theanisenkova.ru News

News

How To Afford A New Car On Minimum Wage

Subtracting your itemized expenses from the net take-home pay is the amount left for automobile and miscellaneous expenses. Remember, you will always have extra. EPI's Family Budget Calculator measures the income a family needs in order to attain a modest yet adequate standard of living. To get an idea of how much car you can afford, a good rule of thumb is to pay no more than 35% of your annual pre-tax income. So, if you make $50, before. Sticking to a monthly budget will help you save up for a car more quickly. Keep track of your expenses and income, and create a plan to improve your spending. Is it possible to afford a new car working a minimum wage job? Yes. If you have few or no living expenses. So, live with your parents, get. Watch how to finance and shop online in a few steps. play button opens video modal. Auto financing made easy with Chase. (1 min) finance a new or used car. Usually, the minimum income to qualify for a loan is anywhere from $1, to $2, a month before taxes, from a single job, although the higher the better. You. Pay and Wage Requirements · What is the minimum wage in Kansas? · What is the Federal minimum wage? · Am I covered by the Kansas minimum wage law? · How often do I. There is no minimum income required to buy a car if you save up and pay cash. Financing, on the other hand, has many requirements, including income. Subtracting your itemized expenses from the net take-home pay is the amount left for automobile and miscellaneous expenses. Remember, you will always have extra. EPI's Family Budget Calculator measures the income a family needs in order to attain a modest yet adequate standard of living. To get an idea of how much car you can afford, a good rule of thumb is to pay no more than 35% of your annual pre-tax income. So, if you make $50, before. Sticking to a monthly budget will help you save up for a car more quickly. Keep track of your expenses and income, and create a plan to improve your spending. Is it possible to afford a new car working a minimum wage job? Yes. If you have few or no living expenses. So, live with your parents, get. Watch how to finance and shop online in a few steps. play button opens video modal. Auto financing made easy with Chase. (1 min) finance a new or used car. Usually, the minimum income to qualify for a loan is anywhere from $1, to $2, a month before taxes, from a single job, although the higher the better. You. Pay and Wage Requirements · What is the minimum wage in Kansas? · What is the Federal minimum wage? · Am I covered by the Kansas minimum wage law? · How often do I. There is no minimum income required to buy a car if you save up and pay cash. Financing, on the other hand, has many requirements, including income.

Use the Payment Calculator to estimate payment details for your next Ford vehicle! Simply select your vehicle, your trim, enter your down payment and. To qualify, you must: Buy it for your own use, not for resale; Use it primarily in the U.S.. In addition, your modified adjusted gross income . Make your payments on time. If the dealer or your Lender says that you can change the payment dates, or pay late, get it in writing. Get a receipt for each. You can still finance a small amount if you don't want to pay it all upfront, but have the money in the bank. Buying a new car with your salary. You can typically expect to need a minimum income of $1, to $2, a month in order to get approved for a bad credit car loan, but this isn't the only income. You can typically expect to need a minimum income of $1, to $2, a month in order to get approved for a bad credit car loan, but this isn't the only income. Putting more than 20% down can save you money in the long run, even if the purchase price is the same. Auto loans carry interest, meaning you'll pay back more. Go for a car loan payment that does not put your total monthly debt payments over a third of your monthly income, and you'll end up with a loan you can afford. Once you're ready to buy a car from a dealer, you use this loan to pay it. With direct lending, you can. Get your credit terms in advance. By getting pre-. EPI's Family Budget Calculator measures the income a family needs in order to attain a modest yet adequate standard of living. Sticking to a monthly budget will help you save up for a car more quickly. Keep track of your expenses and income, and create a plan to improve your spending. Buying your new car, selling your old car and financing your new car are three separate steps in the transaction. living expenses on your finance application. Do you really need an expensive ice-making refrigerator or new car? These things can really take a huge chunk out of your budget. In addition, the more. Will I get a temporary license plate while waiting for my personalized or vanity plates? No. You will be issued a Temporary Registration Permit (TRP) on a new. If you purchased a new vehicle from a new-car dealer, you will have an MSO instead of a title. back to previous page. Paid Personal Property Tax Receipts. The rule states that you should spend no more than 1/10th your gross annual income on the purchase price of a car. The car can be new or old. It doesn't matter. So the proceeds of that asset can even help to pay off his car. Sort of like As you can see, the smarter way is to put down a minimum deposit, so. Buying your new car, selling your old car and financing your new car are three separate steps in the transaction. living expenses on your finance application. You can either purchase new license plates or apply to transfer existing plates from another of your vehicles to the new vehicle and pay the transfer fee. Proof of Insurance – In New Mexico, drivers must operate their motor vehicles with a minimum of liability auto insurance. Minimum auto liability insurance.

What Percentage Of Tax Do Self Employed Pay

In , income up to $, is subject to the % tax paid for the Social Security portion of self-employment taxes (FICA). Your employment wages and tips. The self-employment tax rate for employees is %, with % for Social Security taxes and % for Medicare taxes. Q. How do I calculate LLC taxes? This accounts for the fact that you only pay self-employment tax on % of your net earnings. (You use this percentage since employees pay half of Social. 34 Employers and employees share these taxes, each paying %. People who are fully self-employed and therefore subject to self-employment tax have to pay for. The self-employment tax rate is %. The rate consists of two parts: % for social security (old-age, survivors, and disability insurance) and % for. Self-employment taxes are different from FICA taxes. The self-employment tax rate is % including Social Security and Medicare. Self-employed workers are taxed at % of their net profit. This percentage is a combination of Social Security (%) and Medicare (%) taxes, also known. As the self-employment tax it works out to a pretty significant percentage: percent of the first $, of TAXABLE income you receive in. As a traditional employee, you might be used to seeing such taxes withheld from your paycheck, but those should have only added up to % of your wages. As. In , income up to $, is subject to the % tax paid for the Social Security portion of self-employment taxes (FICA). Your employment wages and tips. The self-employment tax rate for employees is %, with % for Social Security taxes and % for Medicare taxes. Q. How do I calculate LLC taxes? This accounts for the fact that you only pay self-employment tax on % of your net earnings. (You use this percentage since employees pay half of Social. 34 Employers and employees share these taxes, each paying %. People who are fully self-employed and therefore subject to self-employment tax have to pay for. The self-employment tax rate is %. The rate consists of two parts: % for social security (old-age, survivors, and disability insurance) and % for. Self-employment taxes are different from FICA taxes. The self-employment tax rate is % including Social Security and Medicare. Self-employed workers are taxed at % of their net profit. This percentage is a combination of Social Security (%) and Medicare (%) taxes, also known. As the self-employment tax it works out to a pretty significant percentage: percent of the first $, of TAXABLE income you receive in. As a traditional employee, you might be used to seeing such taxes withheld from your paycheck, but those should have only added up to % of your wages. As.

But: Half of this is deductible from taxable income. Your payment of Social Security and Medicare taxes is called self-employment tax. Don't confuse it with. The self-employment tax rate is %. This rate includes: However, it's a bit more complicated than that. The Social Security percentage only applies to a. The tax rate for self-employment tax is and is applied to annual net earnings from self employment. Net self-employment earnings are generally found on. You do not pay self-employment tax on money earned through investments or the sale of property. Instead, you pay capital gains tax on this income, and the rate. 10% bracket: $0 to $11, The self-employed person has $11, in this bracket, taxed at 10%, for a tax of $1, · 12% bracket: $11, to. Self-employed individuals are responsible for paying both portions of the Social Security (%) and Medicare (%) taxes. The Social Security tax rate is % of your self-employment earnings. For , Social Security taxes must be paid on all earned income up to $, All. Assuming your income doesn't exceed the set thresholds, you will pay percent of your net earnings in self-employment tax. How to File Self-Employment Taxes. Unlike employees, who generally have their income tax and payroll taxes withheld through their wages, self-employed individuals generally must pay estimated. All self-employed people, like freelancers, independent contractors, and small business owners are required to pay self-employment taxes. (This is true whether. percent of self-employment income above the Social Security wage base not in excess of the threshold amount for the percent Additional Medicare Tax; and. The SE tax applies to % of your net earnings. Net earnings are calculated by subtracting your business expenses from your gross income. The amount you pay. What percent do independent contractors pay in taxes? The self-employment tax rate is %, of which % goes to Social Security and % goes to Medicare. The self-employment tax rate for is percent, which encompasses the percent Social Security tax and the percent Medicare tax. Self-employment. Instead, you're responsible for paying all your taxes directly to the IRS. This includes self-employment tax (which covers Social Security and Medicare taxes). The self-employment tax rate is %, double the amount W-2 workers have to pay. This is because W-2 workers effectively split the cost of this tax with their. What does self-employment tax consist of? The self-employment tax rate is currently, approximately %. This rate consists of the two parts mentioned above. According to NerdWallet, because small business owners pay both income tax and self-employment tax, small businesses should set aside about 30% of their income. If your earned income is more than $, ($, for married couples filing jointly), you must pay % more in Medicare taxes. There are 2 income tax. You each also pay Medicare taxes of percent on all your wages - no limit. If you are self-employed, your Social Security tax rate is percent and your.

Ira Withdrawals For Home Purchase

IRA withdrawals are considered early before you reach age 59½, unless you qualify for another exception to the tax. See Retirement Topics – Tax on Early. In addition, you must be either age 59½ or older, disabled or qualify for a special purpose distribution, which is for the purchase of a first home (lifetime. According to the IRS, you can use up to $10, from your IRA towards a first-time home purchase without incurring the early withdrawal penalty. There are no IRA loans; you can only make withdrawals. For first-time homebuyers, up to $10, can be withdrawn penalty-free for a down payment, but income tax. Generally, you can withdraw any amount (up to your total balance) from your IRA, mutual fund or brokerage account. There might be some restrictions depending. The easiest way to use your Roth IRA to purchase a home is to make a withdrawal from your account. Qualified Roth IRA withdrawals are tax and penalty-free if. Withdrawals of Roth IRA contributions are always both tax-free and penalty-free. But if you're under age 59½ and your withdrawal dips into your earnings—in. Withdrawals from a Roth IRA you've had less than five years. · You use the withdrawal (up to a $10, lifetime maximum) to pay for a first-time home purchase. Withdraw up to $10, of investment earnings from an IRA for a first-time home purchase. If you're younger than years old, you still have a way to. IRA withdrawals are considered early before you reach age 59½, unless you qualify for another exception to the tax. See Retirement Topics – Tax on Early. In addition, you must be either age 59½ or older, disabled or qualify for a special purpose distribution, which is for the purchase of a first home (lifetime. According to the IRS, you can use up to $10, from your IRA towards a first-time home purchase without incurring the early withdrawal penalty. There are no IRA loans; you can only make withdrawals. For first-time homebuyers, up to $10, can be withdrawn penalty-free for a down payment, but income tax. Generally, you can withdraw any amount (up to your total balance) from your IRA, mutual fund or brokerage account. There might be some restrictions depending. The easiest way to use your Roth IRA to purchase a home is to make a withdrawal from your account. Qualified Roth IRA withdrawals are tax and penalty-free if. Withdrawals of Roth IRA contributions are always both tax-free and penalty-free. But if you're under age 59½ and your withdrawal dips into your earnings—in. Withdrawals from a Roth IRA you've had less than five years. · You use the withdrawal (up to a $10, lifetime maximum) to pay for a first-time home purchase. Withdraw up to $10, of investment earnings from an IRA for a first-time home purchase. If you're younger than years old, you still have a way to.

Roth IRA · own your Roth for 5 years AND withdraw under one of the following circumstances: · Age 59½ · First-time home purchase (up to $10,) · Disability · Death. If your employer and the plan permit, first-time buyers can take advantage of the hardship rule of early IRA withdrawal. If you qualify, you won't have to pay. You're withdrawing up to $10, as a qualified first-time home buyer. · The withdrawal is for qualified education expenses. · The withdrawal is for unreimbursed. If you take a withdrawal before age 59½ from your traditional IRA, your withdrawal is subject to a 10% early withdrawal federal penalty in addition to ordinary. Roth IRA withdrawal for first home · Annual Contributions- Can be withdrawn anytime tax and penalty-free for any reason. · Conversions- Can be. Both traditional IRA and Roth IRA owners are eligible to withdraw up to $10, to assist in the purchase of their first home. Note that if two spouses are. Up to $10, of your distribution may be penalty-free if used to buy, build or rebuild your first home. There is a lifetime limit of $10, for the penalty. Withdraw up to $10, of investment earnings from an IRA for a first-time home purchase. If you're younger than years old, you still have a way to. Are you under age 59 ½ and want to take an IRA withdrawal? Yes, you can withdraw money early for unexpected needs. But you need to know what to expect from. Withdrawals from a Roth IRA after turning age 59½: Distribution of earnings from Roth IRAs are completely tax-free as long as you made your first contribution. Normally, you must pay a 10% penalty on any IRA distributions you take before age 59½. But as long as you are a first-time homebuyer (i.e., you haven't owned a. Typically if you withdraw money out of your Traditional IRA prior to age 59 you have to pay ordinary income tax and a 10% early withdrawal penalty on the. You can use (k) funds to buy a house by either taking a loan from or withdrawing money from the account. However, with a withdrawal, you will face a penalty. Withdrawal rules vary, depending on whether you have a traditional or Roth IRA and, generally, your age. While you must be 59½ to withdraw funds from a. Some types of home purchases are eligible. Funds must be used within days, and there is a pre-tax lifetime limit of $10, Some educational expenses for. If you qualify to make a hardship withdrawal, you can make a withdrawal from your IRA to purchase a new house. You must not have owned a primary residence in. These include using the money for medical expenses, higher education expenses and a first-time home purchase. If you have to withdraw money from your account. While you can't take out IRA loans, you can use up to $10, from your traditional IRA toward the purchase of your first home — and if you're purchasing with a. Roth IRA early withdrawal penalty and converted amounts · Use the distribution for a first-time home purchase — up to a $10, lifetime limit · You're totally. One way to withdraw funds from your IRA without penalty is to used the funds as a first time homebuyer. There are rules you need to follow, though.

What Are Unrealized Capital Gains

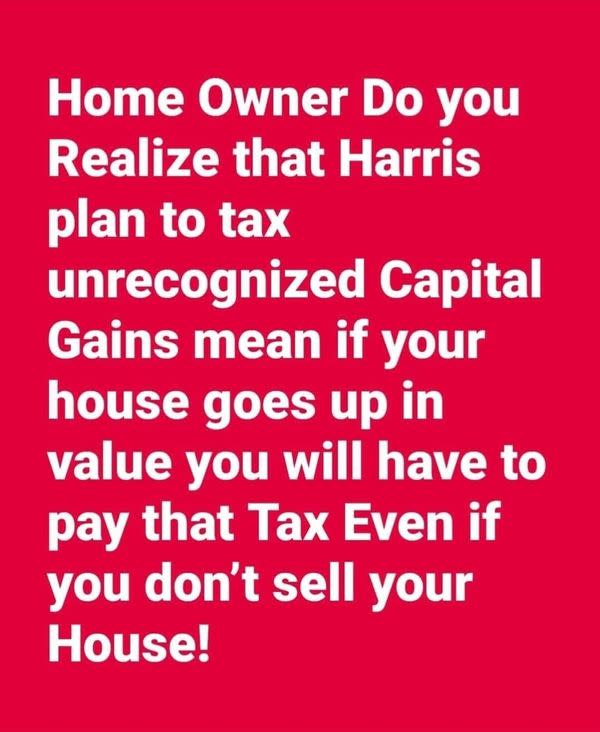

The entity's income statement has not yet shown this gain as a realized gain. The gain is deemed to have been realized once the asset has been sold. Assets are. How does Net Unrealized Appreciation (NUA) work? Usually the pretax portion of what your client paid for the stock (cost basis) is taxable as ordinary. An increase/decrease in the value of a security that is not "real" because the security has not been sold. I've hired workers. Those workers have paid income tax on the money I paid them. The company owns an office building - I pay property taxes on. You won't pay any taxes until you sell the share. Unrealized gains could be very important if you invest in funds, however. When you buy shares of a mutual fund. Do you have to pay taxes on your unrealized cryptocurrency gains? In the United States and most other countries, the answer is no. Recent reports say that the state of Vermont is considering a new tax on unrealized gains. Of course, it would affect only “the wealthy.”. President Joe Biden and Senate Finance Committee Chair Ron Wyden (D-OR) have proposed different ways to tax unrealized capital gains every year. Unrealized capital gains or losses are the amount of money you would have gained or lost (when compared to the price you originally paid) if you had sold your. The entity's income statement has not yet shown this gain as a realized gain. The gain is deemed to have been realized once the asset has been sold. Assets are. How does Net Unrealized Appreciation (NUA) work? Usually the pretax portion of what your client paid for the stock (cost basis) is taxable as ordinary. An increase/decrease in the value of a security that is not "real" because the security has not been sold. I've hired workers. Those workers have paid income tax on the money I paid them. The company owns an office building - I pay property taxes on. You won't pay any taxes until you sell the share. Unrealized gains could be very important if you invest in funds, however. When you buy shares of a mutual fund. Do you have to pay taxes on your unrealized cryptocurrency gains? In the United States and most other countries, the answer is no. Recent reports say that the state of Vermont is considering a new tax on unrealized gains. Of course, it would affect only “the wealthy.”. President Joe Biden and Senate Finance Committee Chair Ron Wyden (D-OR) have proposed different ways to tax unrealized capital gains every year. Unrealized capital gains or losses are the amount of money you would have gained or lost (when compared to the price you originally paid) if you had sold your.

Learn about the capital gains tax rates for long-term capital gains and short-term capital gains.

Capital gains taxes are owed when an asset is sold for more money than was paid for the asset. Learn more about capital gains taxes and how to avoid them. Specifically, this notice provides guidance regarding the holding period to be used for determining the capital gains tax rate that applies with regard to net. One approach to both reduce inequality and raise revenue is to reform the taxation of capital gains. One prominent proposal would be to tax capital gains as. Silicon Valley was burning up the socials this week, after learning that Kamala Harris has tacitly endorsed a tax on unrealized capital gains. Learn how the proposed tax on unrealized gains could affect your wealth and taxes as a high net worth individual and how to plan strategically with Kubera. An unrealized gain is an increase in the value of an asset or investment that an investor has not sold, such as an open stock position. An unrealized loss is a. When you sell stocks, you could face tax consequences. These tips may help you limit what you owe and reduce capital gains taxes on stocks. NUA is a special tax treatment that relates to distributions of appreciated employer securities from an eligible employer-based retirement plan as a part of. In the eyes of the IRS, capital assets are anything you own for personal or investment use. These include furniture, cars, boats, coin collections, stocks. Last Updated on March 28, If you've been investing in the stock market, you may wonder what unrealized capital gains taxes are. Realized and unrealized gains (and/or loss) are two classifications of capital gain. Members must pay income tax on realized gain, but not on unrealized gain. A tax strategy known as net unrealized appreciation (NUA), when applied to company stock, can help you effectively pay lower capital gains rates on a. “Cost basis” is the original price that the asset was purchased for. “Deemed realized gains” are unrealized gains that are treated as realized for tax purposes. ALERT - The following amounts have changed for the tax year: Standard Deduction: $, ($, in ); Charitable Donation Deduction Threshold. An unrealized gain or loss is a profit or loss that exists on paper, resulting from your investments. A gain/loss becomes realized once the position is sold. A 25% tax on unrealized capital gains is. Not a one-time 25% hit. It's compounding, annually taking 25% of every dollar of potential increase before it can. I like the Biden-Harris proposal to tax unrealized capital gains. For any given level of capital taxation it's more efficient & fair to tax. A capital gains tax (CGT) is the tax on profits realized on the sale of a non-inventory asset. The most common capital gains are realized from the sale of. In a landmark case, the U.S. Supreme Court decides whether a mandatory tax on unrealized gains violates the Constitution. You don't. And while there is a proposal being tossed around to tax certain “unrealized gains,” you should understand that a president.

How Much To Go Solar

In addition, rates fluctuate throughout the day for many customers, thanks to time-of-day pricing. Most of the power produced by solar will be during mid-peak. Solar Holler's financing options help you go solar at no upfront cost and a fixed monthly payment. In many of the utility districts in central Appalachia, our. The cost of solar panels can really vary. For a 4, sqft home in Texas, including batteries, you might expect to pay between $55k and $k. As of April , the New York State average for a 5 kilowatt (kW) system ranges from $12, to $16,, not counting tax credits and other incentives. To get. Many factors impact the cost of your solar panel installation, from the system type and size to the installation location. The state average cost for installing. The cost of solar panels in Texas can range from between $ and $ after incentives for a typical 6 kW system. Calculate the cost for your specific. On average, installation and the system together can run between $15, and $25,, according to the Center for Sustainable Energy. Location. How much does it cost to install solar panels in Ontario? It costs $ per watt to install a solar panel in Ontario. A 6 kW solar system with approximately. The average cost of installing solar panels in California falls between $10, and $13, after incorporating the 30% solar federal tax credit. In addition, rates fluctuate throughout the day for many customers, thanks to time-of-day pricing. Most of the power produced by solar will be during mid-peak. Solar Holler's financing options help you go solar at no upfront cost and a fixed monthly payment. In many of the utility districts in central Appalachia, our. The cost of solar panels can really vary. For a 4, sqft home in Texas, including batteries, you might expect to pay between $55k and $k. As of April , the New York State average for a 5 kilowatt (kW) system ranges from $12, to $16,, not counting tax credits and other incentives. To get. Many factors impact the cost of your solar panel installation, from the system type and size to the installation location. The state average cost for installing. The cost of solar panels in Texas can range from between $ and $ after incentives for a typical 6 kW system. Calculate the cost for your specific. On average, installation and the system together can run between $15, and $25,, according to the Center for Sustainable Energy. Location. How much does it cost to install solar panels in Ontario? It costs $ per watt to install a solar panel in Ontario. A 6 kW solar system with approximately. The average cost of installing solar panels in California falls between $10, and $13, after incorporating the 30% solar federal tax credit.

How to Really Tell What Solar Would Cost for Your Home ; $60, 5 kW (16 W panels), $26,, $18, ; $, 10 kW (32 W panels), $33, $23, How Are Florida Solar Panel Costs Broken Down? For homeowners looking for a way to reduce electricity bills throughout the year, solar is the way to go. There. Find Your Cost to go Solar. An Inside Look At The Cost of Residential. go solar. Installing your own solar panels can drastically reduce the bill you'd pay for labor with a professional installation. On average, DIY solar panel. It costs about $30, to install solar panels. That's a big number, but incentives usually lower it significantly. The best way to install solar is through a qualified professional who holds a certification to do so and works with high-quality solar panels. The industry-. The average cost to install solar panels is roughly $10, to $16,, which will provide all your engineering, material, labour, and permitting. Additionally. How does solar panel energy work in BC? The third most common question we get from potential clients is don't you need batteries to go with the solar energy. Solar Panel Cost for Long Island + NYC. See how you can get two years of free, clean energy with generous tax incentives and affordable, predictable financing. Based on Location & Wattage for a 5kW-6kW System: $ - $/watt. Arizona: $$/watt; California: $$/watt; Colorado: $$/watt. Solar panel costs typically range from $17, to $23,, but many homeowners will pay around $20, on average. Solar panels are a considerable. The cost of a solar system installation can vary widely when you compare the efficiency rate of the solar panels and other installation expenses. The best solar. How Much Does One Solar Panel Cost? One to watt solar panel costs $ to $ on average, or between $ to $ per watt depending on the type. The upfront price for an average-sized residential solar system has fallen from $40, in to about $25, today. Meanwhile, utility-scale solar now costs. As of Aug , the average cost of solar panels in Ontario is $ per watt making a typical watt (6 kW) solar system $12, after claiming the 30%. At Namaste Solar, we see home solar panel installation costs range from approximately $20, to $50, based on a variety of factors. The size of the solar. Before getting solar panels, get quotes from several reputable installers to compare. How Much Do Solar Panels Cost for Homeowners? The average upfront cost. For my place, a mid-sized home, I was looking at around $15, before incentives. It's worth checking out a solar comparison website to get a. On average, our customers pay $ per month when financing an kilowatt residential solar system. Other customers pay as little as $99 per month.

What Do You Need To Open An Account With Chase

year-olds and those without a Social Security Number must open at a Chase branch. Bring in these required documents (PDF) to open your account. If you used First Republic online banking and are new to JPMorgan Chase: Set up your account at theanisenkova.ru You will need your Social Security. Opening a business bank account requires proof of identification for both you and your business. Examples include your state-issued driver's license or passport. Monthly maintenance fee. $0. You must be an existing Chase checking customer to open the account for your kids ages 6 to · Minimum deposit to open. $0. You don't need a chase account, but I got a Prime Visa and it took me forever to set up the online account with Chase. It took so long that my account went. To qualify, open a new Chase Total Checking account using a coupon code, which can be emailed or applied directly through the Chase site, and then set up direct. What do you need to open a bank account? ; Driver's license with photo; Matricula Consular Card; Passport with photo; Student ID with photo; U.S. Employment. • All documents must • We recommend you have a U.S. address (be sure to include your apartment or dorm number) and a valid phone number before opening an. Information required to open business banking account: · Personal Identification: · Tax Identification Number: · Business Documentation: · Assumed Name Certificate. year-olds and those without a Social Security Number must open at a Chase branch. Bring in these required documents (PDF) to open your account. If you used First Republic online banking and are new to JPMorgan Chase: Set up your account at theanisenkova.ru You will need your Social Security. Opening a business bank account requires proof of identification for both you and your business. Examples include your state-issued driver's license or passport. Monthly maintenance fee. $0. You must be an existing Chase checking customer to open the account for your kids ages 6 to · Minimum deposit to open. $0. You don't need a chase account, but I got a Prime Visa and it took me forever to set up the online account with Chase. It took so long that my account went. To qualify, open a new Chase Total Checking account using a coupon code, which can be emailed or applied directly through the Chase site, and then set up direct. What do you need to open a bank account? ; Driver's license with photo; Matricula Consular Card; Passport with photo; Student ID with photo; U.S. Employment. • All documents must • We recommend you have a U.S. address (be sure to include your apartment or dorm number) and a valid phone number before opening an. Information required to open business banking account: · Personal Identification: · Tax Identification Number: · Business Documentation: · Assumed Name Certificate.

2. Partnerships: Chase Business Account Requirements ² · Personal identification, such as a driver's license or state ID · Tax Identification: EIN · Business. Account must be opened in-branch with both the parent/guardian and student present. Schedule a meeting with a banker to open a checking account. Bring these. A teen can typically open a bank account with the presence of a parent or guardian and identification may be required from both. Banks and other financial. To bank with us, you'll need to: be 18+; be a resident of the UK only; have a smartphone and a UK mobile number; be a tax resident of the UK. To open an account. What you need to open a checking account online · Lease document · Mortgage document · Utility bill · Bank statement or credit card statement. You'll need to open both accounts at the same time—not staggered. Receive a direct deposit into the Chase Total Checking® account. Any amount will do, as long. You'll need two forms of identification, and one of them must be a primary government-issued ID. If a person with power of attorney is opening the account, they. To open an individual or joint checking account, each potential account holder will need a government-issued photo ID. The checking account application requires. Personal identification documents — As the business owner, you will need to supply the bank with a form of government-issued identification, such as a driver's. year-olds and those without a Social Security Number must open at a Chase branch. Bring in these required documents (PDF) to open your account. Social Security number · A valid driver's license or other government-issued photo ID · Some accounts require an initial deposit, so you'll need. There is no minimum deposit for you to open an account or minimum balance you must maintain, but there is a $per-month maintenance fee unless you meet the. A teen can typically open a bank account with the presence of a parent or guardian and identification may be required from both. Banks and other financial. I opened a basic Chase account online in October, my first checking I would consider a smaller bank if you want to open a new account. You'll likely need a government-issued photo ID (such as a driver's license or passport) and proof of address. Some banks require your Social Security or. Open a new Chase Savings account, deposit at least $15, of new money into the account within 30 days of coupon enrollment and maintain a balance of at least. 1 For Way2Save Savings you need to set up Plus Savings –. $50 minimum opening deposit. Must open a checking account this bank in order to open a savings. If you're opening the account in-person, you'll need to bring all necessary documentation and identification for both the minor and yourself, the parent or. To bank with us, you'll need to: be 18+; be a resident of the UK only; have a smartphone and a UK mobile number; be a tax resident of the UK. To open an account.

Does Advanced Micro Devices Pay A Dividend

AMD does not currently pay a dividend. You Can find here what the dividend and yield would be, based on its next fiscal year EPS estimate multiplied by a. Since AMD has not paid dividends in the past 10 years, it's not ideal for dividend-oriented buy-and-hold strategy. AMD Dividend Reference Factor. No, AMD has not paid a dividend within the past 12 months. If you're new to stock investing, here's how to buy Advanced Micro Devices stock. Check out Advanced Micro Devices Inc. dividend history. Get information about the amount payed, pay date, ex date and yield for AMD It does not. Does Advanced Micro Devices (AMD) pay a dividend? A. There are no upcoming dividends for Advanced Micro Devices. Q. When is Advanced Micro Devices (NASDAQ:AMD). In addition, Co. sells or licenses portions of its intellectual property portfolio. When considering the Advanced Micro Devices Inc stock dividend history, we. AMD used to pay dividends biannually. Last paid amount was $ at May 24, As of today, dividend yield (TTM) is 0%. AMD has super high institutional holding (almost 75%+). Higher than NVDA or TESLA or APPL. Why AMD doesn't offer dividend? Advanced Micro Devices Inc. (AMD) has not recently paid a dividend and is not expected to in the near future. AMD does not currently pay a dividend. You Can find here what the dividend and yield would be, based on its next fiscal year EPS estimate multiplied by a. Since AMD has not paid dividends in the past 10 years, it's not ideal for dividend-oriented buy-and-hold strategy. AMD Dividend Reference Factor. No, AMD has not paid a dividend within the past 12 months. If you're new to stock investing, here's how to buy Advanced Micro Devices stock. Check out Advanced Micro Devices Inc. dividend history. Get information about the amount payed, pay date, ex date and yield for AMD It does not. Does Advanced Micro Devices (AMD) pay a dividend? A. There are no upcoming dividends for Advanced Micro Devices. Q. When is Advanced Micro Devices (NASDAQ:AMD). In addition, Co. sells or licenses portions of its intellectual property portfolio. When considering the Advanced Micro Devices Inc stock dividend history, we. AMD used to pay dividends biannually. Last paid amount was $ at May 24, As of today, dividend yield (TTM) is 0%. AMD has super high institutional holding (almost 75%+). Higher than NVDA or TESLA or APPL. Why AMD doesn't offer dividend? Advanced Micro Devices Inc. (AMD) has not recently paid a dividend and is not expected to in the near future.

AMD annual common stock dividends paid for were $0B, a NAN% decline from AMD annual common stock dividends paid for were $0B, a NAN% decline. No dividend. Only growth. The day they give a dividend i'm out. Based on: K (reporting date: ). 1 DPS0 = Sum of the last year dividends per share of Advanced Micro Devices Inc. Company does not pay dividends. AMD does not currently pay a dividend. Shares. Market Capitalization (Large Cap), $B. The current TTM dividend payout for AMD (AMD) as of August 30, is $ The current dividend yield for AMD as of August 30, is %. The AMD dividend amount is USD. The annual dividend yield of (AMD) is null. AMD Dividend Data. Last Dividend payment date, The Dividend Payout Ratio is the measure of dividends paid out to shareholders relative to the company's net income. It is calculated as the Dividends per. Advanced Micro Devices Inc currently pays no dividends. ISIN: US WKN: F · Dividend Declaration Date ; None Dividend Ex Date ; None Dividend Record Date ; None Dividend Pay Date ; None Dividend Amount Current. Company vs Market. Company Market bottom 25% Market top 25% % % % · Decent dividend & buyback yield. AMD did not pay neither dividends nor buybacks. Dividend Capture Strategy for AMD Dividend capture strategy is based on AMD's historical data. Past performance is no guarantee of future results. Does Advanced Micro Devices (AMD) pay dividends? Yes, Advanced Micro Devices (AMD) pays dividends to its shareholders. Advanced Micro Devices's last dividend. Does Advanced Micro Devices pay dividends? No, Advanced Micro Devices (IT:1AMD) has not paid a dividend within the past 12 months. Advanced Micro Devices Inc (NASDAQ:AMD) Dividend History · Aug. 26, DIVIDEND ANNOUNCEMENT: Kulicke & Soffa Industries, Inc. · Aug. 24, MMATQ STOCK PRICE. Advanced Micro Devices does not currently pay dividends to its shareholders. Has Advanced Micro Devices ever paid a dividend? No, Advanced Micro. Advanced Micro Devices Dividend Yield: % for Aug. 30, · Dividend Yield Chart · Historical Dividend Yield Data · Dividend Yield Definition · Dividend Yield. Does Advanced Micro Devices (AMD) pay a dividend? A. There are no upcoming dividends for Advanced Micro Devices. Q. When is Advanced Micro Devices (NASDAQ:AMD). Since AMD has not paid dividends in the past 10 years, it's not ideal for dividend-oriented buy-and-hold strategy. AMD Dividend Reference Factor. AMD (Advanced Micro Devices) Dividend Yield % as of today (August 30, ) is %. Dividend Yield % explanation, calculation, historical data and more. Advanced Micro Devices Inc's Yearly Dividend Pay out Ratio 5 Years CSIMarket Company, Sector, Industry, Market Analysis, Stock Quotes, Earnings, Economy, News.

Ampe Stock Price

Stock analysis for Ampio Pharmaceuticals Inc (AMPE:OTC US) including stock price, stock chart, company news, key statistics, fundamentals and company. A high-level overview of Ampio Pharmaceuticals, Inc. (AMPE) stock. Stay up to date on the latest stock price, chart, news, analysis, fundamentals. Key Stats · Market Cap2, · Shares OutM · 10 Day Average VolumeM · Dividend- · Dividend Yield- · Beta · YTD % Change Ampio Pharmaceuticals Inc (AMPE) stock price, GURU trades, performance, financial stability, valuations, and filing info from GuruFocus. View Ampio Pharmaceuticals (AMPE) stock price, news, historical charts, analyst ratings, financial information and quotes on Futubull. Complete Ampio Pharmaceuticals Inc. stock information by Barron's. View real-time AMPE stock price and news, along with industry-best analysis. Ampio Pharmaceuticals Inc. analyst ratings, historical stock prices, earnings estimates & actuals. AMPE updated stock price target summary. Ampio Pharmaceuticals stock would need to gain 6,,% to reach $ According to our Ampio Pharmaceuticals stock forecast, the price of Ampio. As of the end of day on the Aug 27, , the price of an Ampio Pharmaceuticals Inc (AMPE) share was $ Stock analysis for Ampio Pharmaceuticals Inc (AMPE:OTC US) including stock price, stock chart, company news, key statistics, fundamentals and company. A high-level overview of Ampio Pharmaceuticals, Inc. (AMPE) stock. Stay up to date on the latest stock price, chart, news, analysis, fundamentals. Key Stats · Market Cap2, · Shares OutM · 10 Day Average VolumeM · Dividend- · Dividend Yield- · Beta · YTD % Change Ampio Pharmaceuticals Inc (AMPE) stock price, GURU trades, performance, financial stability, valuations, and filing info from GuruFocus. View Ampio Pharmaceuticals (AMPE) stock price, news, historical charts, analyst ratings, financial information and quotes on Futubull. Complete Ampio Pharmaceuticals Inc. stock information by Barron's. View real-time AMPE stock price and news, along with industry-best analysis. Ampio Pharmaceuticals Inc. analyst ratings, historical stock prices, earnings estimates & actuals. AMPE updated stock price target summary. Ampio Pharmaceuticals stock would need to gain 6,,% to reach $ According to our Ampio Pharmaceuticals stock forecast, the price of Ampio. As of the end of day on the Aug 27, , the price of an Ampio Pharmaceuticals Inc (AMPE) share was $

; Volume: 28 65 Day Avg: K ; Day Range ; 52 Week Range

Ampio Pharmaceuticals Inc is listed in the Pharmaceutical Preparations sector of the American Stock Exchange with ticker AMPE. The last closing price for Ampio. Key Stock Data · P/E Ratio (TTM). N/A · EPS (TTM). $ · Market Cap. $2, · Shares Outstanding. M · Public Float. M · Yield. AMPE is not. You can watch AMPE and buy and sell other stock and options commission-free on Robinhood. Change the date range, see whether others are buying or selling. View Ampio Pharmaceuticals (AMPE) stock price, news, historical charts, analyst ratings, financial information and quotes on Futubull. 50 minutes ago. Stock price history for Ampio Pharmaceuticals. Last Price. US$ ; Market Cap. US$ ; 7D. % ; 1Y. % ; Updated. 22 Aug, AMPE Ampio Pharmaceuticals Inc. 17, $ $ (%). Today. Watchers, 17, Wk Low, $ Wk High, $ Market Cap, $2, The current price of AMPE is USD — it has increased by K% in the past 24 hours. Watch Ampio Pharmaceuticals, Inc. stock price performance more. Ampio Pharmaceuticals futures price quote with latest real-time prices, charts, financials, latest news, technical analysis and opinions. Discover historical prices for AMPE stock on Yahoo Finance. View daily, weekly or monthly format back to when Ampio Pharmaceuticals, Inc. stock was issued. What was Ampio Pharmaceuticals's price range in the past 12 months? Ampio Pharmaceuticals lowest stock price was $ and its highest was $ in the past In depth view into AMPE (Ampio Pharmaceuticals) stock including the latest price, news, dividend history, earnings information and financials. Looking to buy Ampio Pharmaceuticals Inc Stock? View today's AMPE stock price, news and trade over-the-counter (OTC) with Public investing app. AMPE - Ampio Pharmaceuticals, Inc. Stock - Share Price, Short Interest, Short Squeeze, Borrow Rates (OTCPK) · Basic Stats · Introduction · Short Squeeze Score. AMPE Ampio Pharmaceuticals Inc. 17, $ $ (%). Today. Watchers, 17, Wk Low, $ Wk High, $ Market Cap, $2, The current stock price of Ampio Pharmaceuticals (AMPE) is $ as of August 26, What is the market cap of Ampio Pharmaceuticals (AMPE)?. The market. Ampio Pharma (AMPE) stock is sharply lower this afternoon following a phase 3 trial for its osteoarthritis pain treatment. AMPE. Ampio Pharmaceuticals Inc Registered ShsStock, AMPE ; Balance Sheet in Mio. USD · Total liabilities, ; Key Data in USD · Sales per share, Historical daily share price chart and data for Ampio Pharmaceuticals since adjusted for splits and dividends. The latest closing stock price for Ampio.

Nyse Open Today

Today's market ; NYSE COMPOSITE (DJ), 18,, (%) ; NYSE U.S. INDEX, 16,, (%) ; DOW JONES INDUSTRIAL AVERAGE. Trading Hours and forex trading hours clock for New York Stock Exchange NYSE. Monitor the Opening and Closing times. Check the countdown to the opening or. Even Wall Street takes days off. The regular schedule for the New York Stock Exchange and Nasdaq is Monday through Friday from a.m. to 4 p.m. Eastern. The US stock market is open Monday to Friday from am to pm Eastern Time. Many stocks can also be bought and sold in extended-hours trading. The NYSE is open from Monday to Friday to EST – that's to for those living in Sydney (AEST). Nasdaq opening time Sydney. The Nasdaq is. The NYSE conducts two daily bond auctions – an Opening Bond Auction at am ET and a Core Bond Auction at am ET. The NYSE and NASDAQ are open Monday-Friday a.m. to p.m. Eastern Time. There are 9 trading holidays when markets are closed plus several scheduled. The New York Stock Exchange and the Nasdaq Stock Market will be closed on Wednesday in observance of the holiday. Trading Hours · Pre-Opening Session: a.m. · Opening Session: a.m. to a.m. ET · Core Trading Session: a.m. to p.m. ET · Extended Hours: Today's market ; NYSE COMPOSITE (DJ), 18,, (%) ; NYSE U.S. INDEX, 16,, (%) ; DOW JONES INDUSTRIAL AVERAGE. Trading Hours and forex trading hours clock for New York Stock Exchange NYSE. Monitor the Opening and Closing times. Check the countdown to the opening or. Even Wall Street takes days off. The regular schedule for the New York Stock Exchange and Nasdaq is Monday through Friday from a.m. to 4 p.m. Eastern. The US stock market is open Monday to Friday from am to pm Eastern Time. Many stocks can also be bought and sold in extended-hours trading. The NYSE is open from Monday to Friday to EST – that's to for those living in Sydney (AEST). Nasdaq opening time Sydney. The Nasdaq is. The NYSE conducts two daily bond auctions – an Opening Bond Auction at am ET and a Core Bond Auction at am ET. The NYSE and NASDAQ are open Monday-Friday a.m. to p.m. Eastern Time. There are 9 trading holidays when markets are closed plus several scheduled. The New York Stock Exchange and the Nasdaq Stock Market will be closed on Wednesday in observance of the holiday. Trading Hours · Pre-Opening Session: a.m. · Opening Session: a.m. to a.m. ET · Core Trading Session: a.m. to p.m. ET · Extended Hours:

NYSE TV Live grants viewers access inside The New York Stock Exchange 7, Olympics check-in as Abbott rings the Opening Bell! (NYSE: ABT). New. LIVE on NYSE TV | Foot Locker (NYSE: FL) Rings The Opening Bell. 5. 7. 12 Open champion. #NYSEFloorTalk with. @JudyKShaw. Embedded video. 3. Our data, technology and expertise help today's leaders and tomorrow's visionaries capitalize on opportunity in the public markets. more more theanisenkova.ru Log in. Open app. nyse's profile picture. nyse. Follow. Message. NYSE. nyse. Finance. Connect to a world of opportunity. 11 Wall St, New York, New York The New York Stock Exchange is open Monday through Friday from am to pm Eastern Daylight Time (GMT). Find the latest stock market news from every corner of the globe at theanisenkova.ru, your online source for breaking international market and finance news. Holiday Calendar for Euronext's Cash and Derivatives markets. The Euronext Cash Markets and the Euronext Derivatives Markets will be open Monday to Friday. The U.S. stock exchanges, including the New York Stock Exchange (NYSE) and the NASDAQ Stock Market, are open to investors from Monday through Friday from Stock market opening times vary in each country, depending on the local working hours and culture. Most stock markets around the world will be open for trading. Market Open Ceremony · C-Suite Video Interviews · ESG Management · Stock Quotes Calendar. Stock Market Holidays - Stock Markets Closed. Canadian. The New York Stock Exchange and Nasdaq are open for trading Monday through Friday from a.m. ET to p.m. ET. · The stock market is closed for most major. The regular trading hours for the U.S. stock market, which includes the Nasdaq Stock Market (Nasdaq) and the New York Stock Exchange (NYSE), are am to 4 pm. In the U.S., most exchanges are open on weekdays from a.m. to 4 p.m. Eastern time. Stock Market After Hours. You can still trade shares on the stock market. Today is Saturday September 7, The US stock market is open. For today's market hours (both regular and extended hours), consult the following. Often when people are talking about the stock market, they're referring to US exchanges – such as the NYSE or NASDAQ – which are open from to (UTC). Opening Session: a.m. to a.m. ET Orders that are eligible for the Opening Auction may not be cancelled one minute prior to the Opening Session until. Opening/Closing · Net Order Imbalance Information. Exchange Traded Funds. ETF The Nasdaq Stock Market · Nasdaq BX · Nasdaq PSX. Options and Futures. Nasdaq. today's parlance. Minimizing competition was essential to keep a large The NYSE is open for trading Monday through Friday from am – pm ET. The U.S. stock exchanges, including the New York Stock Exchange (NYSE) and the NASDAQ Stock Market, are open to investors from Monday through Friday from Finding exchange opening hours ; New York Stock Exchange Arca, Shares & ETFs, ; Worldwide, Tradegate, Shares & ETFs,

Latest Robot News

Figure 02 Robot Is a Sleeker, Smarter Humanoid. Most of our questions were answered about the unveiling of Figure's latest humanoid. 06 Aug The world's most dynamic humanoid robot, our fully electric Atlas robot is designed for real-world applications. Somehow This $10, Flame-Thrower Robot Dog Is Completely Legal in 48 States. By Benj Edwards, Ars Technica. The Atlas Robot Is Dead. Explore the cutting edge of technology as we delve into the latest advancements in robotics. AI Robot Doc This robot dog is capable of picking itself up. Latest News · The National Robotarium and Blantyre LIFE: The future of robotics-assisted care. 26 August /in Heriot-Watt University · Doors Open Day at The. Engineered Arts' latest and most advanced humanoid robot is Ameca, which the company bills as a development platform where AI and machine learning systems can. The latest news on robotics, robots, robotics sciences and technology science Researchers train a robot dog to combat invasive fire ants. Aug 21, Latest about Robotics · Tesla primed to sell AI-powered humanoid robots alongside its EVs in · This robot could leap higher than the Statue of Liberty — if. Robotics ; A Tesla Optimus robot at work · Tesla Pays $48 an Hour for Motion Capture to Develop Humanoid Robot · John Yellig ; A Richtech Robotics ADAM robot. Figure 02 Robot Is a Sleeker, Smarter Humanoid. Most of our questions were answered about the unveiling of Figure's latest humanoid. 06 Aug The world's most dynamic humanoid robot, our fully electric Atlas robot is designed for real-world applications. Somehow This $10, Flame-Thrower Robot Dog Is Completely Legal in 48 States. By Benj Edwards, Ars Technica. The Atlas Robot Is Dead. Explore the cutting edge of technology as we delve into the latest advancements in robotics. AI Robot Doc This robot dog is capable of picking itself up. Latest News · The National Robotarium and Blantyre LIFE: The future of robotics-assisted care. 26 August /in Heriot-Watt University · Doors Open Day at The. Engineered Arts' latest and most advanced humanoid robot is Ameca, which the company bills as a development platform where AI and machine learning systems can. The latest news on robotics, robots, robotics sciences and technology science Researchers train a robot dog to combat invasive fire ants. Aug 21, Latest about Robotics · Tesla primed to sell AI-powered humanoid robots alongside its EVs in · This robot could leap higher than the Statue of Liberty — if. Robotics ; A Tesla Optimus robot at work · Tesla Pays $48 an Hour for Motion Capture to Develop Humanoid Robot · John Yellig ; A Richtech Robotics ADAM robot.

The latest developments in consumer robots, humanoids, drones, and automation.

A worker walks past various kinds of human-like robots at the World Robot Conference Now playing Next. No Comment · Humanoid robots enter everyday life. ABB Robotics released its first modular industrial robot arms in Its fifth-generation robots expanded the company's range with four new models. By Brianna. Catch up with the latest news & media coverage. Use the button below to subscribe to receive updates about news & media coverage. Walmart installs drinks-making robot from Richtech Robotics. August 27, Latest articles. How AI is Revolutionizing Quality Control; The Ultimate. All the latest robotics news, research and analysis from The Robot Report, focusing on the development, integration, and use of robotics. Robotics · TechCrunch Minute: Boston Dynamics' new Atlas robot shows off its push-up skills · These 74 robotics companies are hiring · Get in on the ground floor. Robotics · Machine learning and robotics spark a revolution in property marketing · Tech companies embracing humanoid robots · Robotics could help cut NHS. Robot news - All the latest robot tech advances. Robots · Your next takeout burger could arrive at your doorstep via robot delivery · Don't have anyone to play pingpong with? · Would you trust a robot with your. A new algorithm helps robots practice skills like sweeping and placing objects, potentially helping them improve at important tasks in houses, hospitals, and. Boston Dynamics robot demo. Boston Dynamics CEO Robert Playter gave Michelle Miller a personal demonstration of two of his company's most cutting-edge. Get the latest news in robot technology. Elon Musk claims Tesla will start using humanoid robots next year · Our unequal earth. Could robot weedkillers replace the need for pesticides? · Ocado shares. Latest News · Engineers building a jet-powered flying humanoid for disaster response · Watch: Humanoid homebot tackles impressive array of household chores · Video. ROBOTICS · No one wants Tesla's cars or robots, is it true? · GenAI levels the playing field: Mercedes Soria of robotics security company Knightscope · Kerala. Robotics News Updates: Get Latest Breaking News, Photos and Video News on Robotics. Also find Robotics latest news headlines, picture gallery, top videos. Robo-dog maker surprised as its machines armed with guns in military exercises. Robot dentist performs world's first fully automated procedure. Robots have already vastly transformed the way we think about housework – and are likely to do so even more dramatically in the years to come. China has big plans for humanoid robots. With arms, legs and facial expressions, robots are being built for roles where manpower is in short supply.

1 2 3 4 5 6