates the future value of your retirement savings and determines how much more you need to save each month. Are you saving enough for retirement? SmartAsset's award-winning calculator can help you determine exactly how much you need to save to retire. At what age do you plan to retire? What's your current annual salary? What percentage of your current income do you think you will need in retirement? How much. We'll use this to figure out how much income you'll need to generate from your retirement savings. (We'll take care of inflation so tell us based on today's. How much money will you need to live once you have retired (after taxes)? This is the amount you'll need to cover all living expenses for an entire year. One rule of thumb is that you'll need 70% of your annual pre-retirement income to live comfortably. That might be enough if you've paid off your mortgage and. About how much money do you currently have in investments? This should be the total of all your investment accounts including (k)s, IRAs, mutual funds, etc. Typically 10 to 12 times your annual income at retirement age. While there is no one-size-fits-all plan, there are some common guidelines and benchmarks.

Number of years until retirement. Number of years required after retirement. Annual Inflation. Annual Yield on Balance (average). CALCULATE. You will need. Use our retirement savings calculator to help find out how much money you need to save for retirement ll show you what you need to save to make reality meet. One such guideline is to have 10 to 12 times your annual income at retirement age. So, if you currently earn $,, you will need 10 times that amount, or $1. Am I saving enough for retirement? · How much do I need for retirement? · How much can I afford to save from each paycheck? · How much do I need to save today for. Use our personal retirement calculator to find out how much you may need to retire and if you're on track for the retirement that you want. The percentage of your pre-retirement household income you think you will need in retirement. This amount is based on the household income earned during the. We built a simple retirement savings calculator to help you answer the question: “how much do I need to retire?”. Retirement advisors at Fifth Third Securities generally agree that a good rule of thumb for estimating your future spending is to multiply your current monthly. At what age do you plan to retire? What's your current annual salary? What percentage of your current income do you think you will need in retirement? How much. One rule of thumb is that you'll need 70% of your pre-retirement yearly salary to live comfortably. That might be enough if you've paid off your mortgage. This calculator can help with planning the financial aspects of your retirement, such as providing an idea where you stand in terms of retirement savings. Someone between the ages of 41 and 45 should have times their current salary saved for retirement. Someone between the ages of 46 and 50 should have Take your estimated monthly expenses (be sure they're realistic) and divide that number by 4% to figure out how much income you'll need in retirement. For. How much income will you need in retirement? Are you on track? Compare what you may have to what you will need. The timing is up to you and should be based on your own personal needs. Get an estimate. Get an estimate. Check your Social Security account to see how much. ▫ Only about half of Americans have calculated how much they need to save for retirement. Experts estimate that you will need 70 to 90 percent of your. To get a clear idea of how much you may need for retirement, start by considering the many factors that could affect your future spending power, such as. Retirement Savings Rule of Thumb. A generally accepted rule of thumb for retirement planning is that you should have, at minimum, 80 percent of the yearly. So, we did the math and found that most people will need to generate about 45% of their retirement income (before taxes) from savings. Based on our estimates. Find out how much you will need to save for retirement and if you're on track to meet your retirement savings goal. Take 2 minutes to get your results.

Best Blue Chip Stocks With High Dividends

10 Blue Chip Stocks with High Dividends ; American Express (AXP). Market Cap: $ Billion. Dividend Yield: %. Business Focus: Business Credit Cards ; Chevron. Highest Dividend Paying Stocks ; TCPC, BlackRock TCP Capital BDC, , , % ; XFLT, XAI Octagon Floating Rate & Alt Inc Fund, , , %. Blue chip dividend stocks are typically large in size (eg market caps exceeding $10 billion), have tremendous financial strength, maintain leading roles in the. Discover the ranking list of the public companies paying the highest dividends These are often blue-chip stocks or businesses operating in mature. Long term growth with a dividend, I would be looking at the likes of AVGO, Intel, NEE, AWK, JPM, IBM, XOM. These stocks all have 3% or better. Chevron (CVX) International Business Machines (IBM) and Altria Group (MO) are some of the most trending Dividend Stocks. INTEL (INTC), BOEING (BA) and Johnson & Johnson (JNJ) are some of the most trending stocks in the Best Blue sector. read more. Blue Chip Stocks. Blue chip companies with relatively high dividends include Pfizer, Sanofi and Johnson & Johnson. Daria Uhlig and Andrew Lisa contributed to the reporting for. It can pay to buy shares. These Dow 30 companies have a dividend yield of at least %. · Intel Corp. INTC · Walgreens Boots Alliance Inc. WBA · Verizon. 10 Blue Chip Stocks with High Dividends ; American Express (AXP). Market Cap: $ Billion. Dividend Yield: %. Business Focus: Business Credit Cards ; Chevron. Highest Dividend Paying Stocks ; TCPC, BlackRock TCP Capital BDC, , , % ; XFLT, XAI Octagon Floating Rate & Alt Inc Fund, , , %. Blue chip dividend stocks are typically large in size (eg market caps exceeding $10 billion), have tremendous financial strength, maintain leading roles in the. Discover the ranking list of the public companies paying the highest dividends These are often blue-chip stocks or businesses operating in mature. Long term growth with a dividend, I would be looking at the likes of AVGO, Intel, NEE, AWK, JPM, IBM, XOM. These stocks all have 3% or better. Chevron (CVX) International Business Machines (IBM) and Altria Group (MO) are some of the most trending Dividend Stocks. INTEL (INTC), BOEING (BA) and Johnson & Johnson (JNJ) are some of the most trending stocks in the Best Blue sector. read more. Blue Chip Stocks. Blue chip companies with relatively high dividends include Pfizer, Sanofi and Johnson & Johnson. Daria Uhlig and Andrew Lisa contributed to the reporting for. It can pay to buy shares. These Dow 30 companies have a dividend yield of at least %. · Intel Corp. INTC · Walgreens Boots Alliance Inc. WBA · Verizon.

Blue Chip Stocks ; ICT, International Container Terminal Services, Inc. % ; BDO, BDO Unibank, Inc. % ; BPI, Bank of the Philippine Islands, % ; ALI. SULZBERGER: I heard you're thinking of putting it back. TRUMP: I am, indeed. I am. SULZBERGER: Wonderful. So we've got a good collection here from our newsroom. Check out stocks offering high dividend yields along with the company's dividend history. You can view all stocks or filter them according to the BSE group or. There are many blue chip companies that offer high dividends. Examples are: AT&T Inc., UPS, Lockheed Martin Corp, Accenture and Microsoft. Dividend yields vary by company, but energy stocks, telecommunications stocks and real estate investment trusts often have some of the highest dividend yields. In fact, some of the best high dividend stocks are household names such as Qualcomm Inc. (NASDAQ: QCOM), International Business Machines Corp. (NYSE: IBM) and. S&P Companies that Can Afford to Start Paying a Dividend · Biogen Inc. (BIIB) · Facebook Inc. (FB) · Alphabet Class C (GOOG) · Alphabet Class A (GOOGL). Solid balance sheet fundamentals and high liquidity have earned blue chip stocks an investment-grade credit rating. Dividend payments aren't necessary for a. The top 10 blue chip stocks based on dividend yield are Telefonica, Total, Engie, Eni, BASF, Orange. What are European blue chip stocks examples? Examples of. Customers find the book very good and logical. They also appreciate the fast service and the logical approach. AI-generated from the text of customer reviews. For all of these reasons, blue chip stocks can make good investments and are among the most popular stock purchases for investors. Some examples of blue chip. A blue chip stock refers to shares of a well-established, financially stable and reputable company that has a long history of consistent earnings and dividend. Customers find the book very good and logical. They also appreciate the fast service and the logical approach. AI-generated from the text of customer reviews. Weekly options are another great way to boost your weekly income. Click here to learn more about this unique strategy and how you can capitalize on blue-chip. Weiss felt that, over time, stocks repeatedly fluctuate between high and low values best indicated by dividend yield. A careful study of a stock will reveal. Here are the top 40 (based on a combination of size and yield) progressive dividend stocks from the FTSE , FTSE , Small-Cap, Fledgling and AIM UK What makes a stock a blue-chip? · Large market capitalization · Growth history · Component of a market index · Dividends. What blue chip stocks pay the best dividends? The good advice you've blue chip high dividend paying companies then it's a great buy. That makes it easier to answer the question, are high dividend stocks safe? Bonus Tip: Canadian blue chips are among the best high-paying dividend stocks. A. Blue chip, stock of a large, long-established, and well-financed company, regarded as a sound investment and usually selling at a high price relative to its.

What Is Cashback

How cashback cards work. The more you spend, the more you earn. So each time you use your cashback credit card, you earn cashback. Depending on the card, the. For example, a customer purchasing $ worth of goods at a supermarket might ask for twenty dollars cashback. The customer would approve a debit payment of. Cashback is a rewards program where customers can earn back a percentage of the money they spend while shopping. Originally a credit card feature. You click on the 'get cashback' button, which takes you to theanisenkova.ru where you complete your purchase as you usually would, paying £ A few days later. Cash back is basically exactly what it sounds like: the bank pays you for using the card. For credit cards, this will typically be applied. Cashback Rewards With Suits Me. Cashback rewards with Suits Me are simple and effective. It's a smart way to earn while you spend! By opening a Suits Me prepaid. Cashback is when you receive a credit back to your account. For example, when you make a purchase, you may get a fixed amount or a percentage of the amount. How does cash back actually work with a credit card? The cash back amount that you get is equal to the amount of money that you charge on your bill each month. Cash back rewards are bonuses provided to customers when they use their cards to make purchases. Cash back rewards can take the form of dollars or points. How cashback cards work. The more you spend, the more you earn. So each time you use your cashback credit card, you earn cashback. Depending on the card, the. For example, a customer purchasing $ worth of goods at a supermarket might ask for twenty dollars cashback. The customer would approve a debit payment of. Cashback is a rewards program where customers can earn back a percentage of the money they spend while shopping. Originally a credit card feature. You click on the 'get cashback' button, which takes you to theanisenkova.ru where you complete your purchase as you usually would, paying £ A few days later. Cash back is basically exactly what it sounds like: the bank pays you for using the card. For credit cards, this will typically be applied. Cashback Rewards With Suits Me. Cashback rewards with Suits Me are simple and effective. It's a smart way to earn while you spend! By opening a Suits Me prepaid. Cashback is when you receive a credit back to your account. For example, when you make a purchase, you may get a fixed amount or a percentage of the amount. How does cash back actually work with a credit card? The cash back amount that you get is equal to the amount of money that you charge on your bill each month. Cash back rewards are bonuses provided to customers when they use their cards to make purchases. Cash back rewards can take the form of dollars or points.

A cash back credit card is a type of rewards credit card that allows the cardholder to earn a percentage of cash back when they make eligible purchases. In most. With cash back debit cards, you only receive your rewards in the form of cash. When you spend money on your debit card, you earn a small percentage of the. Return on investment (ROI) targets - Cashback websites work on a CPA model, which means that commissions are received only after a successful conversion for an. Put money back in your wallet on each eligible purchase using the best cash back credit cards available from Bankrate's partners. Cashbacks are a marketing tool in which you receive a portion of the purchase price back after making a purchase. The retailer or the cashback platform grants. Cash back refers to a credit card that refunds a small percentage of money spent on purchases. You can also sign up through cash-back sites and apps. The Capital One QuicksilverOne card offers % cash back on all of your everyday purchases. The Capital One SavorOne card offers unlimited 3% cash back on. Cashbacks are a marketing tool in which you receive a portion of the purchase price back after making a purchase. The retailer or the cashback platform grants. Earning 2% cash back simply means that for every $ you spend on your credit card, you'll get $2 back. So if you were to spend $1,, that's $20 back in your. Usually, when you are eligible for a cashback on your ICICI Bank credit card while shopping on any e-commerce or any other online retailer, you get a percentage. Cashback is a credit card perk where a percentage of eligible purchases made on the credit card is paid back to the cardholder. The concept. Cash back rewards are incentives offered by credit card issuers or financial institutions to cardholders for making purchases with their credit cards. These. CASHBACK meaning: 1. a system in which banks or businesses encourage people to buy something by giving them money. Learn more. Money Off. This method of cashback refers to taking “money off” your credit card bill each month. Basically, your bank will give you a credit card. When you. What is Cashback? · They are awarded when you buy through our offers, and you do not have established rewards programs to accrue rewards. · You can receive. Many cash back credit cards offer bonuses when using your card for specific expenses. Depending on your card's bonus categories, you'll generally earn between 1. In order to earn cash back points, you may need to spend within qualifying categories. Keep in mind that there may be limits or caps on how much cash back. Points and miles cards give cardholders more redemption options than cash-back cards but typically require you to put in some effort to find the best deal. You. As their name suggests, cash-back debit cards (also known as reward debit cards) offer rewards for eligible purchases in the form of a percentage of your. How do I redeem Cash Back? Visit your Shopping Dashboard to redeem Cash Back. Cash Back can be redeemed directly into your PayPal balance or a PayPal shopping.

Shark Tank Greatest Successes

Shark Tank pitches are successful (end in a deal). Though it should be noted that many of these deals never actually come to fruition, as the sharks (and most. From bestselling author and Shark Tank star Robert Herjavec comes a business book in which he transcends the business world, helping us all learn the art of. Shark tank USA- Bombas is the most successful company from Shark Tank, with over $ million in lifetime sales. Other successful companies. 12 Amazingly Successful Shark Tank Products that DIDN'T get investments · 1. Kodiak Cakes · 2. Baker's Edge · 3. Belly Buds · 4. SoapSox Washcloths · 5. Puppy Cake. We also find that certain industries have had varying levels of success in securing deals with sharks over time. The greatest peak achieved by an. She has helped many budding entrepreneurs turn their ideas into hit products and has 10 of the top 20 most successful companies on Shark Tank to date. A. These ten Shark Tank successful products have achieved remarkable success, with annual sales exceeding $1 billion. Shark Tank AND one of the greatest motivational and business speakers in the success isn't always pretty and Daymond and I are the REAL DEAL. In this. The 5 Most Successful Businesses That Appeared on Shark Tank · Squatty Potty · Bottle Breacher · Scrub Daddy · BuggyBeds · Cool Wazoo · Take the Leap. Shark Tank pitches are successful (end in a deal). Though it should be noted that many of these deals never actually come to fruition, as the sharks (and most. From bestselling author and Shark Tank star Robert Herjavec comes a business book in which he transcends the business world, helping us all learn the art of. Shark tank USA- Bombas is the most successful company from Shark Tank, with over $ million in lifetime sales. Other successful companies. 12 Amazingly Successful Shark Tank Products that DIDN'T get investments · 1. Kodiak Cakes · 2. Baker's Edge · 3. Belly Buds · 4. SoapSox Washcloths · 5. Puppy Cake. We also find that certain industries have had varying levels of success in securing deals with sharks over time. The greatest peak achieved by an. She has helped many budding entrepreneurs turn their ideas into hit products and has 10 of the top 20 most successful companies on Shark Tank to date. A. These ten Shark Tank successful products have achieved remarkable success, with annual sales exceeding $1 billion. Shark Tank AND one of the greatest motivational and business speakers in the success isn't always pretty and Daymond and I are the REAL DEAL. In this. The 5 Most Successful Businesses That Appeared on Shark Tank · Squatty Potty · Bottle Breacher · Scrub Daddy · BuggyBeds · Cool Wazoo · Take the Leap.

Shark Tank Success Stories Meet Some of Lori's Shark Tank Deals & Entrepreneurs. Collectively They've Done Over $1 Billion in retail sales. The demographics of successful Shark Tank presenters are pretty one sided ”To have the greatest chance at securing a deal with one of the sharks. deal activity, 85 deals across episodes of Shark Tank ; rate of investment, 19% of the pitches heard in episodes received an investment ; largest deal. Shark Tank's Daymond John has become the face of American entrepreneurship, managing a multi-million dollar empire encompassing fashion, media. Lori all day she's the best shark by far, made her entire fortune by direct to consumer products, most of the other sharks had one big exit and now they are. Although controversial but successful, Kevin O'Leary has made 40 deals and invested $8,, on Shark Tank. Barbara Corcoran, with a net worth of $80 million. These days, Daymond John is best known as the impeccably dressed star investor of reality show Shark Tank, but his reputation -- and his millions -- were. The most successful products on Shark Tank are Bombas ($ million in sales), Scrub Daddy ($ million in sales), and Squatty Potty ($ million in sales). He is best known as an investor on the ABC reality television series Shark Tank. As well as being the founder, president, and chief executive officer of. Scrub Daddy Sponges Scrub Daddy, one of the most lucrative Shark Tank inventions, is not just an average sponge. When Scrub Daddy founder and CEO, Aaron. Entrepreneurs that experience the greatest success on the show (and the top-performing sales professionals in the market) defuse the notion that sales is. Shark Tank, the popular television show where entrepreneurs pitch their business ideas to a panel of high-profile investors, has become a household name. She has helped many budding entrepreneurs turn their ideas into hit products and has 10 of the top 20 most successful companies on Shark Tank to date. A. (from Daymond John of Shark Tank). by Roy Furr · daymond-john-power-of-broke “I greatest success yet Even if you're scraping rock bottom. — Click. The sharks change from time to time, but the main ones are Robert Herjavec, Daymond John, and Kevin O'Leary. Barbara Corcoran alternates with Lori Greiner as. And if you're not in real estate, you're probably still aware of Barbara from her regular appearances on ABC's Shark Tank. She's one of the most successful and. The sharks change from time to time, but the main ones are Robert Herjavec, Daymond John, and Kevin O'Leary. Barbara Corcoran alternates with Lori Greiner as. Jeff Overall, Founder and CEO of PolarPro, was successful Besides inventory and distribution, what has been your greatest unforeseen challenge. The Most Successful Shark Tank Products of All Time · Scrub Daddy · Cousins Maine Lobster · Ring Doorbell · Comfy · Baker's Edge · Bombas · Lovepop Cards · Kodiak Cakes. Let's talk about Shark Tank – what are the top three lessons you took away from the experience? Becoming a business owner is like being married.

What Are The Different Tax Brackets For Income

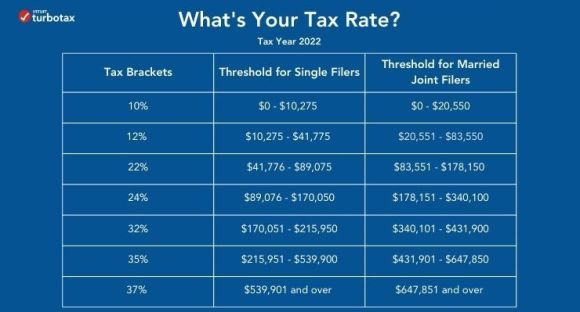

TurboTax's free Ontario income tax calculator. Estimate your tax refund or taxes owed, and check provincial tax rates in Ontario. Tax Types Current Tax Rates Prior Year Rates Business Income Tax Effective July 1, Corporations – 7 percent of net income Trusts and estates – The seven federal income tax rates are 10%, 12%, 22%, 24%, 32%, 35% and 37%. Below, CNBC Select breaks down the updated tax brackets for income exceeding EUR 80, and 5% on the amount of taxable income exceeding EUR , Special tax rates may apply on certain types of income. Non. The IRS uses 7 brackets to calculate your tax bill based on your income and filing status. As your income rises it can push you into a higher tax bracket. Canadian personal tax tables. Tax tables. Federal and Provincial/Territorial Income Tax Rates and Brackets for We've sent another confirmation message to. There are currently seven federal tax brackets in the United States, with rates ranging from 10% to 37%. The U.S. tax system is progressive, with people in. Understanding how federal income tax brackets work · 10% on the first $11, of taxable income · 12% on the next $33, ($44,$11,) · 22% on the remaining. Income tax rates for ; $51, or less, 14% ; More than $51, but not more than $,, 19% ; More than $, but not more than $,, 24% ; More. TurboTax's free Ontario income tax calculator. Estimate your tax refund or taxes owed, and check provincial tax rates in Ontario. Tax Types Current Tax Rates Prior Year Rates Business Income Tax Effective July 1, Corporations – 7 percent of net income Trusts and estates – The seven federal income tax rates are 10%, 12%, 22%, 24%, 32%, 35% and 37%. Below, CNBC Select breaks down the updated tax brackets for income exceeding EUR 80, and 5% on the amount of taxable income exceeding EUR , Special tax rates may apply on certain types of income. Non. The IRS uses 7 brackets to calculate your tax bill based on your income and filing status. As your income rises it can push you into a higher tax bracket. Canadian personal tax tables. Tax tables. Federal and Provincial/Territorial Income Tax Rates and Brackets for We've sent another confirmation message to. There are currently seven federal tax brackets in the United States, with rates ranging from 10% to 37%. The U.S. tax system is progressive, with people in. Understanding how federal income tax brackets work · 10% on the first $11, of taxable income · 12% on the next $33, ($44,$11,) · 22% on the remaining. Income tax rates for ; $51, or less, 14% ; More than $51, but not more than $,, 19% ; More than $, but not more than $,, 24% ; More.

Personal Income Tax Structure ; Tax Rates on. Taxable Income · % on any remainder ; Tax Credit Amounts ; Basic personal amount. $18, ; Spousal/Equivalent. Tax collection agreements enable different governments to levy taxes through a single administration and collection agency. The federal government collects. Determination of Tax. The tax is determined using tax tables furnished by the Louisiana Department of Revenue. income in another state, that income is also. REDUCTION IN INDIVIDUAL INCOME TAX RATES – The top marginal Individual Income Tax rate is % on taxable income. different online filing providers for. For tax year , which applies to taxes filed in , there are seven federal tax brackets with income tax rates of 10%, 12%, 22%, 24%, 32, 35%, and 37%. Understanding how federal income tax brackets work · 10% on the first $11, of taxable income · 12% on the next $33, ($44,$11,) · 22% on the remaining. Each rate applies to a different range of income, and that range constitutes a tax bracket. A taxpayer's tax liability is the sum total of the tax from each of. Canadian corporate investment income tax rates. - Includes all rate separate legal entity. Ernst & Young Global Limited, a UK company limited. By Tax Type · By Tax Year · Fact Sheets and Guides · Fillable PDF Tips · Order Paper Popular. Property Tax Credit · Estimated Income Tax · Property Tax Bill. A marginal tax rate means that different portions of income are taxed at progressively higher rates. Although these taxpayers fall in the third and fourth. Each tax bracket is taxed at a different rate. The system is based on what is called graduated tax rates. This means that if your income increases so that you. This table presents income shares, thresholds, tax shares, and total counts of individual Canadian tax filers, with a focus on high income. Personal Income Tax ; %, 6th Tax Bracket over $, up to $,, %, 6th Tax Bracket over $, up to $, ; %, 7th Tax Bracket over. There are seven different income tax rates: 10%, 12%, 22%, 24%, 32%, 35%, and 37%. Generally, these rates remain the same unless Congress passes new tax. Taxable Income ($), Marginal Tax Rates (%). Interest and Regular Income, Capital Gains, Non-eligible Canadian Dividends, Eligible Canadian Dividends. In addition, Alberta continues to index income tax brackets and tax credit See current and historical fuel tax rates on different types of fuel. Federal Income Tax Rates ; Caution: Do not use these tax rate schedules to figure taxes. Use only to figure estimates. For Married Filing Separate, any unused portion of the $6, exemption amount by one spouse on his/her separate The graduated income tax rate is: 0% on. Manitoba Individual Income Taxes. Major Components: Tax Brackets and Rates for and Taxable Income. Tax Rate. %. $0 - $36, $0. Canadian individuals pay taxes at graduated rates, meaning that your rate of tax gets progressively higher as your taxable income increases. Different tax rates.

Investor Risk Profile

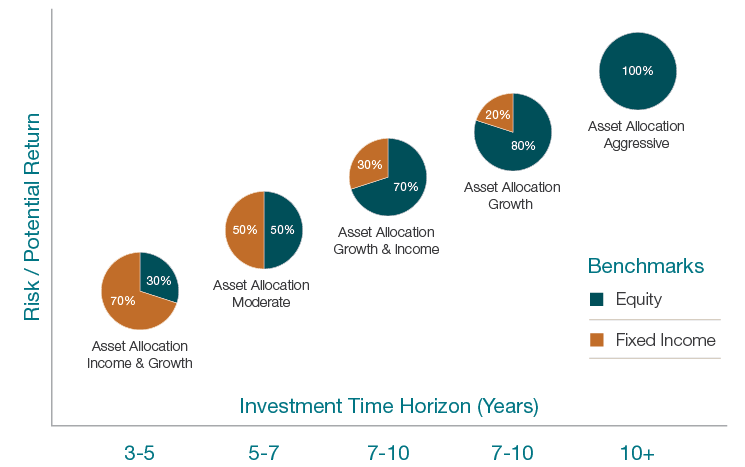

Investment advisors must also create a “risk profile” for an investor, which combines their level of risk tolerance as well as their ability to withstand losses. Types of Investment Risks · General market conditions · Fluctuations in currency exchange rates and interest rates · Possibility of companies defaulting or going. The combination of risk capacity and risk aversion constitutes what the finance industry calls the investor “risk profile.” Investments are deemed suitable for. If you're a conservative investor, you typically are seeking to protect your capital and are comfortable with moderate returns, rather than taking on higher. The reward for taking on risk is the potential for a greater investment return. If you have a financial goal with a long time horizon, you may make more money. That brings us to risk tolerance, officially defined by the U.S. Securities and Exchange Commission (SEC) as “an investor's ability and willingness to lose some. What Is a Risk Profile? An investor risk profile is an assessment of how much risk an investor can tolerate and afford to take. Most advisors don't use a. Time means how long we want to invest for. · Income or growth? · How easily can I get the money? · Find out how much risk you're comfortable with. Risk refers to the possibility of your investments performing below your expectations. Different investments carry different levels of risk. Investment advisors must also create a “risk profile” for an investor, which combines their level of risk tolerance as well as their ability to withstand losses. Types of Investment Risks · General market conditions · Fluctuations in currency exchange rates and interest rates · Possibility of companies defaulting or going. The combination of risk capacity and risk aversion constitutes what the finance industry calls the investor “risk profile.” Investments are deemed suitable for. If you're a conservative investor, you typically are seeking to protect your capital and are comfortable with moderate returns, rather than taking on higher. The reward for taking on risk is the potential for a greater investment return. If you have a financial goal with a long time horizon, you may make more money. That brings us to risk tolerance, officially defined by the U.S. Securities and Exchange Commission (SEC) as “an investor's ability and willingness to lose some. What Is a Risk Profile? An investor risk profile is an assessment of how much risk an investor can tolerate and afford to take. Most advisors don't use a. Time means how long we want to invest for. · Income or growth? · How easily can I get the money? · Find out how much risk you're comfortable with. Risk refers to the possibility of your investments performing below your expectations. Different investments carry different levels of risk.

This investor's risk capacity may therefore be lower than their risk tolerance, which will reflect their overall risk profile. Assessing Your Risk Profile. Establishing an investment risk profile (IRP) is an essential part of structuring an investor's investment portfolio, and the IRP is an integral element of an. Start by taking this quiz to get an idea of your risk tolerance–one of the fundamental issues to consider when planning your investment strategy. A risk profile is the quantification of an investor's overall risk tolerance. The risk profile is different for every individual investor. It depends on. Risk and return are directly related. With higher risk comes a higher possible return, but also a higher possible loss. 1. Personal Profile. Age is a vital factor that governs the risk profile of an investor. · 2. Professional Profile. Your income is an important determinant to. greater potential for appreciation and a higher level of risk. YOUR RISK TOLERANCE How do you feel about risk? Some investments fluctuate more dramatically. The pyramid is an asset allocation tool that investors can use to diversify their portfolios according to the risk profile of each security type. Located on the. The reward for taking on risk is the potential for a greater investment return. If you have a financial goal with a long time horizon, you may make more money. This tool will help you determine what kind of investor you are, and how much risk you may be comfortable with as you save. The tool. Risk profiling is a process that helps you identify the optimal level of risk that is just right for you as an investor. It is determined by various factors, such as age, financial goals, investment experience, and personality. Risk profile is usually classified. The rationale behind this relationship is that investors willing to take on risky investments and potentially lose money should be rewarded for their risk. You. Start by taking this quiz to get an idea of your risk tolerance–one of the fundamental issues to consider when planning your investment strategy. A risk profile is an assessment of an individual's willingness and ability to take on risk in their investment portfolio. Before you invest, decide what kind of investor you will be. Are you more aggressive and ready to accept the possibility of loss in exchange for the possibility. Your risk tolerance is how much risk you are willing to bear when it comes to investing. It involves understanding how you might respond to drastic swings in. This tool uses low, medium and high to measure your risk levels. Low means you're not comfortable with taking risks in your investments and prefer smaller but. Your risk tolerance is how much risk you are willing to bear when it comes to investing. It involves understanding how you might respond to drastic swings in.

1 2 3 4 5