theanisenkova.ru News

News

Stock Market Tips And Tricks For Beginners

Share your videos with friends, family, and the world. But when you dive into the stock market as a beginner, you should invest the bulk of your holdings in diversified funds and ETFs. That is where your "real money. 1. Set Clear Goals: Define your financial goals and objectives. Are you investing for retirement, a down payment on a house, or a specific. Advantages of trading · You have complete control over the investments you pick. This lets you follow your own hunches and invest in companies you believe in—and. Investing · A stock represents an ownership stake in a company as a common shareholder. · Stocks are considered a risk asset that can provide · The market took a. How to Invest in Stocks: A Beginner's Guide for Getting Started · 1. Determine your investing approach · 2. Decide how much you will invest in stocks · 3. Open an. Step 1: Set Clear Investment Goals · Step 2: Determine How Much You Can Afford To Invest · Step 3: Determine Your Risk Tolerance and Investing Style · Step 4. Before taking on the risk of investing your money in the stock market, you should first have a plan and feel financially stable. Douglas Boneparth, New York. 1. Decide if you want to invest on your own or with help · 2. Choose a · 3. Pick a type of investment account · 4. Learn the difference between investing in stocks. Share your videos with friends, family, and the world. But when you dive into the stock market as a beginner, you should invest the bulk of your holdings in diversified funds and ETFs. That is where your "real money. 1. Set Clear Goals: Define your financial goals and objectives. Are you investing for retirement, a down payment on a house, or a specific. Advantages of trading · You have complete control over the investments you pick. This lets you follow your own hunches and invest in companies you believe in—and. Investing · A stock represents an ownership stake in a company as a common shareholder. · Stocks are considered a risk asset that can provide · The market took a. How to Invest in Stocks: A Beginner's Guide for Getting Started · 1. Determine your investing approach · 2. Decide how much you will invest in stocks · 3. Open an. Step 1: Set Clear Investment Goals · Step 2: Determine How Much You Can Afford To Invest · Step 3: Determine Your Risk Tolerance and Investing Style · Step 4. Before taking on the risk of investing your money in the stock market, you should first have a plan and feel financially stable. Douglas Boneparth, New York. 1. Decide if you want to invest on your own or with help · 2. Choose a · 3. Pick a type of investment account · 4. Learn the difference between investing in stocks.

Monitor your portfolio regularly: Investing isn't a one-time activity, but rather a continuous process. You need to periodically monitor your investments. Any stock options tips would tell you that you should diversify your investment portfolio. It means do not rely on one company or one sector. Invest in a. Education is key in the stock market. Familiarize yourself with financial news, market trends, and basic trading principles. Read books, attend. Investing in the stock market can seem fearsome, especially during the beginner's phase because of the complexity and the risks involved in the market. But a. Beginner Tips for the Stock Market · Don't bother with anything under $ · Invest in things you know/understand. · If you want to invest without. Buy Beginners Guide To Stock Market Investing: How To Invest & Make Money In Options Trading: Stock Market Investing Tips (Paperback) at theanisenkova.ru Some of the main stock trading tips for beginners include looking for the type of stock, the company's earnings, and general financial performance or news. Share Market Tips · Choose Strong Fundamental Companies · Research and Do Your Due Diligence · Avoid Being Greedy · Work with Reliable Intermediaries · Avoid Being. Determine Which Kind of Trader You Want to Be · Conduct Due Diligence & Stay Abreast of Current News · Develop a Trading Strategy Suited to Your Goals · Formulate. Contrary to popular belief, buying stocks is not the very first step to for beginner stock market investinging. The first step is understanding what are stocks. In this article, we are going to see, the complete share market ideas for beginners. This article will provide the reader with the 10 key secrets to winning the. The process of stock trading for beginners · 1. Open a demat account · 2. Understand stock quotes · 3. Bids and asks · 4. Fundamental and technical knowledge of. How to Start Investing In the Stock Market: A Beginner's Guide · Step 1: Open a brokerage account · Step 2: Place your first trade · Step 3: Figure out your. Another tip for beginners is to start small. The stock market can be volatile, so it's important to start with a small investment and gradually. Your first trade: how to do it · Open and fund your live account · After careful analysis of the market, select your opportunity · 'Buy' if you think that. Nothing in the Stock Market Is Guaranteed · Know You're Betting on Yourself · Know Your Goals, Timeframe and Risk Tolerance · Research, Research, Research · Keep. It has been shown time and again that trading is not just for professionals, financial experts and people with a huge fortune! Even beginners can achieve. Classify the assets as per the risk level. · Research the company for a good investment return. · A central principle in every stock market for investment is that. Diversification across different sectors is also a good strategy. Please note, that past performance does not guarantee future returns. What are the best. 6 Stock Market Investing Tips & Guide for Beginners · 1. Set Long-Term Goals · 4. Handle Basics First · 5. Diversify Your Investments · 6. Avoid Leverage/Margin.

Can I Learn Russian In 6 Months

I never thought I will be able to learn Russian language but with Daria 6 months of comfortable at-home step-by-step learning of Russian from a. months of studying 20 hours a week and you can speak Russian discussing easy topics! Intensive program of the Russian language is the most popular option. Luckily, since you only need about words to speak a language at a conversational level, all you need to get to that level is around 6 months of focused. If you have any doubts about your ability to learn Russian, you can set them aside right now. With cyrus the virus, I figure in 6 months when I am able to. In our school you can learn Russian in a convenient place and at a convenient time. Duration: intensive 6 mos./measured 1 yr. Online course to start. Language immersion -- living, studying, and playing in Russian all summer long -- is a proven recipe for rapid and lasting language gain. Key Takeaway: Learning Russian can take anywhere from 6 months to 2 years, depending on your current level of proficiency in other languages, how much time you. What if you could speak French in 6 months? Yes, I'm interested ×. Home; Learn You can learn that language fast and fluently.I heard about this. The logical way to measure how long it will take you to learn Russian is not in weeks or months but in learning hours. You could study for three hours a day and. I never thought I will be able to learn Russian language but with Daria 6 months of comfortable at-home step-by-step learning of Russian from a. months of studying 20 hours a week and you can speak Russian discussing easy topics! Intensive program of the Russian language is the most popular option. Luckily, since you only need about words to speak a language at a conversational level, all you need to get to that level is around 6 months of focused. If you have any doubts about your ability to learn Russian, you can set them aside right now. With cyrus the virus, I figure in 6 months when I am able to. In our school you can learn Russian in a convenient place and at a convenient time. Duration: intensive 6 mos./measured 1 yr. Online course to start. Language immersion -- living, studying, and playing in Russian all summer long -- is a proven recipe for rapid and lasting language gain. Key Takeaway: Learning Russian can take anywhere from 6 months to 2 years, depending on your current level of proficiency in other languages, how much time you. What if you could speak French in 6 months? Yes, I'm interested ×. Home; Learn You can learn that language fast and fluently.I heard about this. The logical way to measure how long it will take you to learn Russian is not in weeks or months but in learning hours. You could study for three hours a day and.

Immerse yourself - If you want to learn Russian, you can't practice once a week and expect to be fluent in 6 months. You need to dedicate a good amount of. As you progress with the course, you will improve your language skills. When learning the last lessons, you will be able to use a vocabulary of words. This online course can help kids learn Russian through fun lessons on Zoom 6. Duration of the course: 6 month. Language levels: A1 - A2. Schedule. What Will You Learn with Lingomelo? Grammar Mastery. Understand the 6 months. $/mo. Buy Now. Charged $ every 6 months. Save 83%. 12 months. Russian language is very hard. It takes time to learn (understand, speak, write and listen). Let's says, it would take you 6 to 8 years. 6 months. Secondly, starting from , the foreigners can make the registration online [ ] Students of the RFL “Leader” school at a culinary workshop. months of studying on the Intensive program and you can speak Russian discussing easy topics! Start dates for beginners. September. 2, October. 7, All content on this site is best used in conjunction with the e-learning platform theanisenkova.ru Use code for test sign up. The Russian module is meant. Duration of the Russian language course for children. Online Russian course for foreign children can be: Short-term(up to 6 months). If students are good in. After six months study you will still find targeting English speaking Russians your best bet because you won't have the vocabulary or experience to game girls. 1. · 1. · It is possible to learn the basics of Russian within several months, dedicating at least one hour a day for studying. · You can join the “Russian Course. Intermediate · Specialization · 3 - 6 Months. In summary, here are 10 Anyone can benefit from learning the Russian language or any language. 6 months ago · 3 Reasons why swearing in Russian is OVERRATED. K views What any Russian learner can learn from Bald and Bankrupt. 15K views. 2. More than 2 hours of audio will help you along the way. Moreover, since each course is an independent learning unit, you can choose where to theanisenkova.ru Russian language courses, lessons, texts, audio and video. Free resources from basic to advanced to learn Russian as a foreign language. 6, 7, 8, 9, 10, 11, 12, 13, 14, 15, 16, 17, 18, 19, 20, 21, 22, 23, 24, 25, 26, 27, 28, 29, 30 Starting to learn Russian is like setting off on an exciting. For that reason, an experienced language learner will be much more likely to reach conversational fluency in 3 months than a complete newbie would. If you know. Learn Russian in 6 months with 45% OFF! Unlock our complete learning program: All lessons, lesson notes, exclusive apps, study tools, and much more: https. This is a course that consists of 30 lessons structured for learning Russian from zero to level A1-A2. You will gain access to a platform with recorded video.

What To Ask When Starting A Business

Here are a few questions you should ask yourself before you launch your new business. 1) Am I really willing for this business to take time? From questions around compliance costs to local zoning restrictions, here are answers to the question, “What is one question to ask a lawyer when starting a. step guide to starting a business, how to research your market and competitors, buying a business or franchise, registering with government agencies. Key questions to ask yourself about starting your own business: Do you have the skills/experience needed to run a business? - Do you have sufficient. 5 Questions to Ask Before Starting a Business · 1. What Problem Will My Business Solve? · 2. Who Is My Target Market? · 3. How Will I Advertise My Business? · 4. 1. What Problem Is My Business Going to Solve? · 2. Am I Looking to Create A Job for Myself or a Scalable Company? · 3. How Should I Register My Company? · 4. · 5. Here are a few questions you should ask yourself before you launch your new business. 1) Am I really willing for this business to take time? Ask yourself these 7 questions: 1. “Why do I want to start this business?” Every business has its own “why”. What is your business idea? What problem are you solving? · Who is your target market? Who are you trying to reach with your business? · What is. Here are a few questions you should ask yourself before you launch your new business. 1) Am I really willing for this business to take time? From questions around compliance costs to local zoning restrictions, here are answers to the question, “What is one question to ask a lawyer when starting a. step guide to starting a business, how to research your market and competitors, buying a business or franchise, registering with government agencies. Key questions to ask yourself about starting your own business: Do you have the skills/experience needed to run a business? - Do you have sufficient. 5 Questions to Ask Before Starting a Business · 1. What Problem Will My Business Solve? · 2. Who Is My Target Market? · 3. How Will I Advertise My Business? · 4. 1. What Problem Is My Business Going to Solve? · 2. Am I Looking to Create A Job for Myself or a Scalable Company? · 3. How Should I Register My Company? · 4. · 5. Here are a few questions you should ask yourself before you launch your new business. 1) Am I really willing for this business to take time? Ask yourself these 7 questions: 1. “Why do I want to start this business?” Every business has its own “why”. What is your business idea? What problem are you solving? · Who is your target market? Who are you trying to reach with your business? · What is.

In this article, Let's look at the questions to ask when starting a business and assist you in making sound business choices. Key questions to ask yourself about starting your own business: Do you have the skills/experience needed to run a business? - Do you have sufficient. 99 Questions to ask BEFORE starting a business in the US [Chittenden, James, Castro Esq., Renata] on theanisenkova.ru *FREE* shipping on qualifying offers. There are a few questions you should ask yourself before starting a business. It includes asking how to start, financing, tax laws, and much more. The Business Plan: Seven Questions You Need to Ask When Starting a Business · What is the product or service? · Who are your customers? · What is your marketing. 7 questions to ask when starting a business · 1. Why do you want to start a business? · 2. Do you have the necessary skills? · 3. Do you understand the. Start by answering these questions — your answers will help you piece together the road map for starting an online business and develop an effective marketing. Is it something that I can make life changing money with? · Is it a business that other people have started with the same resources I have and. 7 Questions To Ask Before Starting Your Own Business · Why are you going into business? · What are you planning to do? · Who are your customers? · What is your. I do not believe quitting your day job is always the best route to starting a business. If you can maintain your current employment while starting this company. The Business Plan: Seven Questions You Need to Ask When Starting a Business · What is the product or service? · Who are your customers? · What is your marketing. This list of 10 questions should help you determine if your idea for a business is viable and worth pursuing. Business in the USA: make sure you ask yourself these 7 essential questions before starting a business abroad. · What drives me to start my company? · What kind. This publication provides a series of questions to assist you in deciding whether owning your own business is right for you. Thinking about starting a business? We've compiled 50 plus questions to help you understand your business, customers and life goals when you’re thinking. Even if many things turn out differently afterwards than you think, the following are some of the important questions you should ask yourself before starting a. Taxes and legal issues – Don't take on anything unresolved. · Receivables and payables – Are accounts up-to-date? · Inventory – What quantities will you start. 9 questions to ask before starting a business · 1. How passionate are you about this? · 2. Do you really need to quit your 'real' job yet? · 3. Who are you. Finally, one of the most important things you'll need to figure out before starting your business is where you'll find funding. The Muse outlines several. It's important to ask yourself the following questions about your start-up idea: Do I have the skills, knowledge, financial backing, and aversion to risk.

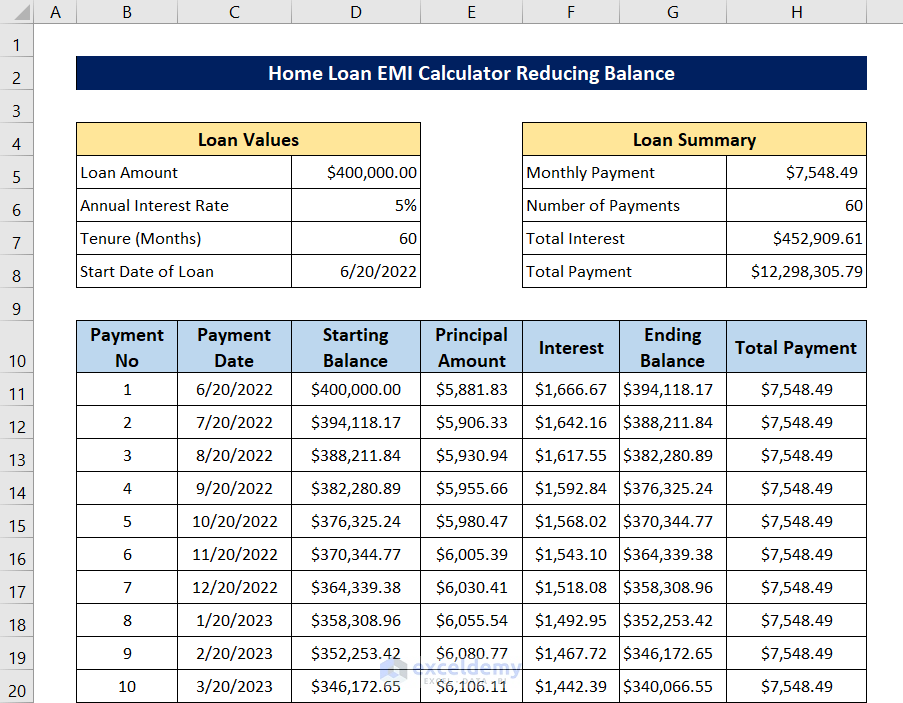

Home Loan Calculation Formula

The home loan EMI calculator considers three variables: the loan amount, interest rate, and tenure. The interest rate could either be fixed or floating. While a. A good rule of thumb is that banks will loan you up to 30% of your gross income annually. For instance, let's say your annual income is RM50, 30% of that. The major variables in a mortgage calculation include loan principal, balance, periodic compound interest rate, number of payments per year, total number of. You can figure out how much equity you have in your home by subtracting the amount you owe on all loans secured by your house from its appraised value. This. decoding the home loan calculator formula here, e is the emi amount, p is the principal, r is the interest rate, and n is the loan term. here, e amounts to. Interest on your home loan is usually calculated daily and then charged to you at the end of each month. Your bank will take the outstanding loan amount at the. What Is a Fixed-Rate Loan? How Do I Calculate It? · Number of periodic payments (n) = payments per year times number of years · Periodic Interest Rate (i). A good rule of thumb is that banks will loan you up to 30% of your gross income annually. For instance, let's say your annual income is RM50, 30% of that. Interest Rate Calculation Formula: This calculation is based on the textbook interest rate formula. You can use this simple formula to calculate Home Loan. The home loan EMI calculator considers three variables: the loan amount, interest rate, and tenure. The interest rate could either be fixed or floating. While a. A good rule of thumb is that banks will loan you up to 30% of your gross income annually. For instance, let's say your annual income is RM50, 30% of that. The major variables in a mortgage calculation include loan principal, balance, periodic compound interest rate, number of payments per year, total number of. You can figure out how much equity you have in your home by subtracting the amount you owe on all loans secured by your house from its appraised value. This. decoding the home loan calculator formula here, e is the emi amount, p is the principal, r is the interest rate, and n is the loan term. here, e amounts to. Interest on your home loan is usually calculated daily and then charged to you at the end of each month. Your bank will take the outstanding loan amount at the. What Is a Fixed-Rate Loan? How Do I Calculate It? · Number of periodic payments (n) = payments per year times number of years · Periodic Interest Rate (i). A good rule of thumb is that banks will loan you up to 30% of your gross income annually. For instance, let's say your annual income is RM50, 30% of that. Interest Rate Calculation Formula: This calculation is based on the textbook interest rate formula. You can use this simple formula to calculate Home Loan.

Open Excel and select a cell to display the EMI. · Use the formula "=PMT(interest rate/12, tenure in months, loan amount)". · Replace "interest rate" with your. Mortgage Formulas · P = L[c(1 + c)n]/[(1 + c)n - 1]. The next formula is used to calculate the remaining loan balance (B) of a fixed payment loan after p months. Calculate home loan payments for Purchase or Refinance. Take the guesswork out of your mortgage payments. Use this mortgage loan calculator to generate a. Free loan calculator to find the repayment plan, interest cost, and amortization schedule of conventional amortized loans, deferred payment loans. Lenders multiply your outstanding balance by your annual interest rate and divide by 12, to determine how much interest you pay each month. Calculate your monthly VA mortgage payments with taxes, insurance and the VA funding fee with this VA loan calculator from Veterans United Home Loans. To calculate your DTI, add all your monthly debt payments, such as credit card debt, student loans, alimony or child support, auto loans and projected mortgage. Formula to determine Home Loan EMI amount · P is the principal loan amount · r is the monthly interest rate (annual rate divided by 12) · n is the number of. Your monthly mortgage payment depends on a number of factors, like purchase price, down payment, interest rate, loan term, property taxes and insurance. What is the EMI for 20 lakhs home loan? The EMI amount for 20 lakhs for year tenure is Rs. 17, You can use the home loan EMI calculator given in IDFC. Calculate Home Loan EMI Use our Home Loan Calculator to get insights on your loan plan! Just select an amount, set an approximate interest rate and loan. Payments: Multiply the years of your loan by 12 months to calculate the total number of payments. A year term is payments (30 years x 12 months = The formula to determine home loan EMI amount ; E · EMI amount ; P · Principal amount ; R · Rate of interest ; N · Loan tenure. Use our free mortgage calculator to get an estimate of your monthly mortgage payments, including principal and interest, taxes and insurance, PMI, and HOA. Open Excel and select a cell to display the EMI. · Use the formula "=PMT(interest rate/12, tenure in months, loan amount)". · Replace "interest rate" with your. The EMI calculator uses the formula EMI = [P x R x (1+R)^N]/[(1+R)^N-1] to compute the EMI amount. Enter the principal loan amount you need, a reasonable. EMI is computed based on an unequal distribution of the principal amount and interest. In the initial phase of a home loan, majority of the EMI constitutes the. Calculate your monthly USDA home loan payment to get a breakdown of estimated USDA mortgage fees, taxes, and insurance costs. Mortgage Formulas · P = L[c(1 + c)n]/[(1 + c)n - 1]. The next formula is used to calculate the remaining loan balance (B) of a fixed payment loan after p months. Determine what you could pay each month by using this mortgage calculator to calculate estimated monthly payments and rate options for a variety of loan.

Business Checking Account Promo

Everyday business purchases made more rewarding · Earn 1 Membership Rewards® point for every $2 you spend on an eligible Business Debit Card purchase. With the most perks of any TD small business checking account — discounts on services, free unlimited money orders and official checks, and more · No monthly fee. Offer 1: Earn $ by opening a new TD Every Day A, B or C Business Chequing Account or Earn $ by opening a new TD Unlimited Business Chequing Account. Reach your goals faster with a business savings account and earn a 6-month promotional interest rate up to % Learn about business savings accounts. GET. Qualifications for Earning $ Checking Account Bonus · Open your business checking account at any Guaranty Bank branch or online. · Opening deposit must be in. More freedom. Fewer fees. · Business owners get up to $ welcome bonus! · A Business Checking Account That Works for You · Business deposit accounts FDIC insured. Get Prime+ 0% on conventional lines of credit up to $1MM3. OR Prime+ 3% on an SBA Express line of credit up to $k Cover unexpected expenses and access. Every growing business needs a checking account — and right now is a great time to open one with Vectra Bank. You can earn a cash bonus of up to $2, when you. Our most popular way to manage your online business banking. No monthly fee; Unlimited electronic transactions. Everyday business purchases made more rewarding · Earn 1 Membership Rewards® point for every $2 you spend on an eligible Business Debit Card purchase. With the most perks of any TD small business checking account — discounts on services, free unlimited money orders and official checks, and more · No monthly fee. Offer 1: Earn $ by opening a new TD Every Day A, B or C Business Chequing Account or Earn $ by opening a new TD Unlimited Business Chequing Account. Reach your goals faster with a business savings account and earn a 6-month promotional interest rate up to % Learn about business savings accounts. GET. Qualifications for Earning $ Checking Account Bonus · Open your business checking account at any Guaranty Bank branch or online. · Opening deposit must be in. More freedom. Fewer fees. · Business owners get up to $ welcome bonus! · A Business Checking Account That Works for You · Business deposit accounts FDIC insured. Get Prime+ 0% on conventional lines of credit up to $1MM3. OR Prime+ 3% on an SBA Express line of credit up to $k Cover unexpected expenses and access. Every growing business needs a checking account — and right now is a great time to open one with Vectra Bank. You can earn a cash bonus of up to $2, when you. Our most popular way to manage your online business banking. No monthly fee; Unlimited electronic transactions.

Initiate Business Checking · No transactions fee for the first transactionsFootnote 1 per fee period. After , it's $ each transaction. · No cash deposit. Open a business checking account today and get a $ bonus*. For more information, visit your local branch, call , or complete the form below. Limit one bonus per customer. To receive offer, a $25, deposit is required in the new business checking account within the first 30 days of account opening. Up to 1, transactions and up to $25, in cash deposits each month without an additional fee. If your business meets any of these criteria, we offer. Find business banking offers for new business account openings, business credit cards and industry specific bundles here. Business banking should be simple. That's why we offer checking accounts for your business that are convenient and have a team of bankers who've got your back. Limit one bonus per customer. To receive offer, a $25, deposit is required in the new business checking account within the first 30 days of account opening. Earn up to a $ Reward Bonus**. For a limited time, you can receive $, $, $ or $ by opening new business accounts and meeting all deposit and. LIMITED TIME OFFER. Earn up to $1, New business checking customers can earn a cash bonus when opening an M&T Tailored Business Checking account with. Earn up to a $ bonus when you open a new, eligible US Bank business checking account online with promo code Q3AFL24 and complete qualifying activities. Receive an introductory $ bonus. Get $ when you open a Chase Business Complete Checking® account with qualifying activities. For new business checking. New or existing business clients with no deposit accounts can earn up to $ to open a new business checking and savings account with offer code: 24BU. Earn 30, Membership Rewards® points after qualifying activities. See details below. · No monthly maintenance fees · 24/7 support - specialists are a click or. *Interest Checking (consumer account) and Business NOW Account are interest bearing accounts. The annual percentage yield (APY) on Interest Checking is %. Here are some of the best bank account bonuses that are out there currently and what you need to do to earn them. Promotional Bonus Payment: If you meet all of the Eligibility and Qualifications above, we will post the $ bonus to your account within 2 business days of. Checking Account Benefits · $0 · $0 or $ No fee with $1, in total monthly deposits, or $5, in total relationship balances, otherwise $10 a month · $0 or. Earn $ when you open a new Compak Business Checking account. · Deposit a minimum of $10, in new money within the first 30 days. · Maintain an average. Gold Business Checking Package · $20 or $0 monthly maintenance fee when you meet requirements · free transactions per statement cycle · $ fee for each. View list of the current top business checking deals and promotions. Earn cash bonuses for opening a new account.

What Is The Difference In Life Insurance

Whole life is permanent, while Universal Life offers long-term protection. With whole life, your premiums are fixed and guaranteed never to rise1. As long as. When you are old, the cost of insurance is very expensive. If you average out the cost over your “whole life”, you get the cost of permanent insurance. The. Term coverage only protects you for a limited number of years, while whole life provides lifelong protection—as long as you keep up with the premium payments. There are two basic life insurance options: term and permanent. Term lasts for a specific, pre-set period. Permanent lasts your entire lifetime. What is Whole Life Insurance? With whole life insurance, the premiums will never decrease, but they also allow you to “overpay”, thus increasing the overall. A term life policy is purchased to last for a specified period, such as 1, 5, 10, or sometimes as much as 30 years. Coverage expires when that period ends–hence. There are two types of life insurance: term and permanent. Term insurance covers you only for a specified time period — 10, 20 or 30 years, for example. Universal life insurance is more flexible than whole life. You can change the amount of your premiums and death benefit. But any changes you make could affect. There are five main types of life insurance: Term life insurance, whole life, universal life, variable life, and final expense life insurance. Whole life is permanent, while Universal Life offers long-term protection. With whole life, your premiums are fixed and guaranteed never to rise1. As long as. When you are old, the cost of insurance is very expensive. If you average out the cost over your “whole life”, you get the cost of permanent insurance. The. Term coverage only protects you for a limited number of years, while whole life provides lifelong protection—as long as you keep up with the premium payments. There are two basic life insurance options: term and permanent. Term lasts for a specific, pre-set period. Permanent lasts your entire lifetime. What is Whole Life Insurance? With whole life insurance, the premiums will never decrease, but they also allow you to “overpay”, thus increasing the overall. A term life policy is purchased to last for a specified period, such as 1, 5, 10, or sometimes as much as 30 years. Coverage expires when that period ends–hence. There are two types of life insurance: term and permanent. Term insurance covers you only for a specified time period — 10, 20 or 30 years, for example. Universal life insurance is more flexible than whole life. You can change the amount of your premiums and death benefit. But any changes you make could affect. There are five main types of life insurance: Term life insurance, whole life, universal life, variable life, and final expense life insurance.

Whole life is permanent, while Universal Life offers long-term protection. With whole life, your premiums are fixed and guaranteed never to rise1. As long as. Permanent life insurance policies remain active until the insured person dies, stops paying premiums, or surrenders the policy. A life insurance policy is only. Life Insurance Product Comparison ; Needs life insurance only; Most affordable option; Offers coverage for a specific period of time -often 10, 20, or 30 years. Universal life insurance is more flexible than whole life. You can change the amount of your premiums and death benefit. But any changes you make could affect. You want (or need) more cost-effective coverage: Term life insurance typically comes with more cost-effective monthly premiums than whole life insurance—. Whole life insurance policies have a fixed premium, meaning you pay the same amount each and every year for your coverage. Much like universal life insurance. Term life insurance is designed to be less expensive than whole life insurance, with lower payments. This may be appealing to some families, as it may fit their. A fixed premium remains constant throughout the life of an insurance policy, while a variable premium can change over time based on various factors such as the. Are whole life insurance policies worth it? Whole life insurance provides stability and peace of mind because the coverage doesn't end as long as the premiums. Understand the Difference Between Term and Cash Value · Do I pay the premiums on a set schedule? · Does the policy have a cash value? · Do the policy values change. For the most part, there are two types of life insurance plans - either term or permanent plans or some combination of the two. Life insurers offer various. The insurer: the insurance company that sells the life insurance policy. · The policyholder: the person or entity (such as a family trust or a business) who owns. Whole or ordinary life —This is the most common type of permanent insurance policy. It offers a death benefit along with a savings account. If you pick this. Key Takeaways: · Term life insurance is temporary, typically has level premiums, and usually costs less than permanent life insurance. · Permanent life. Which is appropriate for you, term or permanent life insurance? While term life insurance is initially less expensive, permanent life insurance may be more. Like its name indicates, whole life insurance can provide lifelong coverage. This type of policy, similar to term insurance, will pay your beneficiaries if. Eli5: whats the difference between term vs whole life insurance? Term - is good for X amount of years. Super Cheap and provides a large amount. Whole Life vs. Term Life Insurance · The policy length: A whole life policy lasts your entire life, while a term policy only provides coverage for a limited. There are two main life insurance types – term and permanent. Both offer protection in the form of a death benefit paid to beneficiaries; however, term coverage.

How To Choose A Good Mutual Fund

In this blog, we will talk about how to select the right mutual fund as per your investment objectives. 1. Identify your Goals. The first step you need to do is list down all your financial goals. · 2. Identify you Risk. Different mutual funds have different. To choose a mutual fund, define your investment objectives (e.g., retirement, education, wealth creation), choose a fund category (equity, debt, hybrid) based. Professional money management: Mutual funds provide professional management, ongoing supervision of your holdings and automatic diversification – all important. Top 25 Mutual Funds ; 11, VFFSX · Vanguard Index Fund;Institutional Select ; 12, VIIIX · Vanguard Institutional Index Fund;Inst Plus ; 13, VTBNX · Vanguard. A mutual fund is a type of investment company, known as an open-end fund, that pools money from many investors and invests it based on specific investment. Choosing a Mutual Fund: Key Factors to Consider · 1. Returns (Last 3 Years CAGR) · 2. Fund Size (Total Value of Capital) · 3. Expense Ratio · 4. When Selecting Mutual Funds Consider: · Past performance measures such as 3- and 5-year returns, though past performance is no guarantee of future results · Risk. Instead, look for funds that consistently provide above-average investment returns in the same fund category for the past three, five, and 10 years. Lower. In this blog, we will talk about how to select the right mutual fund as per your investment objectives. 1. Identify your Goals. The first step you need to do is list down all your financial goals. · 2. Identify you Risk. Different mutual funds have different. To choose a mutual fund, define your investment objectives (e.g., retirement, education, wealth creation), choose a fund category (equity, debt, hybrid) based. Professional money management: Mutual funds provide professional management, ongoing supervision of your holdings and automatic diversification – all important. Top 25 Mutual Funds ; 11, VFFSX · Vanguard Index Fund;Institutional Select ; 12, VIIIX · Vanguard Institutional Index Fund;Inst Plus ; 13, VTBNX · Vanguard. A mutual fund is a type of investment company, known as an open-end fund, that pools money from many investors and invests it based on specific investment. Choosing a Mutual Fund: Key Factors to Consider · 1. Returns (Last 3 Years CAGR) · 2. Fund Size (Total Value of Capital) · 3. Expense Ratio · 4. When Selecting Mutual Funds Consider: · Past performance measures such as 3- and 5-year returns, though past performance is no guarantee of future results · Risk. Instead, look for funds that consistently provide above-average investment returns in the same fund category for the past three, five, and 10 years. Lower.

At first glance picking out a mutual fund can be difficult, but the following 4 tips can help you make an informed decision. Unlike stocks or exchange-traded funds, mutual funds trade just once per day, and many investors own them as part of a defined contribution retirement plan such. There are several equally good resources to choose a good MF. • Value Research Online. • Morning Star India. • Money Control. • Live Mints list of 50 funds. Differences between ETFs & mutual funds An ETF could be more suitable for you. You can buy an ETF for the price of 1 share—commonly referred to as the ETF's. Use these tools to help you narrow down your choice of mutual funds and ETFs. Compare specific Vanguard mutual funds and ETFs. How to Select a Mutual Fund · The minimum dollar amount required to open an account; · The investment objective. · Look at the fund's performance. · Be certain that. Choose the right mutual funds Growth-and-income funds — These typically invest in stocks of companies that pay dividends and have good prospects for earnings. To pick a mutual fund, start by reviewing your investment goal and considering performance benchmarks. Then, try to minimize costs, consider diversification. Mutual funds are considered a safer investment and provide more diversification than buying shares in an individual stock. Bottom line. Mutual funds are a good. We offer a Mutual Fund comparison tool on our website that can help you compare various funds; this makes it easy to find which funds best fit. When choosing a mutual fund, you should consider the following aspects: Return · Return. This is the most commonly used criterion for comparing funds. · Quartile. Mutual funds can provide access to many different parts of the market, even within the broad asset classes of stocks and bonds. Within stocks you can invest in. How to choose mutual funds in India? · Investment horizon: It will depend on how long you have to reach your financial goal. · Investment objective: · Risk profile. Consistency: The fund should have performed consistently in the past vis-à-vis its benchmark index and the category average (the average returns of all schemes. The best way to begin is to decide on a method to narrow down on the right fund for you. Rarely do investors who do something else for a living employ a. Before buying shares, you should check with your employer if they offer additional mutual fund products since these might come with matching funds or are more. Read The Prospectus Before buying shares in a mutual fund, read the prospectus carefully. · Understand The Risks Understand that you can lose money investing in. The mutual fund buying process should start with the investor addressing his or her goals; this includes answering questions about your investment objectives. Just as you would buy a computer that fits your needs and budget, you should choose a mutual fund that meets your risk tolerance (need) and your risk capacity . The key to building wealth long-term is buying high-quality, no-load mutual funds run by seasoned stock pickers. Here are our favorites.

2 3 4 5 6